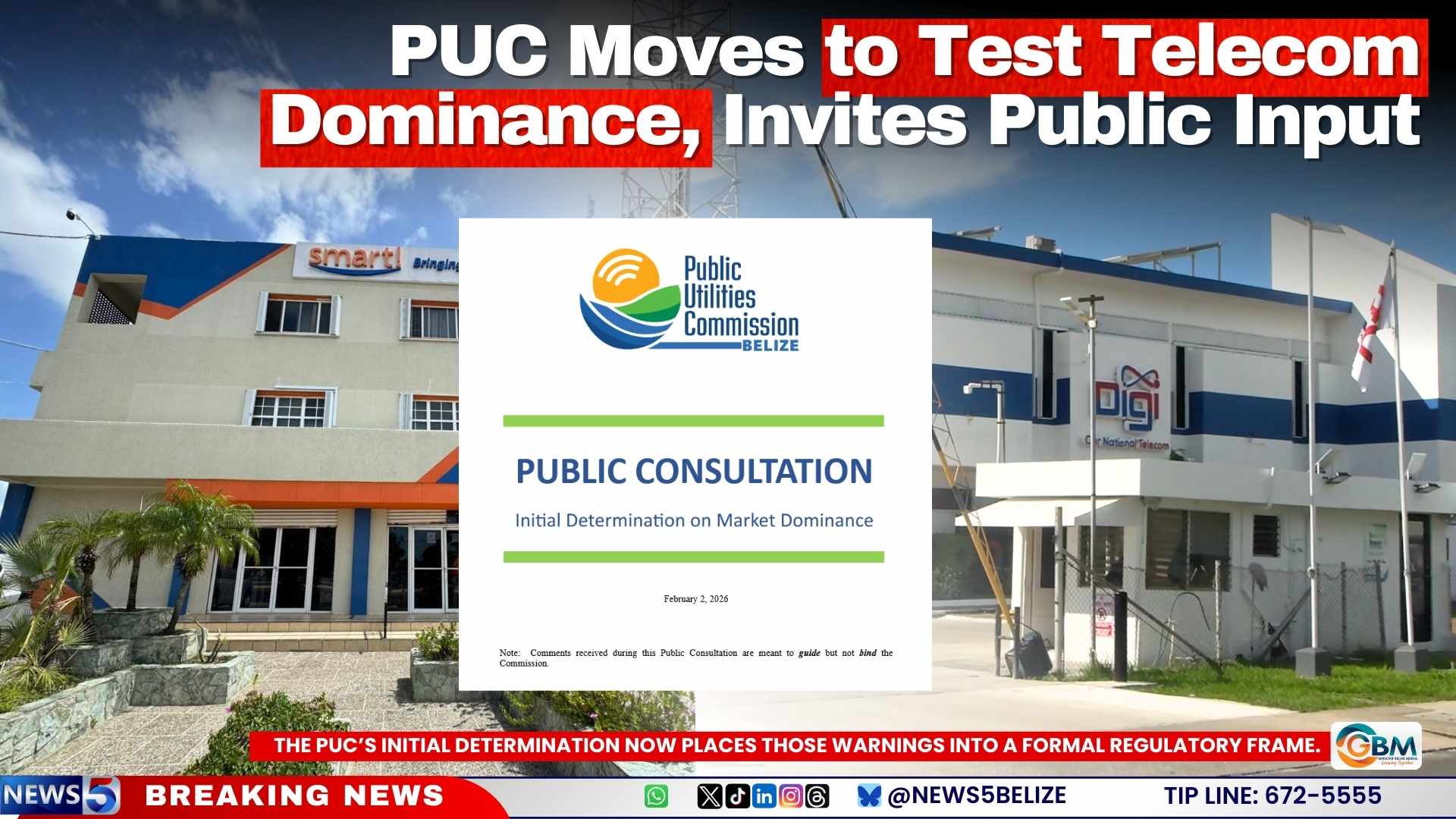

The Public Utilities Commission (PUC) of Belize has initiated a comprehensive review of the nation’s telecommunications landscape, raising fundamental questions about market competition and consumer protection. In a significant regulatory development, the Commission has published a 57-page Initial Determination that casts doubt on whether current market conditions adequately safeguard consumer interests.

The document, now open for public consultation until March 2, represents the regulator’s preliminary assessment of both retail and wholesale telecommunications markets. Central to this examination is whether any market participant possesses sufficient dominance to operate independently of competitive pressures—a condition that could trigger regulatory intervention under Section 42 of the Telecommunications Act.

PUC officials emphasize that the primary objective of this review is consumer protection, noting that inadequate competitive constraints can lead to excessive pricing, limited service options, reduced quality, and discriminatory practices. The Commission maintains that effective market competition naturally protects consumers, while regulatory oversight becomes necessary where competition proves insufficient.

The review assumes particular significance in light of Section 19(5) of the Telecommunications Act, which requires PUC approval for any sale, merger, or transfer of control. The regulatory body retains authority to reject transactions that potentially undermine the Act’s objectives of preventing monopolistic practices and ensuring fair competition.

While not explicitly ruling on any specific acquisition, the PUC’s analysis appears to center on a crucial question: Would the disappearance of Speednet significantly diminish market competition? The Commission clarifies that this Initial Determination does not constitute a final ruling on market dominance or represent any finding of legal violation.

The assessment encompasses a broad spectrum of services, including retail fixed voice, mobile services, broadband internet access, international roaming, toll-free services, and enterprise messaging. At the wholesale level, the review examines call termination, network access, leased lines, and international connectivity, recognizing that dominance in wholesale markets can adversely affect retail competition.

The PUC stresses that market dominance identification does not imply unlawful conduct but serves as a regulatory mechanism to determine whether enhanced oversight might be necessary to protect consumers and promote effective competition. The analysis adopts a forward-looking perspective based on current and foreseeable market conditions rather than past regulatory decisions.

Belize Telecommunications Limited (BTL) has responded by asserting that no final decisions have been made and that the company operates within legal boundaries. Meanwhile, the proposed acquisition continues to face opposition from various business groups, religious organizations, media outlets, and civil society representatives.

Interested parties including licensees, consumer advocacy groups, and public stakeholders are invited to submit written comments by 4:00 p.m. on March 2. These submissions will inform whether the Commission’s preliminary findings are confirmed, modified, or withdrawn before any final determination is issued.