A Nigerian firm, VTA Global Services, has recently been authorized as a Marketing Agent for Grenada’s Citizenship by Investment (CBI) program, marking a significant step in the country’s efforts to expand its reach across Africa. The license, effective from November 3, 2025, was officially announced in the Government Gazette on November 21, 2025, and signed by Thomas Anthony, CEO of the Investment Migration Agency (IMA).

VTA Global Services, located in the upscale Osborne Foreshore area of Ikoyi, Lagos, specializes in providing global citizenship services, including those for Grenada, St. Lucia, St. Kitts and Nevis, Antigua and Barbuda, and the Dominican Republic. The company emphasizes its expertise in immigration consulting, aiming to secure positive outcomes for its clients.

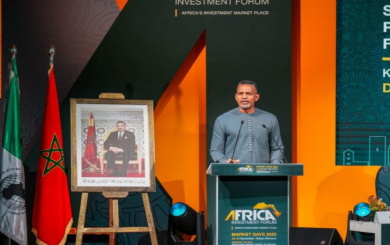

Nigeria has emerged as the leading African nation in terms of applications for Grenada’s CBI program, a trend that the IMA plans to extend to other African countries. In July 2025, Anthony highlighted Nigeria’s dominance in CBI applications and announced plans for a West African tour to promote the program further. The IMA has already engaged with Kenya through a collaboration with the Nairobi Chamber of Commerce, attracting over 100 participants to a recent event.

The CBI program, launched in 2014, has become a significant revenue generator for Grenada, with marketing agents required to collaborate with local agents to submit applications for consideration. The program’s expansion into Africa aligns with Grenada’s broader strategy to attract investment and foster economic growth through immigration initiatives.