In a striking commentary on January 12, 2026, prominent media executive Louis Wade, owner of Plus TV, voiced substantial concerns regarding Belize Telemedia Limited’s (BTL) prospective acquisition of Smart. While explicitly affirming his support for the sellers’ prerogative to divest their private enterprise, Wade directed pointed criticism toward the prospective buyer. He characterized BTL as a historically monopolistic entity with a demonstrable record of poor stewardship within the open marketplace of ideas. Wade’s critique traversed BTL’s entire operational history, referencing its phases under government ownership, the controversial ‘golden share’ era, and its current structure, which he describes as a ‘government-owned private entity.’ He contends this blurred ownership model means it fundamentally remains a public instrument, thereby posing a significant threat to principles of fair competition and market transparency. This perspective adds a critical voice to a story receiving extensive coverage from outlets like Greater Belize Media, which has been reporting on the negotiations by incorporating viewpoints from the broader business community, independent senators, and trade unions.

分类: business

-

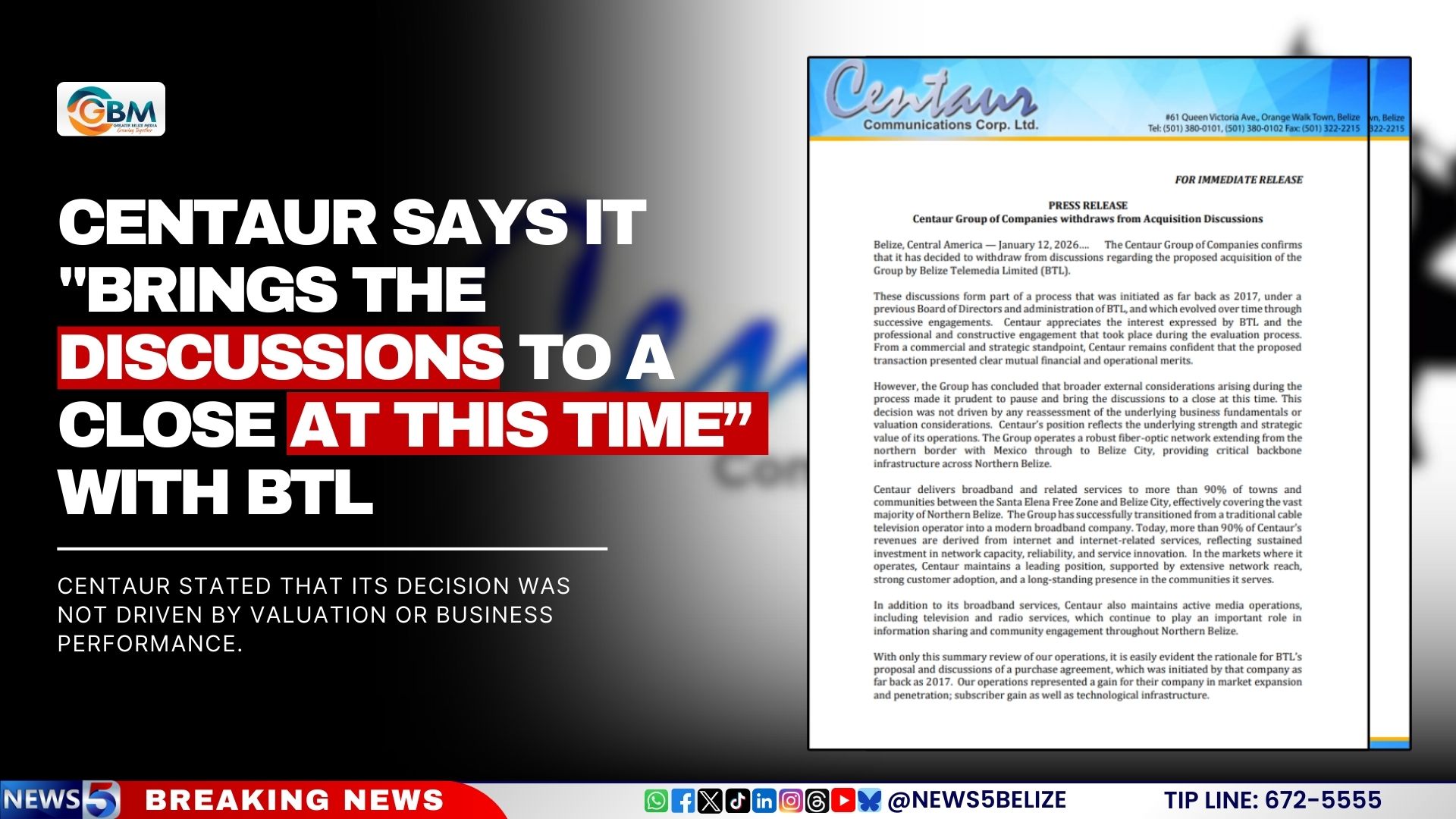

Centaur Says it “Brings the Discussions to a Close at This Time” with BTL

Centaur Communications Corp. Ltd has formally withdrawn from acquisition negotiations with Belize Telemedia Limited (BTL), concluding nearly a decade of intermittent discussions. The company announced its decision on January 12, 2026, citing significant external factors that ultimately overshadowed the transaction’s commercial merits.

In an official public statement, Centaur revealed that dialogue regarding a potential acquisition commenced in 2017 under previous leadership structures and continued through subsequent administrative changes. Despite acknowledging the strategic and financial benefits of the proposed merger, the company identified mounting political and reputational considerations that compelled termination of negotiations.

‘From a commercial and strategic standpoint, Centaur remains confident that the proposed transaction presented clear mutual financial and operational merits,’ the company stated. However, it emphasized that ‘broader external considerations’ necessitated discontinuing discussions at this time.

The telecommunications provider highlighted its substantial infrastructure assets, including a comprehensive fibre-optic network extending from the Mexican border to Belize City. The company currently delivers broadband coverage to over 90% of Northern Belize’s towns and communities, with internet and related services now constituting more than 90% of total revenue.

Centaur expressed appreciation for BTL’s interest and the professional nature of negotiations throughout the evaluation process. The decision underscores how external market forces and political climates can influence corporate consolidation attempts even when transactions demonstrate clear business logic.

-

Chon Saan Palace Warns Against Credit Card Fraud

A critical alert from Chon Saan Palace has exposed a severe security breach within Belize’s vital call center sector. The company’s official Facebook statement revealed that certain agents are allegedly engaging in fraudulent activities by utilizing stolen client credit card information to conduct unauthorized transactions.

This malpractice represents more than individual misconduct—it threatens the very foundation of Belize’s outsourcing industry. The company’s warning highlighted how such data security violations directly contravene the stringent protection standards demanded by international partners. Failure to maintain these security protocols places Belizean call centers at imminent risk of losing crucial overseas contracts.

Beyond immediate contractual concerns, Chon Saan Palace outlined the potentially devastating ripple effects. Should international clients withdraw their business due to security concerns, the consequences would extend throughout the national economy. Call center operations might face complete shutdowns or relocation to more secure destinations, creating widespread unemployment among the thousands of Belizeans currently employed in this sector.

The company emphasized the industry’s indispensable role in Belize’s economic landscape and issued a direct appeal to all industry professionals. Employees were urged to demonstrate utmost responsibility in handling sensitive financial data and maintain ethical standards that preserve Belize’s hard-earned reputation as a reliable outsourcing destination.

Chon Saan Palace’s statement concluded with a stark warning: “If call centers leave Belize, everyone loses,” emphasizing collective responsibility in safeguarding both the industry and the nation’s economic stability.

-

Olieprijzen stabiel ondanks spanningen in Iran en Venezuela

Global oil markets maintained positions near five-week peaks on Monday as traders carefully assessed the complex interplay of geopolitical developments across multiple oil-producing nations. The delicate balance between supply constraints and potential market expansions created a volatile trading environment.

In Iran, market participants expressed concerns that the government’s harsh crackdown on widespread anti-regime protests could potentially disrupt the nation’s oil export capabilities. Meanwhile, Venezuela—another OPEC member under international sanctions—prepares to resume oil exports following the resignation of President Nicolás Maduro. According to statements from U.S. President Donald Trump, the emerging administration is expected to transfer up to 50 million barrels of oil to United States markets, triggering intense competition among energy corporations scrambling to secure tankers and logistical support.

Price movements reflected this uncertainty with Brent crude edging upward by 8 cents to $63.42 per barrel, while U.S. West Texas Intermediate (WTI) experienced a slight decline of 13 cents to $58.99 per barrel.

The geopolitical landscape extended beyond these immediate flashpoints. Market analysts closely monitored the escalating tensions between Russia and Ukraine, where attacks on critical energy infrastructure and potential tightening of international sanctions threatened to disrupt supply chains. Simultaneously, Azerbaijan reported declining export volumes while Norway unveiled strategic plans to safeguard its petroleum industry’s future.

Financial institution Goldman Sachs projected that increasing global supply and potential market surplus would likely drive oil prices downward throughout the year. However, analysts acknowledged that persistent geopolitical risks—particularly in Russia, Venezuela, and Iran—would continue to fuel market volatility.

Adding another layer of complexity, uncertainties surrounding U.S. interest rate policies and the Federal Reserve’s monetary stance created additional market apprehensions that indirectly influenced oil price trajectories through currency fluctuations and broader economic sentiment.

-

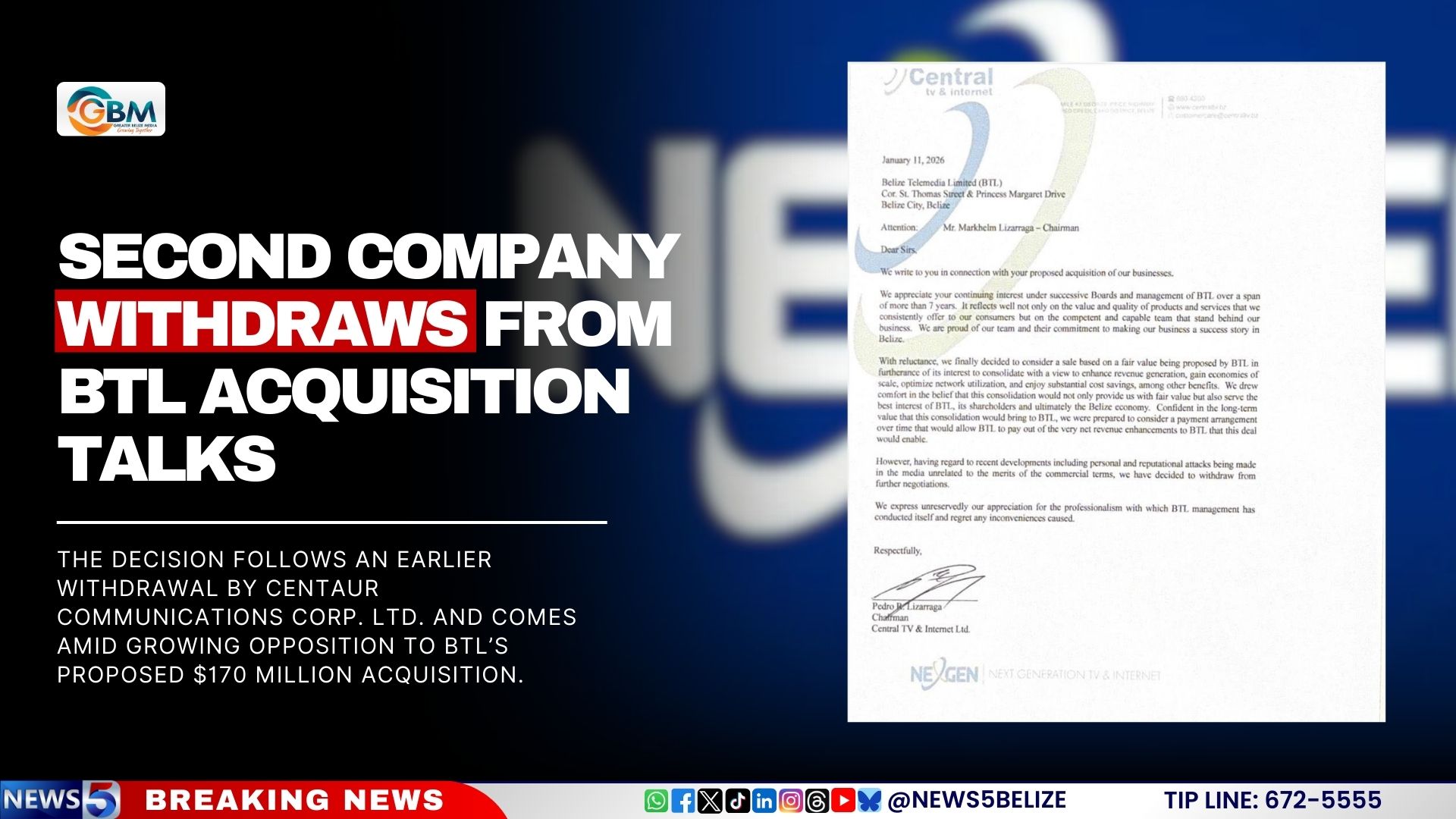

Second Company Withdraws from BTL Acquisition Talks

In a significant setback for Belize’s telecommunications consolidation efforts, Central TV & Internet Ltd. has become the second company to withdraw from acquisition negotiations with state-owned Belize Telemedia Limited (BTL). The decision was formally communicated to BTL Chairman Markhelm Lizarraga through a letter citing mounting reputational concerns and media attacks unrelated to the commercial merits of the proposed deal.

Pedro Lizarraga, Chairman of Central TV & Internet Ltd., revealed that his company had engaged in discussions with BTL for over seven years before reluctantly considering a sale based on what was described as a ‘fair value’ proposition. The company had even proposed a payment arrangement structured around projected revenue enhancements that the consolidation would generate for BTL.

The withdrawal follows a similar exit by Centaur Communications Corp. Ltd. and occurs amidst growing opposition to BTL’s ambitious $170 million acquisition plan. The controversial proposal has already triggered significant repercussions, including the resignation of Social Security Board Chair Chandra Nisbet-Cansino from the BTL board last Friday. Both the National Trade Union Congress of Belize (NTUCB) and independent senators have called for a complete halt to the consolidation process.

Central TV & Internet Ltd.’s statement emphasized that while they recognized potential benefits including enhanced revenue generation, economies of scale, optimized network utilization, and substantial cost savings, the negative media environment and personal attacks had ultimately made continued negotiations untenable.

-

Seiveright discusses development finance options with US officials

Jamaican officials initiated high-level discussions with United States financial representatives on Tuesday to explore avenues for catalyzing private investment into the nation’s strategic economic sectors. The pivotal meeting featured Delano Seiveright, State Minister in the Ministry of Industry, Investment and Commerce, engaging with delegates from the US International Development Finance Corporation (DFC) and the US Embassy stationed in Kingston.

Central to the dialogue was Michael McNulty, Regional Managing Director for Central America and the Caribbean at the DFC, who represented the US government’s primary development finance institution. The DFC operates with an impressive global investment portfolio authority capped at US$60 billion, employing sophisticated financial instruments including direct loans, comprehensive guarantees, strategic equity investments, and political risk insurance solutions.

This collaborative engagement focused on identifying concrete mechanisms to mobilize capital toward Jamaica’s priority industries, signaling a strengthened economic partnership between the two nations. The discussions underscored Jamaica’s proactive approach to securing development financing that leverages private sector involvement rather than relying solely on traditional aid models.

The meeting represents a significant step in Jamaica’s ongoing efforts to attract foreign investment and stimulate economic growth through international partnerships, particularly with United States financial institutions possessing substantial resources for development initiatives across the Caribbean region.

-

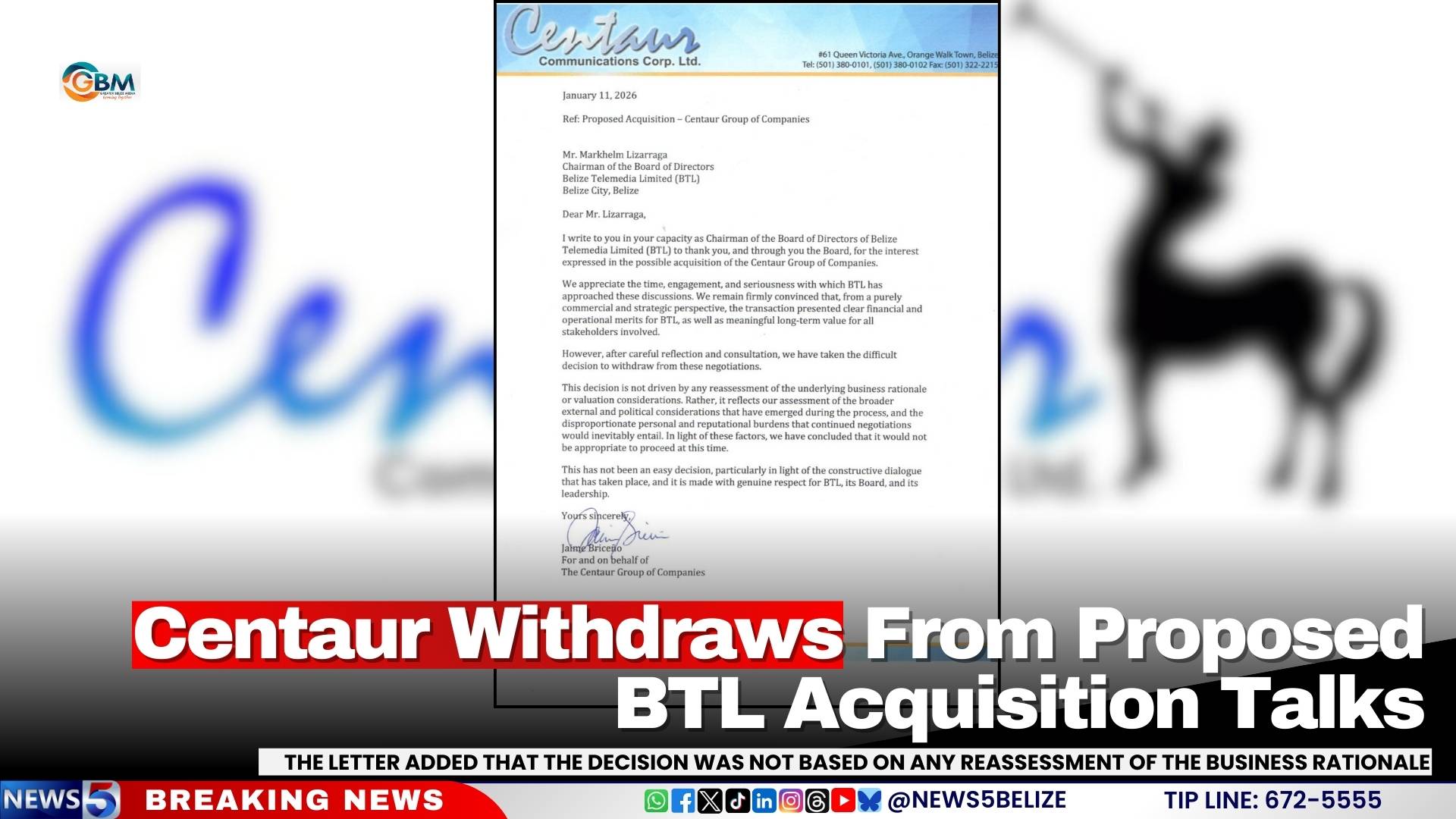

Centaur Withdraws From Proposed BTL Acquisition Talks

Centaur Communications Corp. Ltd. has terminated negotiations for its proposed acquisition by Belize Telemedia Limited (BTL), marking a sudden collapse of what was considered a strategically significant corporate transaction. The decision was formally communicated through a letter dated January 11, 2026, from Centaur’s representative Jaime Briceño to BTL Chairman Markhelm Lizarraga.

Despite acknowledging the transaction’s strong commercial merits, Centaur cited external political pressures and potential reputational damage as primary reasons for withdrawal. Briceño’s correspondence emphasized that the abandonment was not motivated by financial reassessment or valuation concerns, but rather by broader contextual factors that emerged during negotiation proceedings.

The company statement revealed that after extensive deliberation and consultation, leadership determined that continuing negotiations would impose disproportionate personal and reputational burdens on involved parties. While the acquisition promised substantial operational synergies and long-term stakeholder value, Centaur concluded the political climate rendered the timing inappropriate for such a strategic move.

This development represents a significant setback for BTL’s expansion strategy and highlights how external political considerations can override sound business rationale in corporate acquisitions. The withdrawal demonstrates increasing corporate sensitivity to political environments and reputational risks in merger and acquisition activities within regulated industries.

-

Dominican manufacturing activity declines in December, AIRD reports

Santo Domingo, Dominican Republic – The Dominican Republic’s industrial sector experienced a significant downturn in December 2025, according to the latest data from the Association of Industries (AIRD). The Monthly Index of Manufacturing Activity (IMAM) recorded a substantial decline of 10.3 points, dropping to 49.1 and falling below the critical 50-point threshold that separates economic expansion from contraction.

The dramatic decrease from November’s 59.4 reading marks one of the most pronounced monthly contractions in recent memory. AIRD’s comprehensive analysis identifies declining sales figures and reduced production volumes as the primary drivers behind this industrial slowdown. These two components carry the most substantial weighting within the index’s calculation methodology.

The IMAM, which follows the internationally recognized Purchasing Managers’ Index framework, serves as a crucial monthly barometer of manufacturing health. The index incorporates five key components: sales performance, production output, employment levels, raw materials inventory, and supplier delivery times.

December’s report revealed concerning trends across multiple sectors, with four of the five components registering negative performance. The most severe contractions occurred in sales and production metrics, while employment figures and raw materials inventories also showed weakening trends. The sole positive indicator was improved supplier delivery times, suggesting some supply chain normalization.

AIRD representatives emphasized that these results indicate diminishing manufacturing momentum as 2025 concluded, potentially signaling broader economic challenges that warrant close monitoring by policymakers and industry stakeholders.

-

Reis says local stock exchange undervaluing Banks DIH shares, Ali promises reform this year

Guyana’s financial markets are facing serious credibility challenges following explosive allegations by Banks DIH Chairman Clifford Reis, who claims the local stock exchange is dramatically undervaluing his company’s shares while showing preferential treatment toward competitors.

Speaking at the commissioning of the company’s new GY$13.7 billion malt bottling facility in Thirst Park, Reis presented compelling financial data suggesting systemic market failures. Despite Banks DIH’s shares trading at GY$155, the chairman asserted their true value should range between GY$400-450 based on performance metrics that significantly outpace competitors.

The controversy centers around glaring disparities: while a competitor’s shares trade at GY$200, Banks DIH demonstrates superior financial health with revenues surging 45% and profits increasing 54% between 2021-2025. The company reported a staggering GY$10.5 billion net profit—nearly double the competitor’s GY$5.5 billion—while maintaining a zero debt-equity ratio and funding its massive new plant entirely through internal cash flow.

Reis raised alarming questions about potential conflicts of interest, demanding transparency regarding broker company shareholders and their valuation methodologies. “Any reasonable person will consider that the stock market in Guyana cannot be taken seriously,” he stated, highlighting how a mere GY$1.00 price drop per share could wipe out GY$849 million in market capitalization.

The situation has reached the highest levels of government, with President Irfaan Ali—a former Banks DIH employee—pledging comprehensive stock market reforms. The President confirmed ongoing consultations would lead to modernization of Guyana’s financial architecture, including establishing a junior stocks exchange and ensuring fair valuation mechanisms that properly reflect company growth and asset values.

The newly commissioned facility itself represents a significant manufacturing advancement, capable of producing 400,000 beer cases monthly on single shift operations, with storage capacity for 900,000 cases, positioning Banks DIH for continued market dominance despite the current valuation controversies.

-

Spanish Ambassador highlights FITUR as key platform for promoting Dominican tourism

The Dominican Republic is poised to leverage the upcoming International Tourism Fair (FITUR) in Madrid as a pivotal platform for global tourism promotion, according to Spanish Ambassador Lorea Arribalzaga. Scheduled for January 21-25 at IFEMA Madrid, the event will enable the Caribbean nation to demonstrate its significant advancements, diverse attractions, and enhanced competitiveness as a premier international destination. The ambassador emphasized the strategic importance of FITUR for facilitating knowledge exchange and forging strategic partnerships, with substantial institutional support provided by the Spanish Agency for International Development Cooperation (AECID) and Madrid City Council.

Ambassador Arribalzaga further noted the exceptionally robust bilateral relations between Spain and the Dominican Republic, characterizing the diplomatic ties as strongly cooperative and conducive to joint initiatives. This strengthened partnership creates fertile ground for expanded tourism collaboration and increased Spanish investment in the Dominican economy, with FITUR serving as a crucial convergence point for projects promising both economic growth and social development.

The Dominican delegation, officially confirmed for FITUR 2026 and led by Tourism Minister David Collado, will prominently feature emerging destinations including Pedernales, Miches, and Punta Bergantín. Particular focus will be directed toward responsible and sustainable tourism development, especially in the Cabo Rojo region. Minister Collado’s agenda includes presenting progress on strategic tourism projects, introducing new hotel brands, and conducting high-level meetings with European tour operators, airline representatives, and potential investors. These efforts aim to consolidate the Dominican Republic’s position in the European market and reinforce its leadership status across Caribbean and Latin American tourism sectors.