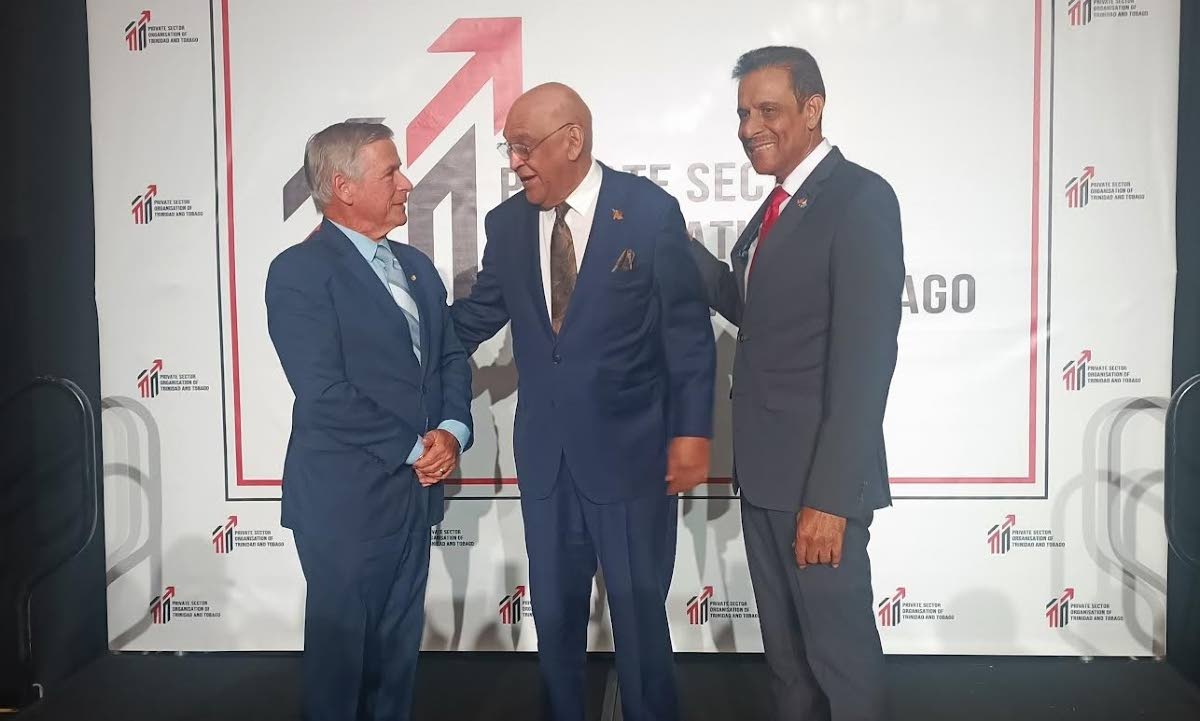

PARAMARIBO – The fourth edition of Who’s Who in Suriname Business was officially unveiled at Royal Torarica during a high-profile gathering that brought together business leaders, diplomatic missions, investors, and regional partners. This comprehensive directory, developed with strategic support from the Suriname-Guyana Chamber of Commerce (SGCC), has established itself as a vital platform for enhancing corporate visibility, business profiling, and cross-border collaboration throughout the Guiana Basin region.

Minoushi Filemon, SGCC Membership Lead, emphasized during the launch ceremony that the publication is evolving into an essential strategic tool for companies seeking to strengthen their market positioning. The directory serves dual purposes by simultaneously assisting international investors in identifying reliable local partners while enabling Surinamese entrepreneurs to expand their regional footprint.

Keynote speaker and publisher Vishnu Doerga highlighted the critical importance of developing strong English-language business propositions as Suriname continues to emerge as a significant opportunity hub within the rapidly developing Guiana Basin. Doerga stated, ‘If you don’t tell your own story, others will tell it for you. This directory provides businesses with a credible platform to make their capabilities visible and accessible to potential partners.’ He further emphasized that digital, economic, and professional bridges between Suriname and Guyana are fundamental prerequisites for sustainable regional growth.

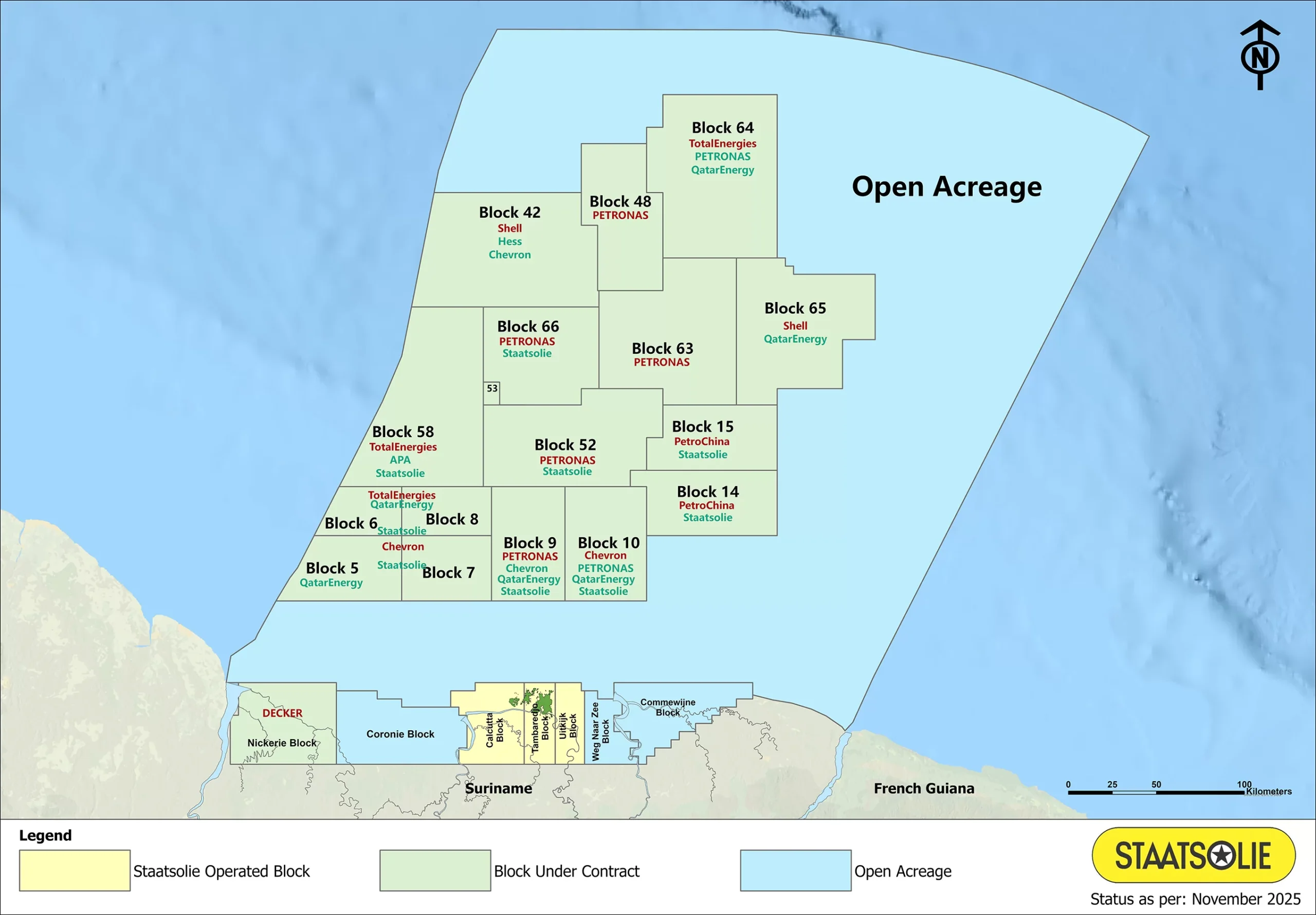

Guyanese Ambassador to Suriname, Virjanand Depoo, commended the professional standards of Suriname’s business community, describing the directory as a milestone achievement that underscores the private sector’s maturity and readiness for international engagement. Minister Patrick Brunings of Oil, Gas & Environment reinforced the message of regional cooperation, highlighting the shared historical ties and common future aspirations of both nations. Minister Brunings asserted that enhanced collaboration between Suriname and Guyana is absolutely crucial for accelerating economic development throughout the region.