Antigua’s most visited news platform is now offering businesses a unique opportunity to elevate their digital presence through fully customizable and flexible marketing packages. Designed to cater to diverse advertising needs, these packages allow brands to connect with a broad audience in a dynamic and engaging manner. Businesses looking to amplify their reach can collaborate with the platform’s expert team to craft tailored campaigns that align with their goals. For inquiries and to explore the available options, interested parties are encouraged to contact the platform via email at [email protected]. This initiative underscores the platform’s commitment to supporting local and international businesses in achieving their marketing objectives while leveraging its extensive readership and digital influence.

分类: business

-

Marine Exports See Boost in August 2025

Belize’s export performance in August 2025 remained largely stagnant, with marine products emerging as the sole standout in an otherwise flat trade landscape, according to the Statistical Institute of Belize (SIB). The SIB reported a significant $1.3 million increase in marine export revenues, climbing from $4.5 million in August 2024 to $5.7 million this year. This growth was primarily driven by heightened international demand for lobster meat, a key foreign exchange generator for the nation. Marine exports, encompassing shrimp, conch, whole lobster, and various fish species, have traditionally been a cornerstone of Belize’s export economy. However, the sector has encountered persistent challenges in recent years, including the collapse of the farmed shrimp industry and intensifying competition in global seafood markets. Despite these obstacles, lobster continues to hold its ground as a prized commodity, with steady demand from markets in the United States and Europe. The recent revenue boost signals a potential recovery for the industry, which plays a vital role in supporting the livelihoods of coastal communities and small-scale fishers across Belize.

-

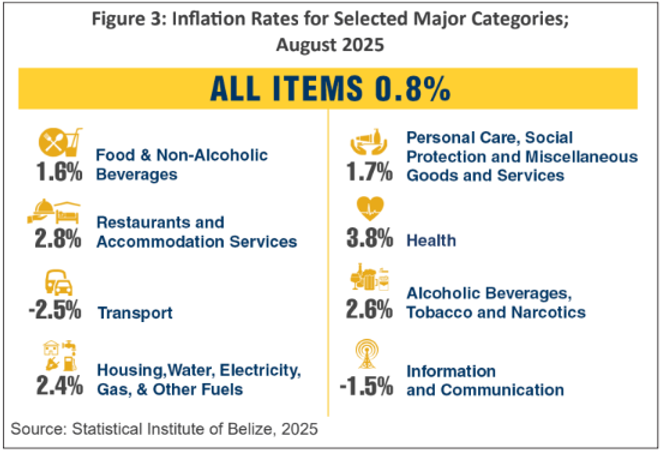

Food, Rent, and Gas Push Inflation Up 0.8% in August; Fuel Prices Ease Burden

In August 2025, Belizeans experienced a mixed economic landscape as rising costs in essential sectors like food, housing, and liquefied petroleum gas (LPG) were partially offset by declining fuel prices, resulting in an overall inflation rate of 0.8 percent compared to the previous year. According to the Statistical Institute of Belize, the Consumer Price Index (CPI) rose to 120.7, up from 119.7 in August 2024. The most significant contributors to this increase were the ‘Housing, Water, Electricity, Gas and Other Fuels’ category, which surged by 2.4 percent, and ‘Food and Non-Alcoholic Beverages,’ which climbed by 1.6 percent. Together, these categories represent nearly half of household expenditures, amplifying their impact on consumers. Housing costs were driven by a $12.24 year-over-year increase in the price of a hundred-pound LPG cylinder, reaching $130.04, alongside a 1.7 percent rise in home rental prices. Food inflation was fueled by higher prices for bread, bakery products, and meats, with beef steak and chicken breast prices soaring by 10.7 and 8.5 percent, respectively. Non-alcoholic beverages also saw a 4.4 percent increase, primarily due to higher costs for purified water, juices, and soft drinks. Additional notable price hikes included health services (up 3.8 percent), restaurants and accommodation (up 2.8 percent), and personal care items like deodorants and lotions (up 1.7 percent). Alcoholic beverages and tobacco rose by 2.6 percent, led by cigarette prices. However, these increases were partially mitigated by a 2.5 percent decline in transport costs, driven by lower gasoline and diesel prices. Regular gasoline dropped by $0.90 per gallon, diesel by $0.67, and premium gasoline by $0.62. Information and communication costs also fell by 1.5 percent, reflecting cheaper cell phones. Inflation varied significantly across municipalities, with Punta Gorda experiencing the steepest rise at 2.7 percent due to broad-based increases in food, LPG, and personal care items. In contrast, Orange Walk recorded a slight decline of -0.2 percent, benefiting from lower fuel, garment, and vegetable prices. Month-to-month, consumer prices increased by 0.2 percent between July and August 2025, primarily due to higher diesel, vehicle, and restaurant costs. Year-to-date inflation for the first eight months of 2025 stood at 1.3 percent, largely influenced by rising food, housing, and personal care expenses, while transport and communication costs trended downward.

-

Forex: $161.30 to one US dollar

KINGSTON, Jamaica — The US dollar demonstrated a slight upward trend against the Jamaican dollar on Friday, September 26, closing at $161.30, an increase of eighteen cents compared to the previous trading session. This data was reported in the Bank of Jamaica’s daily exchange trading summary, highlighting the ongoing fluctuations in the foreign exchange market. Concurrently, the Canadian dollar also experienced a notable rise, ending the day at $121.14, up from $117.65. The British pound, however, saw a marginal increase, closing at $216.34, just slightly higher than its previous close of $216.08. These shifts reflect broader global currency dynamics, influenced by economic indicators, trade relations, and market sentiment. The Bank of Jamaica continues to monitor these trends closely, as they impact the nation’s import and export activities, as well as overall economic stability.

-

Leiba takes helm of Jamaica Chamber of Commerce

KINGSTON, Jamaica — The Jamaica Chamber of Commerce (JCC) has announced Emile Leiba, managing partner at DunnCox, as its new president for the 2025/2026 term. This leadership transition follows the completion of two successful terms by outgoing president Phillip Ramson. Leiba, a seasoned attorney with over 20 years of expertise in corporate and commercial law, is set to bring a unique combination of legal proficiency and business insight to the role. His extensive experience in financial regulation, mergers and acquisitions, and governance aligns seamlessly with the chamber’s focus on advocacy and policy-driven initiatives.

During the annual general meeting, Warren McDonald, chair and director of elections, confirmed Leiba’s uncontested election, stating, ‘As Mr. Leiba is the only nominee, it is my duty to announce his election as president for the 2025/2026 term.’

The chamber also unveiled its new leadership team, including Martha Miller, CEO of National Rums of Jamaica, as first vice-president; Jonathan Swire, deputy chairman of Delta Supply Company, as second vice-president; Colonel (Retired) Jamie Ogilvie, vice-president at Jamaica Broilers, as third vice-president; and Janine Chin, a senior pharmaceutical executive, as fourth vice-president. John Butler, executive director at EY Jamaica, was appointed honorary treasurer to oversee financial matters.

Additionally, eight directors were elected to the board, representing a diverse range of industries and expertise. Outgoing president Phillip Ramson reflected on his tenure, highlighting achievements in advocacy, trade facilitation, and support for small and medium-sized enterprises. ‘It has been a true honour to serve as president of the Jamaica Chamber of Commerce…This has been a journey of collaboration, resilience, and shared vision,’ he remarked.

Ramson expressed confidence in the chamber’s future, stating that it is ‘positioned for even greater impact’ under Leiba’s leadership. The transition comes as the JCC continues to advocate for tax reforms, improved public procurement access for SMEs, and enhanced support for businesses undergoing digital transformation.

-

Technology outage impacting several services at VM Building Society branches

KINGSTON, Jamaica — VM Building Society, a prominent financial institution in Jamaica, experienced significant service disruptions on Friday due to a widespread technology outage. The incident forced the delayed opening of all branches until 10:00 am, with extended operating hours until 4:00 pm to accommodate affected customers. The outage impacted critical services, including online banking, ABM access, and point-of-sale transactions, rendering them temporarily unavailable. The bank assured members that updates on service restoration would be provided by 10:00 am. Customers visiting branches were advised to anticipate longer wait times due to the disruption. VM Building Society issued an apology for the inconvenience, expressing gratitude for members’ patience and continued support as their technical team worked diligently to resolve the issue.

-

RATINGS UPGRADE

S&P Global Ratings has elevated Jamaica’s sovereign credit rating from ‘BB-’ to ‘BB’, marking a significant milestone in the nation’s financial recovery. This upgrade, announced on Thursday, underscores Jamaica’s decade-long commitment to fiscal discipline, which has drastically reduced its debt-to-GDP ratio from nearly 145% in 2013 to approximately 62% today. Despite this achievement, the agency’s analysis highlights the pressing challenge of stimulating economic growth in the aftermath of the debt crisis. The ‘BB’ rating, while still within the speculative-grade tier, represents a notable improvement in creditworthiness, signaling reduced default risk. S&P also affirmed Jamaica’s ‘B’ short-term rating and assigned a positive outlook, suggesting the potential for another upgrade within 18 months if fiscal progress continues. The report praised Jamaica’s unique fiscal achievements, including maintaining an annual primary fiscal surplus above 3% of GDP for ten consecutive years—a feat unmatched by any of the 141 sovereigns rated by S&P. However, the agency cautioned that Jamaica’s growth prospects remain constrained by high security costs, low productivity, and vulnerability to external shocks. Policymakers now face the dual challenge of sustaining fiscal credibility while fostering economic expansion. The upgrade reflects Jamaica’s institutional resilience, bolstered by initiatives like its proactive disaster risk framework and strengthened financial institutions. Yet, the path forward hinges on translating fiscal stability into sustainable growth, a task that will define Jamaica’s next chapter.

-

Dominica delegation participates in 18th OECS Credit Union Summit in St. Kitts

A delegation of 23 representatives from Dominica is actively participating in the 18th Organisation of Eastern Caribbean States (OECS) Credit Union Summit, held from September 23 to 28, 2025, at the St. Kitts Marriott Resort. The group comprises staff and volunteers from four prominent credit unions—Central Cooperative Credit Union, Marigot Cooperative Credit Union, West Coast Co-operative Credit Union, and National Cooperative Credit Union—alongside officials from the Dominica Co-operative League Ltd and the Corporate Finance Facility (CORPEFF).

The summit, themed “One Vision, One Future: OECS Credit Unions Growing Together,” is organized by the St. Kitts and Nevis National Co-operative League Ltd. It aims to unite cooperators from across the OECS region to devise strategies for bolstering the credit union movement and tackling economic challenges through cooperative business models.

The event kicked off with an Opening Ceremony on September 24, featuring a keynote address by Timothy Antoine, Governor of the Eastern Caribbean Central Bank (ECCB). His presentation, titled “Navigating the Economic and Financial Landscape of the Eastern Caribbean Currency Union (ECCU): Are Credit Unions Positioned for Strategic Expansion?” laid the groundwork for the week’s discussions.

Participants are engaging in a variety of sessions, including plenary discussions, fire side chats, round table engagements, and networking events. Key topics under discussion include modernizing regulatory standards, the potential of green lending, diversifying investment portfolios, multi-generational member engagement, building resilient IT ecosystems, strengthening governance, and reimagining operational models for strategic growth.

The Dominica delegation departed on September 23 and is set to return on September 28, following the summit’s conclusion.