Guyana’s state-owned sugar corporation, GUYSUCO, is operating under severe financial strain with production costs dramatically exceeding market sale prices, according to revelations in the National Assembly. APNU’s agriculture spokesman, Vinceroy Jordan, disclosed that the corporation is producing sugar at an average cost of US$1.31 per pound while selling it for just US$0.17 per pound—representing a staggering 154% cost-to-price disparity. This translates to a loss of US$1.14 on every pound of sugar sold internationally. In local currency terms, the figures are equally alarming: GUYSUCO spends GY$275 to produce one pound of sugar but sells it for only GY$35. The 2026 National Budget indicates sugar prices fell by 17.1% to US$0.37 per kilogram in 2025, with a further 0.5% decline expected this year. Despite these financial challenges, the government plans to inject an additional GY$13.4 billion into the sugar sector following last year’s GY$13.3 billion expenditure on mechanization and operational improvements. Finance Minister Dr. Ashni Singh reported that sugar production reached 59,600 tonnes in 2025—a 26.5% expansion despite being hampered by heavy rainfall, labor shortages, low employee turnout, and factory machinery issues. The sector is projected to grow by 67.9% in 2026 with a target of 100,041 tonnes. GUYSUCO remains a significant employer with over 8,000 workers.

分类: business

-

NTUCB Calls on SSB to Oppose BTL–Smart Acquisition

The National Trade Union Congress of Belize (NTUCB) has issued a forceful condemnation of Belize Telemedia Limited’s (BTL) planned acquisition of telecommunications provider Speednet (Smart), characterizing the proposed transaction as rash and poorly conceived while raising alarms about potential risks to worker-contributed funds.

In a strongly worded statement released Monday, the labor organization expressed profound concern over the Social Security Board’s (SSB) conspicuous silence regarding the matter. The NTUCB emphasized that the SSB bears fundamental responsibility for protecting workers’ financial contributions, stating unequivocally that “workers’ money is not a bargaining chip, nor is it a private investment fund for risky deals.”

While acknowledging support for investments that might enhance the SSB’s fiscal standing, the union stressed that rigorous due diligence and comprehensive stakeholder consultation must precede any such financial commitments. The organization issued a stark warning that “any entity that carelessly assigns workers’ contributions or threatens the economic stability of this country will be held fully accountable.”

The NTUCB further criticized BTL for insufficient transparency and accountability throughout the acquisition process. The union has formally demanded that the SSB immediately adopt a public position opposing the acquisition until thorough due diligence procedures are satisfactorily completed.

To amplify their demands, NTUCB representatives confirmed to News Five that they have initiated procedures to obtain a permit for a demonstration scheduled Wednesday at 11 a.m. outside the SSB headquarters in Belize City.

-

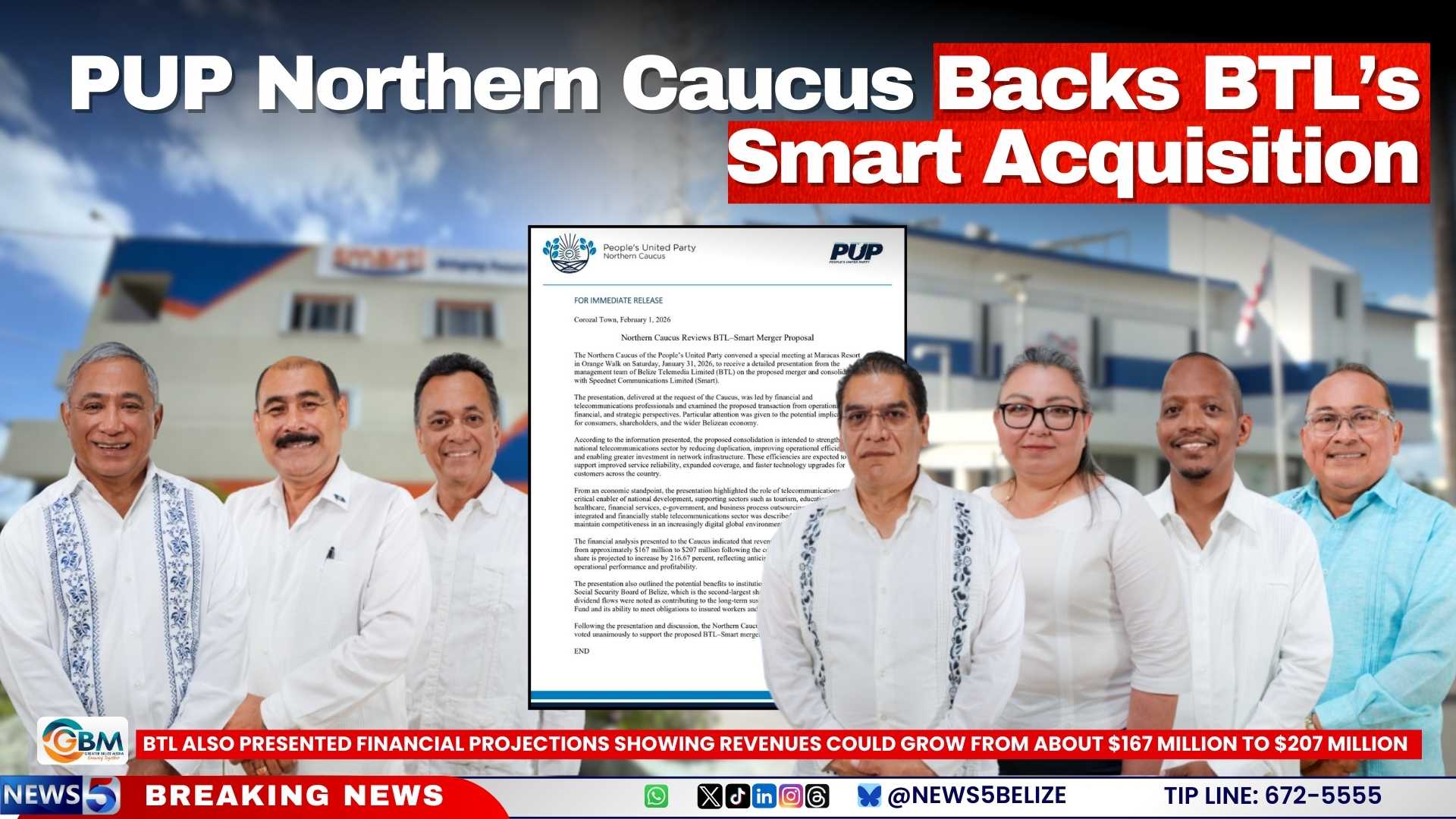

PUP Northern Caucus Backs BTL’s Smart Acquisition

In a significant development within Belize’s telecommunications sector, the Northern Caucus of the governing People’s United Party has unanimously endorsed Belize Telemedia Limited’s proposed acquisition of Speednet (Smart). The endorsement emerged from a special meeting convened in Orange Walk on Saturday, representing electoral divisions across Corozal, Orange Walk, and Belize Rural South.

According to caucus representatives, BTL executives presented a comprehensive case for the consolidation, emphasizing how the merger would eliminate redundant operations, enhance efficiency, and facilitate substantial infrastructure investment. The company projects that these operational improvements would translate into superior service quality, expanded network coverage, and accelerated technological advancements for consumers nationwide.

Financial projections presented to caucus members indicate potential revenue growth from approximately $167 million to $207 million following the acquisition. Notably, dividends per share are forecast to surge by over 200%, potentially benefiting major institutional shareholders including the Social Security Board of Belize. This financial boost could contribute significantly to the long-term viability of the Social Security Fund.

This political endorsement contrasts sharply with mounting public opposition. Last Tuesday, United Democratic Party supporters and several labor unions staged demonstrations outside BTL headquarters, demanding increased transparency regarding the acquisition terms. The UDP has announced plans for additional protests scheduled for Wednesday.

Simultaneously, the Belize Communications Workers for Justice conducted separate demonstrations on Friday, highlighting unresolved severance payment issues and announcing intentions to maintain protest activities throughout the week. This opposition underscores the complex stakeholder landscape surrounding the proposed telecommunications consolidation.

-

PRESS RELEASE: IICA Director General and CAF President and Vice President discuss the role of financing in expanding scientific and technological revolution in agriculture of the Americas

In a significant development for hemispheric agriculture, the Inter-American Institute for Cooperation on Agriculture (IICA) and CAF – Development Bank of Latin America and the Caribbean have established a strengthened partnership to address critical funding gaps in the agricultural sector. The alliance was formalized during the International Economic Forum for Latin America and the Caribbean 2026 in Panama City, where IICA Director General Muhammad Ibrahim met with CAF Executive President Sergio Díaz Granados and Vice President Christian Asinelli.

The high-level meeting, attended by numerous heads of state and government ministers, focused on creating innovative synergies between the development bank and the specialized agricultural agency. Key discussion areas included health initiatives, soil restoration projects, water resource management, and development programs for specific crops. Díaz Granados outlined CAF’s ambitious Agricultural Prosperity Strategy, which aims to provide $8.5 billion in financing by 2030 with emphasis on social and territorial inclusion.

Director General Ibrahim, who assumed his position in January 2026, emphasized the urgent need to bridge the financial divide preventing widespread adoption of agricultural technologies. “Clearly, input costs are rising, and this affects competitiveness,” Ibrahim stated during forum sessions. “Financial considerations must be a central component of any strategy aimed at transforming food systems to satisfy increasing demands.”

The IICA leader detailed how the organization has been developing innovative programs to provide guarantees helping small farmers overcome credit access barriers. He explained that while science offers numerous solutions to boost productivity and improve resilience, many cannot advance beyond initial stages due to financing limitations, inadequate regulatory frameworks, and insufficient infrastructure.

CAF Vice President Asinelli highlighted IICA’s pivotal role in reinforcing Latin America and the Caribbean’s position as a solution to global challenges, noting that agriculture remains a structural mainstay of regional economies despite financial obstacles affecting productivity.

Beyond the CAF meetings, Director General Ibrahim engaged in multiple bilateral discussions with regional leaders including Jamaica’s Minister of Industry, Investment and Commerce Aubyn Hill, Panama’s Ambassador to the OAS Ana Irene Delgado, and Portuguese Parliament Member Paulo Neves, who also serves as President of the Institute for the Promotion of Latin America and the Caribbean in Portugal.

During the forum’s panel discussions, particularly the session on “Agriculture and Food for the Sustainable Transformation of Latin America and the Caribbean,” Ibrahim advocated for stronger alliances between scientific and financial stakeholders. He emphasized the need to develop diverse financial mechanisms that account for the realities small farmers face while promoting sustainable food production systems and accessible healthy diets.

-

Disney names theme parks boss chief Josh D’Amaro as next CEO

The Walt Disney Company has initiated a landmark leadership transition, appointing theme parks division head Josh D’Amaro as successor to longtime Chief Executive Bob Iger. The 54-year-old executive will assume the CEO role effective March 18 following unanimous board approval, marking the culmination of a meticulously planned succession strategy.

D’Amaro brings 28 years of institutional knowledge and operational expertise to the position, having most recently overseen Disney’s most profitable business segment. Under his leadership, the parks, experiences, and products division generated $36 billion in fiscal 2025 while managing 185,000 employees across global operations spanning 12 theme parks and 57 resort properties.

Board Chairman James Gorman emphasized D’Amaro’s unique qualifications, noting his ‘inspiring leadership and innovation, strategic growth vision, and profound connection to the Disney brand.’ The incoming CEO has spearheaded major expansion initiatives including the groundbreaking ‘Star Wars: Galaxy’s Edge’ development, plans for Abu Dhabi’s upcoming theme park, and Disney’s transformative partnership with Epic Games for Fortnite integration.

In a concurrent executive restructuring, Dana Walden assumes the newly created position of President and Chief Creative Officer. As co-chairman of Disney Entertainment, Walden will report directly to D’Amaro while overseeing creative direction across the company’s extensive portfolio.

Iger will remain engaged through December 2026 as senior advisor, providing transitional support following his transformative tenure. His legacy includes landmark acquisitions of Pixar, Marvel, Lucasfilm, and 21st Century Fox, alongside the successful launch of Shanghai Disney Resort and Disney’s streaming services expansion.

The leadership change occurs during a period of significant industry disruption, with traditional media models facing unprecedented challenges. Disney+ continues its path toward profitability after launching in 2019 to compete with streaming giant Netflix, while the company explores emerging technologies including generative AI through recently signed licensing agreements.

This transition represents Disney’s third CEO change in four years, following Iger’s brief 2020 retirement and subsequent return after successor Bob Chapek’s pandemic-era dismissal. Iger’s recent restructuring efforts addressed streaming losses and operational challenges, positioning the company for its next chapter under D’Amaro’s leadership.

-

Tony Bates, Michael Leitner appointed to Digicel board

KINGSTON, Jamaica — Caribbean telecommunications leader Digicel has significantly bolstered its corporate governance with the strategic appointment of two industry veterans to its board of directors, effective February 1, 2026. The company announced the addition of Tony Bates and Michael Leitner, bringing decades of specialized expertise to guide its long-term strategic objectives.

The appointments are a calculated move to enhance oversight as Digicel executes its multi-faceted strategy centered on achieving operational resilience, enforcing disciplined capital allocation, and ensuring sustainable performance across its core Caribbean markets. These regions are characterized by their capital-intensive nature and stringent regulatory frameworks, demanding expert navigation.

Tony Bates contributes over thirty years of senior financial and operational leadership within global telecommunications and media corporations. His most notable tenure was as Group Chief Financial Officer at satellite communications giant Inmarsat. In this role, Bates was instrumental in steering business performance, optimizing capital structures, and leading major corporate transactions. His portfolio includes overseeing complex refinancing initiatives and playing a key role in the company’s landmark sale to Viasat, showcasing his proficiency in managing high-stakes financial transformations in regulated industries.

Michael Leitner joins as a Partner and Senior Managing Director at Stonepeak, a leading alternative investment firm. He currently holds board positions across several of Stonepeak’s communications and digital infrastructure portfolio companies. Leitner’s extensive career encompasses growth, restructuring, and turnaround projects spanning the entire digital ecosystem, including fibre optics, wireless technology, satellite services, data centers, and cloud computing. His executive experience includes significant roles at financial and tech powerhouses such as BlackRock, Tennenbaum Capital Partners, and Microsoft. With a seat on more than 25 public and private company boards, Leitner offers unparalleled governance and investment insight.

Digicel’s Chairman, Rajeev Suri, emphasized the strategic fit of the new members, stating, ‘The perspectives Tony and Michael bring are directly aligned with Digicel’s current priorities. Tony’s profound experience in financial leadership and execution, combined with Michael’s deep background in digital infrastructure and capital stewardship, will significantly enhance the board’s strategic oversight.’

Echoing this sentiment, Digicel’s Chief Executive Officer, Marcelo Cataldo, commented, ‘Operating in our markets requires impeccable execution and financial discipline. Both Tony and Michael have built their careers mastering these complex environments. Their seasoned judgment will be invaluable as we continue to build a resilient business focused on delivering sustainable, long-term performance for our customers and stakeholders.’

-

Bermuda records increase in volume of retail sales index last August

HAMILTON, Bermuda — Bermuda’s retail sector demonstrated notable economic resilience with a 2.6 percent increase in the volume of retail sales index for August 2025 compared to the same period the previous year, according to the latest data released by the Ministry of Economy and Labour. The report also indicated a moderate rise in consumer expenses, with shoppers paying 1.9 percent more for the standard basket of goods and services than they did twelve months prior.

In monetary terms, retail sales surged to an estimated $117.3 million, reflecting robust consumer activity across multiple sectors. The performance was unevenly distributed, however, with four out of seven sectors achieving year-over-year growth. Leading the expansion, motor vehicle stores recorded a substantial 20.2 percent volume increase. The ‘all other store types’ category—encompassing household items, furniture, appliances, electronics, pharmaceuticals, and tourist-related goods—also posted impressive gains of 15.3 percent. More modest growth was observed in food stores (up 1.1 percent) and apparel stores (up 0.6 percent).

Conversely, several sectors experienced significant declines. Building material stores suffered the most severe contraction with a 21.5 percent drop in sales volume. Liquor stores saw a decrease of 7.9 percent, while service stations recorded a 1.6 percent reduction in volume.

On the inflation front, the Consumer Price Index (CPI) showed a slight improvement as the annual inflation rate edged downward by 0.1 percentage points from July 2025 levels, suggesting a minor easing of price pressures in the Bermudian economy.

-

After Hurricane Melissa, HR leaders take centrestage in recovery push

In the wake of Hurricane Melissa’s devastation, Jamaica’s human resource professionals are being positioned as pivotal figures in the nation’s reconstruction efforts. The Human Resource Management Association of Jamaica (HRMAJ) has strategically recalibrated its 45th Annual Conference to address the expanded crisis management responsibilities now facing HR leaders across the island nation.

The conference, launched January 28 at ATL Automotive’s Audi Showroom on Oxford Road, will convene February 4-5, 2026 at Jamaica Pegasus hotel in New Kingston under the reconfigured theme: “Resilient Leadership, Strategic Impact: HR at the Heart of Jamaica’s Rebuilding.” This thematic shift directly responds to the hurricane’s aftermath, which exposed critical gaps in organizational preparedness and crisis response capabilities.

HRMAJ President Dr. Cassida Jones Johnson emphasized that catastrophic events fundamentally change employee expectations. “When disaster strikes, employees don’t look to systems or policies, they look to leadership,” she stated. “HR serves as the crucial bridge between uncertainty and stability, and this conference aims to fortify that bridge.”

The event will feature prominent voices including Lisa Soares Lewis, who played key roles in Jamaica’s private-sector emergency response coordination through the Joint Private Sector Emergency Operations Centre. Soares Lewis praised HRMAJ’s agile response to the national emergency, noting the association demonstrated “anti-fragile approach in how it responded” by realigning conference programming to meet urgent national needs.

Conference highlights include Soares Lewis’s opening keynote “From Strategy to Impact: The Evolving Role of HR and HR’s Role in National Rebuilding” and a Day Two address by Bank of Jamaica Deputy Governor George Roper on “Change Management Excellence – The BOJ Story.” The agenda will also examine Jamaica’s new Code of Ethics and National Registry for HR practitioners, designed to enhance professional accountability during this period of increased public scrutiny.

The event has garnered substantial corporate support with diamond sponsorships from MC Systems, Triblock HR, and digital gifting platform GiftMe. Latoya Newman of GiftMe highlighted how their technology solutions help organizations retain talent and reward employees—critical functions during reconstruction periods.

Beyond immediate recovery discussions, Conference45 aims to equip HR professionals with strategies for future crisis management, positioning human resource leadership as essential to sustainable growth and organizational resilience.

-

GMIN Mining refuses to comment on criminal incident at Guyanese concession

Canadian mining giant GMIN Mining has maintained a strict no-comment stance regarding a reported criminal incident at its Oko West concession in Guyana, where a massive US$1.5 billion gold mining operation is under development. The company’s spokesperson explicitly stated “no comments at this time from us” when pressed for details about the January 29, 2026 event.

While Guyana Police Force officials have not issued an official response to media inquiries, law enforcement sources disclosed that a shooting incident occurred at the remote mining site without resulting in any robberies. These anonymous sources confirmed that no arrests have been made in connection with the event.

Unofficial accounts circulating within the region suggest a more severe scenario, alleging that armed individuals deliberately shot at power generators, plunging the entire operation into darkness before proceeding to rob multiple workers of their personal valuables. The mining sector’s key stakeholders have reportedly remained unaware of these developments, highlighting potential communication gaps in the industry’s security protocols.

The Oko West project represents one of Guyana’s most significant mining investments, designed to yield approximately 400,000 ounces of gold annually upon completion. This incident raises serious questions about security preparedness at remote mining operations and corporate transparency regarding safety incidents.