H.H. V Whitchurch & Co., the operator of the FRS Express Des Iles ferry service, has released an updated schedule following a series of cancellations over the weekend. The announcement, shared on the company’s official Facebook page, assures passengers of a seamless travel experience during the upcoming World Creole Music Festival season. The company extended its appreciation to customers for their understanding and patience during the service disruptions. The revised timetable, which outlines ferry operations through the end of October, aims to restore reliability and meet the heightened demand expected during the festival period. This update comes as the company works to address operational challenges and ensure customer satisfaction.

分类: business

-

Briceño’s Fortis Strategy Sparks Heated Debate in Senate

The Briceño administration’s $256 million acquisition of Fortis Belize Limited and its BEL shares has reignited a fiery debate in the Senate, with Opposition Senator Patrick Faber leading the charge against the government’s plan to divest the newly acquired assets. Faber criticized the move as reckless, questioning the expertise of the local investors Prime Minister Briceño named last Friday to manage a hydroelectric company. ‘Even if we accept the acquisition, we must reject the reckless plan to divest the very assets we have just bought,’ Faber stated. He argued that institutions like Social Security, Credit Unions, and commercial banks lack the necessary experience to run such a complex operation. Government Senator Hector Guerra countered, emphasizing the potential benefits for Belizean investors. ‘It will open doors for Belizean people, ensuring they can invest in a critical asset and expect returns,’ Guerra asserted. He highlighted the excess liquidity in the banking sector as an opportunity for broader public investment. The debate underscores the deep divisions over the government’s strategy to manage Belize’s energy assets.

-

Senators Demand Answers on Fortis Pullout

In a heated Senate debate on October 20, 2025, Belizean senators demanded clarity on Fortis Inc.’s decision to withdraw from the country’s energy sector and the potential ramifications for electricity costs and national energy independence. Union Senator Glenfield Dennison questioned the rationale behind Fortis, a seasoned power generation company, exiting the market while Belize, with limited expertise in the field, takes over. Dennison emphasized the critical role of water resources in hydroelectric power, urging a closer examination of the nation’s hydrological prospects. Church Senator Louis Wade echoed public concerns, highlighting Belize’s exorbitant electricity rates and stressing the need for affordable energy solutions. He acknowledged the symbolic significance of reclaiming control over Belize’s rivers but underscored the importance of tangible benefits for citizens. NGO Senator Janelle Chanona called for greater public awareness and a thorough cost-benefit analysis to assess the long-term impact of the acquisition. She noted that while electricity rates are perceived as high, a detailed tariff review is essential to determine future pricing. The senators’ inquiries reflect widespread unease about the transition and its potential to either alleviate or exacerbate Belize’s energy challenges.

-

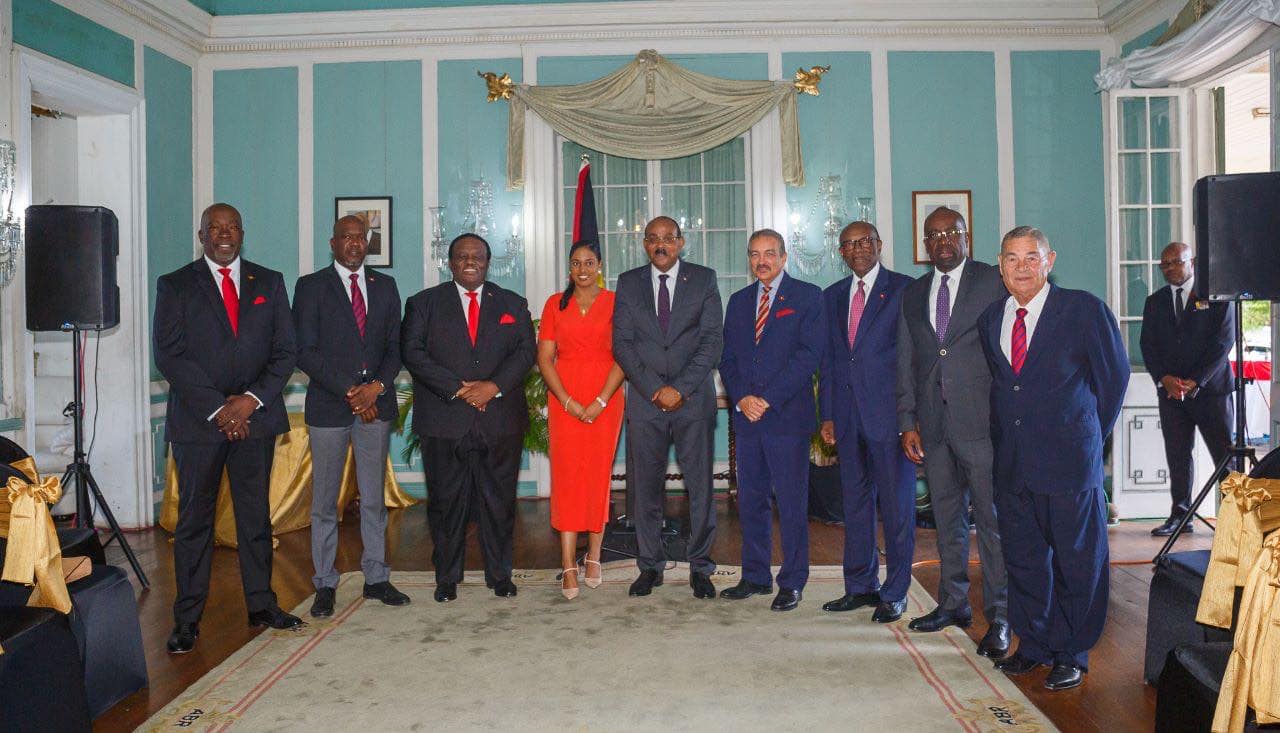

Caribbean Development Bank fosters new agreement with OPEC Fund to cement sustainable goals in region

The Caribbean Development Bank (CDB) has solidified a landmark partnership with the OPEC Fund for International Development by signing a Memorandum of Understanding (MOU). This collaboration is designed to enhance financial opportunities and accelerate sustainable development across the Caribbean region. The agreement facilitates joint financing and co-financing initiatives in critical areas such as climate resilience, renewable energy, infrastructure, food security, trade financing, and youth development. It also underscores the importance of knowledge sharing, technical assistance, and capacity-building to empower Borrowing Member Countries (BMCs) with innovative solutions and expanded resources.

The MOU was formalized during a signing ceremony last week, coinciding with the International Monetary Fund-World Bank Annual Meetings in Washington D.C. CDB President Mr. Daniel Best emphasized the transformative potential of such strategic alliances. ‘Multilateral development banks must unite their expertise, resources, and priorities to address global challenges effectively and advance the Sustainable Development Goals. This partnership exemplifies the power of collaboration in creating lasting, positive change for the Caribbean,’ he stated.

The agreement outlines a framework for joint project development, technical assistance programs, and regional dialogues to promote inclusive and environmentally sustainable growth. Key focus areas include climate-smart agriculture, water security, digital connectivity, and private sector development, all aligned with CDB’s mission to enhance resilience and reduce poverty.

Mr. Best highlighted the partnership’s potential to unlock unprecedented opportunities for BMCs. ‘By combining the OPEC Fund’s global influence with CDB’s regional expertise, we can accelerate investments in infrastructure, climate adaptation, and human development. This will pave the way for a sustainable, inclusive, and prosperous future for the Caribbean,’ he added.

Additionally, the alliance is expected to bolster youth empowerment, vocational training, and innovative financial mechanisms such as debt-for-sustainability swaps and blue economy initiatives. These efforts will further cement the Caribbean’s leadership in climate resilience and sustainable development.

-

Opposition Questions $256M Energy Deal: Can Belize Afford Fortis Buyout?

The Briceño Administration’s announcement of a $256 million deal to acquire Fortis’s operations in Belize has ignited a heated debate over the nation’s financial capacity to manage such a significant investment. The agreement includes Fortis’s 33% stake in Belize Electricity Limited (BEL), marking a pivotal step toward national energy control. However, the move has drawn sharp criticism from the opposition, led by Tracy Panton, who has raised serious concerns about the government’s ability to sustain the financial obligations tied to the deal. Panton highlighted recent costly repairs at key hydro facilities, including a $250,000 generator failure at the Chalillo Dam in December and additional repairs at the Mollejon Dam in June. She questioned whether Belize can afford the long-term financial burdens while ensuring reliable energy services. The deal, while ambitious, has left many questioning its feasibility and the potential impact on taxpayers.

-

Entrepreneurs now have extra time to apply for Phillip Nassief Entrepreneurship Challenge and win up to $20,000

The GEMS Foundation has announced an extension of the application deadline for the 2025 Phillip Nassief Entrepreneurship Challenge, now set for December 8, 2025. This decision aims to provide more entrepreneurs across Dominica with the opportunity to participate, particularly during the busy Creole season, which sees many small businesses engaged in food, hospitality, culture, tourism, and entertainment. The Foundation emphasized its commitment to ensuring fair and accessible participation for all entrepreneurs after the festivities conclude. Supported by the Dominica Association of Industry and Commerce (DAIC), the competition honors the legacy of the late Phillip Nassief by fostering entrepreneurial spirit and innovation. The initiative focuses on empowering small enterprises in Dominica’s hospitality and tourism sectors, including food and beverage, agro-processing, wellness, technology, transportation, and marketing. Following the extended submission window, the judging process will conclude on January 28, 2026, with seven finalists advancing to the LIVE Ultimate Pitching Challenge on February 19, 2026. Finalists will receive mentorship from seasoned professionals to refine their business models and presentations. The top three winners will receive monetary awards: EC$20,000 for first place, EC$15,000 for second, and EC$10,000 for third, aimed at supporting business growth and sustainability. The GEMS Foundation encourages all applicants to review and complete their submissions by the new deadline. Further details and applications are available at www.gems.dm/foundation or via @gemsfoundation on social media.

-

KFTL invests in modernisation to strengthen port operations

KINGSTON, Jamaica — Kingston Freeport Terminal Limited (KFTL) is making significant strides in its modernization and expansion efforts with the acquisition of two cutting-edge ship-to-shore cranes, valued at nearly US$24 million. This strategic move underscores KFTL’s commitment to establishing Jamaica as a premier logistics hub in the Caribbean region.

-

Murally appointed Carib managing director

In a landmark appointment, Leesa Murally has been named the first female managing director of Carib Brewery Ltd, a subsidiary of the Ansa McAL group, effective November 1. This historic move underscores the company’s commitment to diversity and leadership excellence. Murally, who currently serves as the beverage sector’s chief financial officer and corporate secretary to the board of Caribbean Development Company Ltd (CDC), brings a wealth of experience in finance, risk management, and corporate governance. Her career spans key roles at CDC and Witco, and she currently sits on the boards of CDC, Bayside Towers, and Community Chest. Murally’s academic credentials include an MBA in strategic planning from Heriot-Watt University, and she is a Fellow of the ACCA and a Certified Internal Auditor. Known for her people-centered leadership style, Murally has a proven track record of driving continuous improvement, fostering data-driven decision-making, and enhancing governance and cybersecurity. In addition to Murally’s appointment, Ansa McAL announced David Welch as the new managing director of AMCO, effective November 1. Welch, with over 25 years of experience in the FMCG industry, previously served as managing director of Carib Brewery and marketing director at CBL. The group expressed confidence that both leaders will play pivotal roles in advancing the beverage and distribution sectors’ growth and success.