In a significant move to bolster Grenada’s cooperative financial sector, Ariza Credit Union has unveiled an innovative annual sponsorship program. This initiative is specifically designed to empower smaller credit unions by funding their participation in the Caribbean Confederation of Credit Unions (CCCU) Convention and Trade Show.

As the largest credit union in Grenada and the second largest within the Organisation of Eastern Caribbean States (OECS), Ariza acknowledges the indispensable role smaller institutions play in promoting financial inclusion and fortifying community economic resilience. The program strategically targets credit unions with total assets not exceeding EC$10 million, entities that typically operate with constrained resources and limited access to regional developmental forums.

The selection process for the inaugural beneficiary was conducted via a live, transparent draw held at Ariza’s Head Office. From a pool of eligible candidates—including Gateway Cooperative Credit Union, Hermitage Cooperative Credit Union, Birchgrove Cooperative Credit Union, Horizon Cooperative Credit Union, and GTAWU Credit Union—GTAWU Credit Union was selected as the first participant.

Attendance at the prestigious CCCU Convention is anticipated to yield substantial benefits for the chosen institution, encompassing advanced training in governance protocols, sophisticated risk management strategies, exposure to cutting-edge financial technologies, and the opportunity to forge valuable professional networks across the Caribbean region.

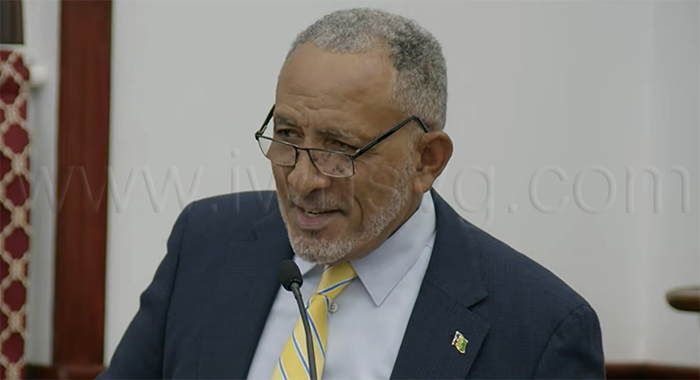

The President of Ariza Credit Union emphasized the philosophical underpinning of the initiative, stating, “We are deeply convinced that the collective strength of our sector is predicated on collaborative efforts to ensure continuous capacity building through training, development, and supportive initiatives.”

This rotating sponsorship model ensures that support is equitably distributed, with the overarching goal of generating sector-wide advantages that transcend individual credit unions. By investing in the development of its smaller counterparts, Ariza reinforces its commitment to the principle of ‘cooperation among cooperatives’ and cements its leadership role in fostering the long-term growth and sustainability of Grenada’s credit union movement.