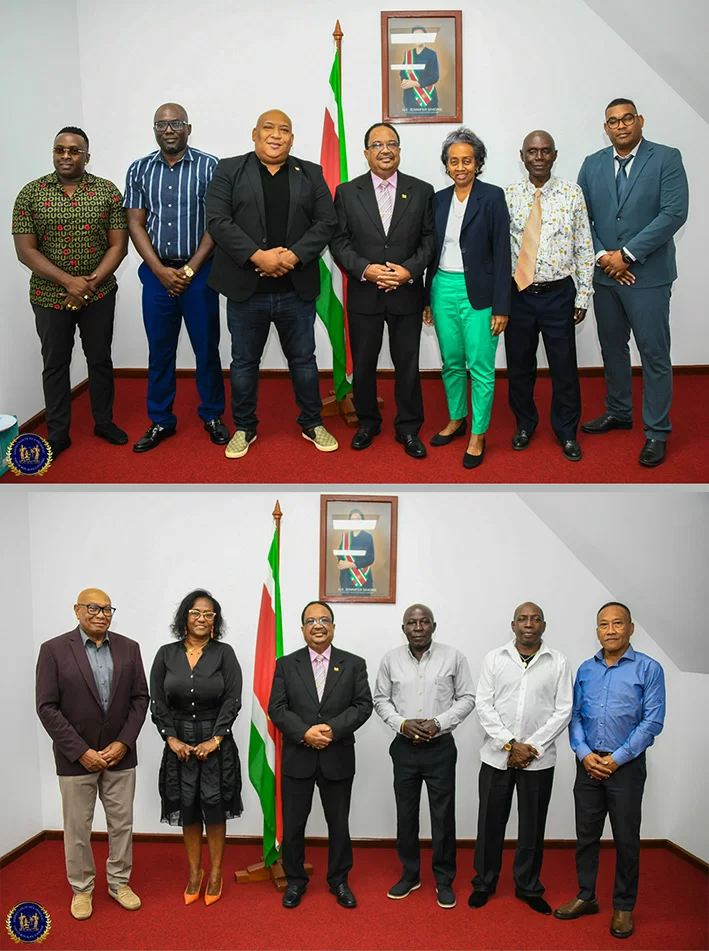

In a pivotal address to the Suriname Economists Association (VES), President Jennifer Simons unveiled the foundational framework for the nation’s economic and governance strategy extending to 2030. Speaking at the New Year’s reception, the president articulated a vision moving beyond macroeconomic stability as an end goal, positioning it instead as the essential foundation for sustainable growth and equitable wealth distribution.

Simons characterized Suriname’s current juncture as a decisive crossroads, emphasizing that with the IMF program concluded and the 2025 political transition completed, the nation must now assume full responsibility for coherent fiscal, monetary, and structural policies. “We commenced our term amidst scarcity, a fragile economic recovery, and limited public trust,” Simons noted. “This reality demands not grand rhetoric but clear direction, disciplined execution, and institutional strength.”

The administration declared 2026 as both a new budgetary cycle and the launch of a comprehensive Multi-Year Development Plan (MOP) targeting 2030 objectives. This strategic framework will integrate policy priorities, investment decisions, and implementation agreements within a macro-fiscal structure featuring scenario analyses for growth trajectories, inflation control, exchange rate management, and future petroleum revenues.

Central to the government’s approach is the “one government, one course” principle, organized around five national priorities: enhancing revenue generation capabilities, strengthening education and healthcare systems, improving public security, revitalizing the housing sector, and ensuring policy coherence and execution. The economic direction rests on three fundamental pillars: macroeconomic stability, economic diversification, and investments in human capital and institutions.

President Simons issued stern warnings regarding inflation risks and budgetary deviations, highlighting Suriname’s import dependency which rapidly transmits exchange rate pressures to consumer prices, thereby eroding purchasing power and undermining business and household confidence. Fiscal policy must consistently support monetary measures, with no room for broad wage adjustments that could fuel inflationary spirals. Protection mechanisms, she stressed, should specifically target low-income households and vulnerable populations.

The address extensively addressed foreign exchange challenges, emphasizing that currency earnings must actively circulate within the domestic economy rather than accumulate stagnant reserves. Economic leakages including gold smuggling, underreporting, and informal exports exacerbate exchange rate pressures and constrain budgetary flexibility. The government is collaborating with the Central Bank to establish a stable and transparent foreign exchange market, supported by analytical work from a dedicated currency commission.

Regarding public finances, while government revenues reached approximately SRD 45.6 billion in 2025, expenditures grew more significantly due to election costs, salary adjustments, and subsidies. For 2026 onward, the administration aims to implement expenditure controls without obstructing productive investments. Education and healthcare budgets will receive explicit protection, while inefficient programs face phase-out and state-owned enterprises will undergo enhanced oversight.

Looking toward anticipated oil revenues, Simons cautioned that additional resources cannot justify unfettered spending. The savings and stabilization fund requires strengthened legal and operational frameworks with transparent rules for deposits, withdrawals, and public accountability. International experience demonstrates that nations typically fail not from resource scarcity but from weak management and transparency deficits, she observed.

Concluding her address, President Simons invited VES and professional associations to actively contribute to policy formulation and public knowledge sharing. Effective policy demands not only technical excellence but also societal understanding and support, she remarked, adding that “economic choices are fundamentally moral choices—they determine whether families can prosper and whether youth can envision futures.”