Basseterre, 24 October 2025 – Cable & Wireless St. Kitts & Nevis Ltd has announced a dividend payout of EC$0.70 per share, approved by its Board of Directors. This payment covers the fiscal years 2021, 2022, 2023, and 2024 and will be distributed to shareholders recorded as of 19 September 2025. The Eastern Caribbean Securities Exchange (ECSE) will facilitate the disbursement, effective from 24 October 2025. Additionally, the company has indicated that further details regarding the Annual General Meeting (AGM) will be communicated soon. The AGM will focus on reviewing the financial performance of the company over the aforementioned years. This announcement underscores the company’s commitment to delivering value to its shareholders amidst its financial operations.

分类: business

-

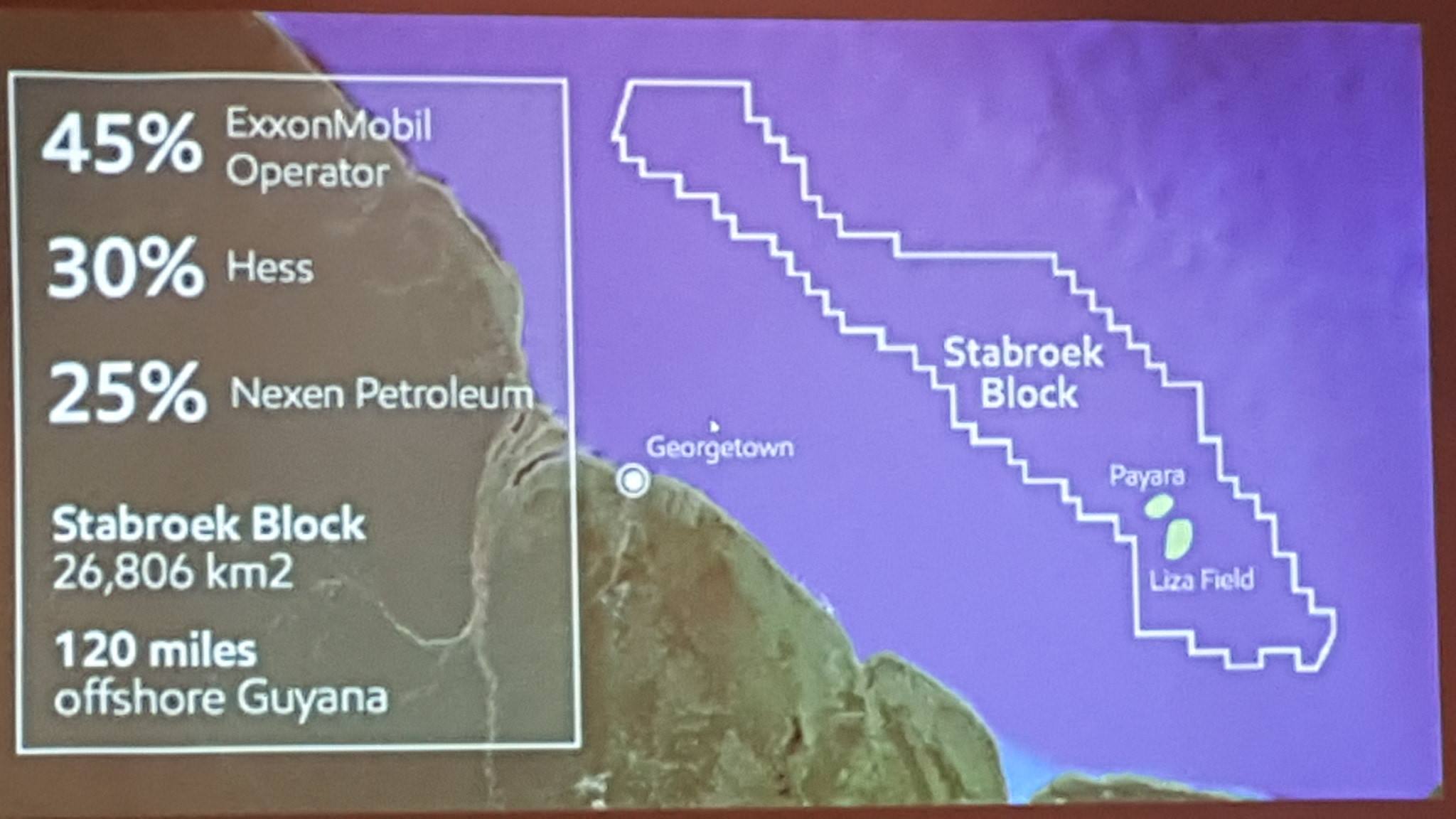

Eco-Atlantic says Hammerhead may fuel heavy oil build out offshore Guyana

Eco Atlantic Oil & Gas has indicated that the recent sanctioning of the Hammerhead project by ExxonMobil could pave the way for significant heavy oil development offshore Guyana. The US$6.8 billion seventh phase of the Stabroek block has demonstrated the economic viability of heavy oil extraction, according to Eco Atlantic’s President and CEO, Gil Holzman. In an interview, Holzman emphasized that this development has prompted a reevaluation of the Jethro-1 discovery, which holds an estimated 1 billion barrels of oil, located in the neighboring Orinduik block where Eco Atlantic holds a 100% working interest. The company is now in discussions with the Guyanese government to potentially revisit the non-commercialization notice issued by Tullow, the previous operator of Orinduik. Holzman also noted that the extended farmout process for Orinduik was influenced by the shift in focus from light Cretaceous oil to heavy oil development. Additionally, Eco Atlantic maintains a stake in the Canje block, which borders Stabroek, further solidifying its presence in Guyana’s burgeoning oil sector.

-

Faber Criticizes Secretive BEL Acquisition Plan

Opposition Senator Patrick Faber has launched a scathing critique of the Belizean government’s secretive plan to acquire Fortis Belize and its shares in Belize Electricity Limited (BEL). Faber accuses the Briceño administration of lacking transparency in its dealings with Fortis principals, particularly regarding the financial and procedural details of the agreement. The senator expressed frustration over the rushed legislative process, which he claims forces the Senate to evaluate, study, and pass the bill in a single sitting. Faber described this approach as ‘unconscionable,’ suggesting the government is attempting to push through a significant financial deal without proper scrutiny. The acquisition includes Fortis Belize Ltd., which owns three hydroelectric dams, at a reported cost of $110 million USD. Faber questioned whether the payment has already been made, citing discrepancies in the circulated documents, including one marked ‘executed’ with the prime minister’s signature. This move, according to Faber, represents an unnecessary and costly expansion of the government’s initial plan to repurchase BEL shares.

-

Central America Targets Connectivity Fix to Boost Regional Tourism

Central America is taking significant steps to address its connectivity challenges, which have long hindered the growth of its tourism sector. Despite marketing itself as a unified, multi-destination region, the lack of seamless air and land routes continues to restrict travelers’ ability to move freely between countries. Efren Perez, Pro Tem President of the Federation of Central American Tourism Chambers and President of the Belize Tourism Industry Association, emphasized the importance of this issue during a recent regional meeting. Key organizations such as the Central American Tourism Agency and FEDECATUR are collaborating to develop solutions that improve cross-border access, revisit the CA-4 Agreement, and strengthen partnerships with regional airlines. Perez highlighted that these efforts are part of a broader strategy to make travel within the region more accessible, encourage longer stays, and elevate Central America’s position on the global tourism map. During the meeting, Perez also discussed the need for regional immigration reforms and the integration of the private sector into promotional strategies. He provided an example of how travelers moving from Honduras to Belize might not require a round-trip ticket if they are engaging in multi-destination travel, which is a key focus of the region’s tourism promotion. Perez stressed the importance of balancing border security with the need to maintain a smooth flow of tourists. The private sector is actively working with government agencies to propose solutions that enhance connectivity and improve the overall tourism experience. These initiatives are expected to be a central topic in ongoing regional discussions, with the goal of fostering a more integrated and attractive tourism market in Central America.

-

Howai: Central Bank not main supplier of forex to commercial banks

Central Bank Governor Larry Howai has addressed widespread misconceptions about the institution’s role in Trinidad and Tobago’s foreign exchange (forex) market. Speaking at the TT Stock Exchange’s Capital Markets and Investor Conference in Port of Spain on October 24, Howai emphasized that the Central Bank accounts for just over 20% of forex entering the financial system, with the remaining 80% sourced from private entities and individuals. He clarified that while the bank intervenes to stabilize supply, the majority of forex distributed through commercial banks originates from private channels. Howai stressed the need for long-term solutions to broaden the country’s capacity to earn forex, rather than relying on central bank interventions. He highlighted the importance of boosting exports, both traditional and non-traditional, such as those from the creative sector. Howai, a former finance minister, also discussed the challenges of managing interest rates, inflation, and forex outflows, noting that policy tools like the repo rate and reserve requirements often yield mixed results. He pointed out the narrowing interest rate differential between US and TT Treasury bills, which could influence local investment behavior. Howai underscored the critical relationship between the Central Bank and the Ministry of Finance in managing liquidity and inflationary pressures, advocating for continued public engagement to refine forex distribution mechanisms.

-

Grand Lucayan power cut amid dispute over who pays overdue electric bill

The Grand Lucayan Resort in Grand Bahama experienced a temporary power outage on Thursday morning, reportedly due to unresolved electricity bills tied to the property’s recent change of ownership. The Office of the Prime Minister (OPM) confirmed that the issue was swiftly resolved, attributing it to a minor hiccup during the transition process. Latrae Rahming, Director of Communications at the OPM, stated, ‘The matter of power supply at the Grand Lucayan has been resolved, and electricity has been reconnected. This was a matter of reconciling utility bills between the government and the new owners.’ The resort, currently unoccupied, remains in a transitional phase as redevelopment efforts progress. Approximately 300 employees are still on staff to manage operations during this period. Sources revealed that the Grand Bahama Power Company (GBPC) disconnected the resort’s power supply due to unpaid arrears from the previous management. The new owners, Miami-based Concord Wilshire Capital, reportedly refused to assume the debt, leading to the brief disruption. GBPC declined to comment on the matter. The government sold the 56-acre property to Concord Wilshire in May for $120 million as part of an $827 million redevelopment plan aimed at transforming the resort into a mixed-use complex featuring a hotel, casino, marina, and cruise port. The incident highlights the challenges of transitioning ownership and the expectations for tangible progress on the project, which is seen as pivotal to revitalizing Grand Bahama’s tourism sector after years of setbacks, including hurricane damage and stalled ownership changes.

-

TTSE announces shift to T+1 trade settlement by 2026

The Trinidad and Tobago Stock Exchange (TTSE) is set to transition to a one-day trade settlement cycle (T+1) by 2026, as part of its broader efforts to modernize operations and align with global standards. CEO Eva Mitchell made the announcement during her opening remarks at the TTSE’s 2025 Capital Markets and Investor Conference held at the Hyatt Regency in Port of Spain on October 24. Mitchell highlighted that the exchange had already reduced its settlement cycle from T+3 to T+2 in 2024, and the move to T+1 will further enhance market efficiency. The T+1 system, already adopted by major exchanges like the New York Stock Exchange, will reduce settlement time to a single day, improving liquidity and minimizing counterparty risk. Mitchell emphasized that this transition aligns the TTSE with global best practices for advanced exchanges. Alongside the settlement cycle change, the TTSE is rolling out a series of technology upgrades, including an updated depository portal set to launch in November. The new portal promises faster processing, smarter systems, and enhanced scalability, while also enabling the collection of valuable data to better understand market trends and opportunities. Additionally, the exchange introduced TOBI, a user-friendly digital assistant designed to help investors access information and ask questions about the market and its services. Mitchell also revealed that the TTSE has completed infrastructure for a new Spot Market to support derivatives trading, marking a first for the Caribbean. The exchange is also exploring the introduction of a ‘market maker’ framework to improve liquidity and price stability. In line with its commitment to sustainability, the TTSE has partnered with IDB Invest to develop a Green Bond Guide and joined the United Nations Sustainable Stock Exchanges (UNSSE) Initiative. Mitchell acknowledged the subdued local market but urged stakeholders to focus on long-term growth, emphasizing the importance of modernizing the market, embracing innovation, and fostering transparency and trust.

-

Young warns of energy sector fallout

The closure of Nutrien’s operations at the Point Lisas Industrial Estate in Trinidad has sparked significant concerns over the management of the country’s energy sector. Former Energy Minister and Prime Minister Stuart Young attributed the shutdown to what he termed “unfortunate mismanagement,” warning of its potential to undermine Trinidad and Tobago’s global competitiveness. The shutdown, confirmed on October 23, has already begun to disrupt the supply of carbon dioxide (CO₂) to local and regional manufacturers, including those in the carbonated beverage industry, a key export sector for the nation. Nutrien cited port access restrictions and unreliable natural gas supply as primary reasons for the decision, which has impacted its Trinidad Nitrogen operations’ cash flow over an extended period. Despite the closure, Nutrien remains confident in meeting its 2025 nitrogen sales targets, supported by its North American production. Young emphasized the critical role of the energy sector as a major foreign exchange earner and employer, stressing the importance of maintaining investor confidence and fostering respectful relationships with energy companies. He criticized the current government for failing to uphold these principles, warning of potential long-term plant closures and broader economic fallout.

-

NGC finds alternative CO2 for beverages amid Nutrien shutdown

The National Gas Company of Trinidad and Tobago (NGC) has successfully secured alternative sources of carbon dioxide (CO2) for the food and beverage industry, following the abrupt shutdown of Nutrien, the primary supplier. The announcement, made on October 24, comes in response to widespread concern over potential disruptions to CO2 supplies, which are critical for various domestic and industrial applications. Nutrien’s closure on October 20 had sparked fears of a shortage, particularly affecting Massy Gas Products Trinidad Ltd, the main distributor of CO2 to local manufacturers. NGC has collaborated with key stakeholders, including Proman Group and Plipdeco, to ensure a seamless transition. Proman has committed to supplying the same volume of CO2 previously provided by Nutrien, with no price increases for customers. Engineering pipeline tie-ins are currently being installed, with completion expected by October 27. NGC expressed regret over Nutrien’s indifference to the potential hardships caused by its shutdown but emphasized that the crisis has been averted. Meanwhile, former Energy Minister Stuart Young criticized the government’s handling of the situation, accusing it of aggressive tactics that led to Nutrien’s closure and warning of broader regional impacts on CO2-dependent industries.