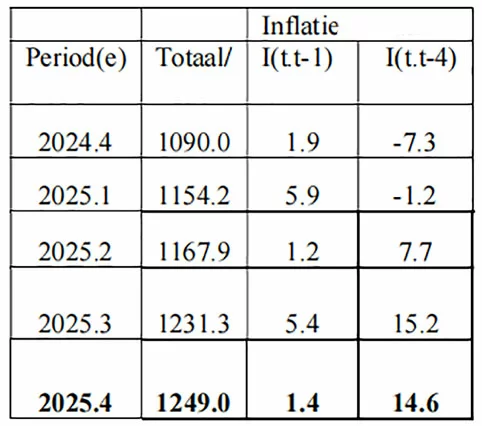

Suriname’s construction sector continues to face significant cost pressures as latest data reveals persistent price increases throughout 2025. According to preliminary statistics released by the General Bureau of Statistics (ABS), the Construction Price Index (BPI) climbed by 1.4% in the fourth quarter of 2025 compared to the previous quarter. More strikingly, when measured against the same period in 2024, construction prices have surged by 14.6%.

The BPI, which tracks average price fluctuations across a fixed basket of 107 construction goods and services categorized into 16 major groups, collects pricing data from approximately fifty monitoring points across Paramaribo and Wanica. The index covers residential buildings, utility structures, and civil engineering works, providing a comprehensive overview of the construction industry’s cost dynamics.

Quarterly analysis demonstrates a consistent upward trajectory throughout 2025, with the overall index climbing from 1154.2 in Q1 to 1249.0 by year’s end. The third quarter proved particularly volatile, registering a sharp quarterly increase of 5.4% and pushing year-over-year inflation to 15.2%.

Labor expenses constitute the most substantial cost component within the index, representing 41.73% of total weighting. Unlike other categories, labor costs maintain a constant share without separate price monitoring. Other significant cost drivers include steel and concrete works (13.50%), paving works (13.35%), and masonry and pouring works (12.38%).

This sustained inflationary trend poses considerable challenges for housing affordability and infrastructure development. Elevated material and operational costs directly impact both private and public sector construction initiatives, potentially delaying new projects and renovations across the nation.