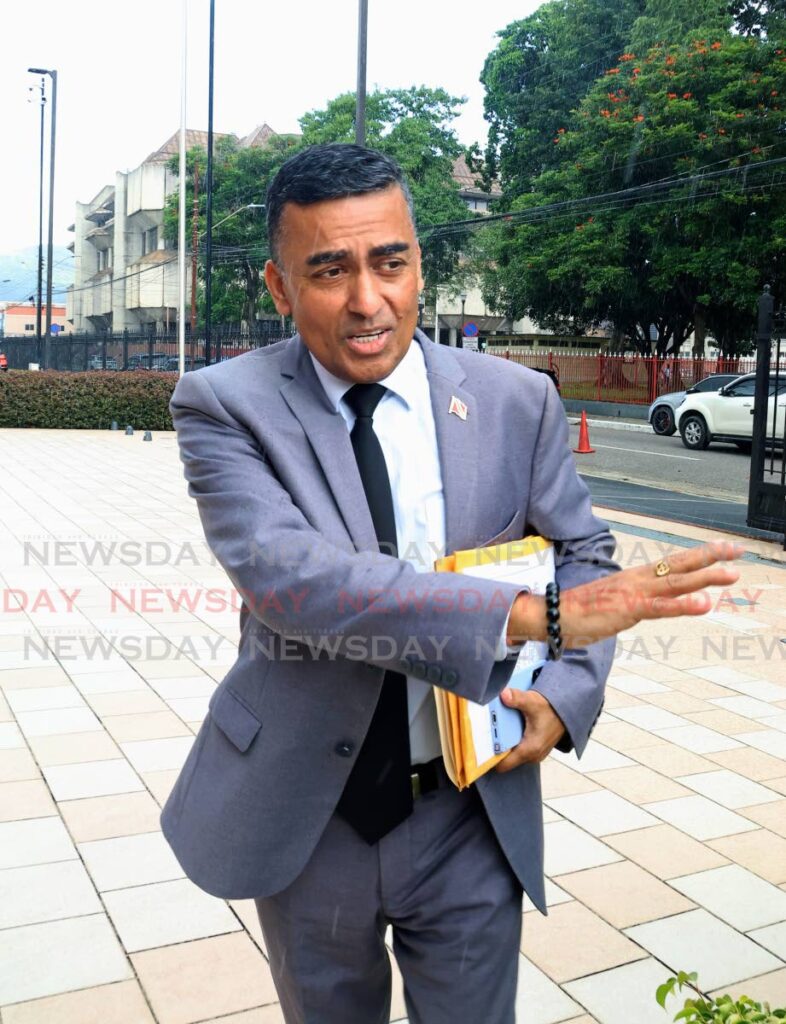

The Couva Carnival Committee has officially launched its 2026 celebrations with an urgent appeal for increased corporate funding to deliver what organizers promise will be “the best carnival ever.” Committee Chairman Ramchand Rajbal Maraj revealed the stark financial reality facing the festival during the December 6th launch event at Couva Joylanders Steel Orchestra’s panyard on Railway Road.

Despite receiving an annual subvention from the National Carnival Commission, the committee faces a significant funding gap with its 2026 budget projected at $480,000. “We produce several marquee events leading up to the actual two days of carnival which increases our expenses substantially,” Rajbal Maraj explained to attendees. “As a result, we depend heavily on the goodwill and generosity of the corporate community.”

The chairman emphasized that all Couva Carnival events remain free to the public, attracting thousands of patrons who enjoy what he described as “unforgettable experiences.” He made a compelling case for corporate investment, suggesting sponsors would “benefit tremendously by partnering with us and giving back to the community.”

The launch event itself demonstrated the cultural vibrancy that defines Couva Carnival. Former medium-band Panorama champions Couva Joylanders delivered a spectacular performance, thrilling the audience with several of their hit arrangements. Richard Gill, the band’s executive manager, welcomed the initiative and confirmed the orchestra would play an expanded role in 2026 celebrations.

Mas enthusiasts received an exclusive preview of 2026 costumes from children’s bands House of Jacqui (presenting ‘Come Fly With Me’) and Carivog Kids (with ‘Explorers’), along with double J’Ouvert champions Wall Brothers (featuring ‘Maljo J’Ouvert’). The entertainment lineup included popular performers Johnny Ramnarine, Blue Magic, and Wackerman, who kept the atmosphere electric with crowd-pleasing hits.

The committee also announced an extensive calendar of events leading up to the main carnival days, including the Miss Central Trinidad Queen Pageant screening on January 3rd, calypso competition auditions on January 11th, and various showcases and finals throughout February. The grand finale will feature the traditional Parade of the Bands on February 17th, following J’Ouvert celebrations and Monday Nite Mas events.