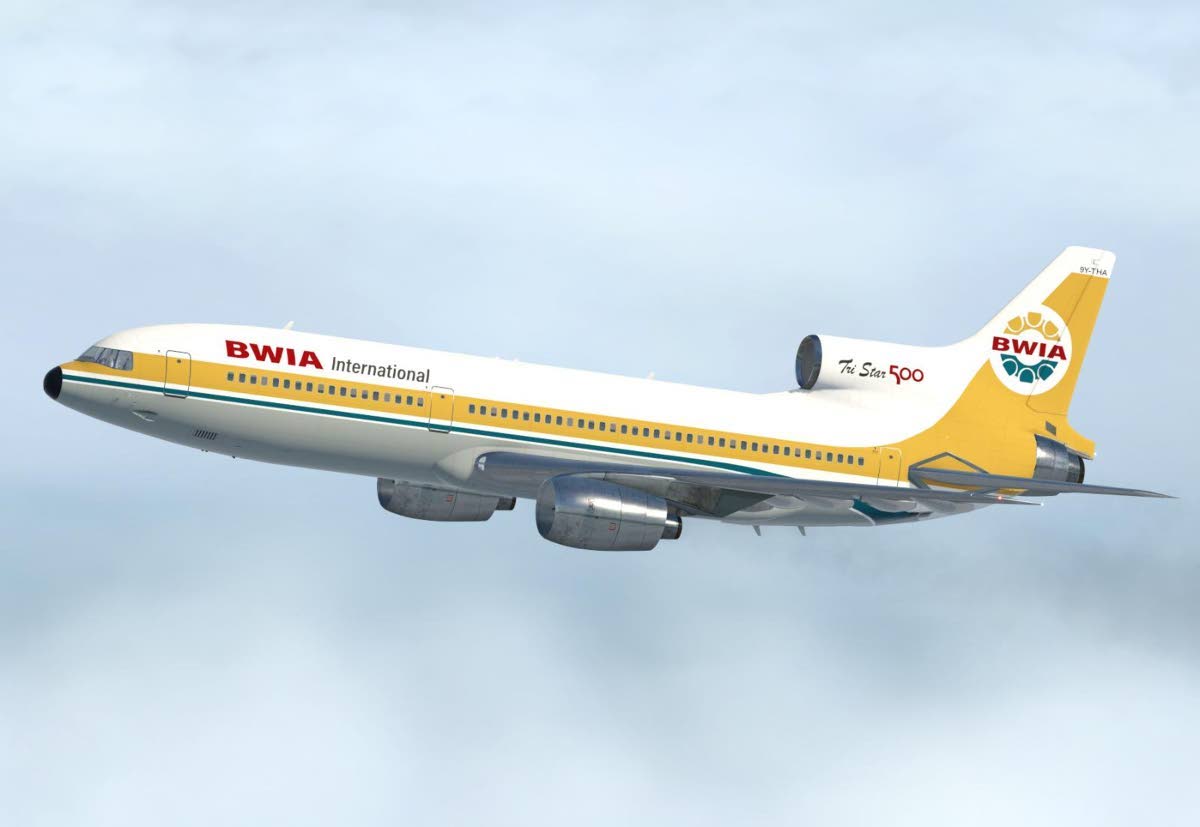

In a decisive move to safeguard over 700 jobs and maintain vital air connections across the Caribbean and the eastern United States, the Trinidad and Tobago (TT) government, under the leadership of Premier Dr. Eric Williams, took control of British West Indian Airways (BWIA) in 1961. This action was prompted by the British Overseas Airways Corporation’s (BOAC) proposed austerity measures, which threatened significant staff retrenchments and disruptions to regional air services. Premier Williams, addressing the House of Representatives on March 23, 1962, highlighted the government’s intervention to acquire BWIA, emphasizing the need to preserve employment and sustain air links. BOAC, in a letter dated June 16, 1961, valued BWIA at £1,034,036 (BWI$5,445,726), but independent technical advice was sought to facilitate negotiations. The TT government engaged C.S. Sundaram, a consultant from the International Civil Aviation Organisation (ICAO), whose report on September 27, 1961, influenced the decision to acquire BWIA on October 3, 1961. The TT government’s acquisition plan included purchasing BWIA as a going concern, negotiating pooling arrangements with BOAC, and offering BOAC a 20% equity stake. The final agreement, concluded on October 7, 1961, saw BOAC agree to the acquisition for $2.5 million, less than half the initial valuation. This strategic move underscored the TT government’s commitment to regional connectivity and employment stability, independent of broader federal plans.

分类: business

-

Positioning Trinidad and Tobago for the AI economy

As the global economy increasingly relies on cutting-edge technologies like artificial intelligence (AI) and robotics, Trinidad and Tobago (TT) faces a critical question: Is the nation prepared to seize the opportunities these innovations present? The answer, unfortunately, is far from reassuring. Recent data paints a troubling picture of TT’s declining performance in global innovation benchmarks. On the 2024 Global Innovation Index, TT ranked 108th, a significant drop from its peak at 68th in 2008. Similarly, the UNCTAD Frontier Technology Readiness Index shows TT slipping to 86th in 2025, down from 75th in 2021. These rankings highlight systemic weaknesses in industrial capacity and research and development (R&D), with TT scoring 122nd and 130th globally in these areas, respectively. The nation’s R&D expenditure remains below 0.5% of GDP, and patent filings are alarmingly low, averaging just one per year. Despite these challenges, there are glimmers of hope. Ramps Logistics’ AI-driven solution, MAWI, is revolutionizing customs brokerage and generating foreign exchange, while Carib Brewery’s $200 million smart manufacturing initiative marks a bold step toward industrial modernization. These successes underscore the potential for TT to tap into the $2.5 trillion global frontier technology market, projected to grow to $16.4 trillion by 2033. To bridge the innovation gap, TT must prioritize R&D and industrial capacity, strengthen governance frameworks, and support SMEs in adopting advanced technologies. The urgency of these reforms cannot be overstated, as failure to act risks leaving TT behind in the rapidly evolving global economy.

-

Guardian Group pledges US$312k hurricane relief

In a significant move to aid Jamaica’s recovery from the devastation caused by Hurricane Melissa, the Guardian Group Charitable Foundation has committed US$312,000. This donation, one of the largest single contributions from Trinidad and Tobago (TT), is part of the broader ‘Building a Better Jamaica Fund,’ a coordinated recovery initiative led by the National Commercial Bank Jamaica Ltd (NCB) and managed by the NCB Foundation. The fund has already raised approximately US$2.8 million, including an initial US$1.25 million from NCB, supplemented by partner contributions and Guardian Group’s substantial donation. Hurricane Melissa, which struck Jamaica on October 28, left widespread destruction across the island, damaging infrastructure, agriculture, and housing, and displacing thousands of residents. The Jamaican government declared a national disaster, prompting a large-scale relief and reconstruction effort supported by regional governments, businesses, and aid agencies. Guardian Group’s contribution will support both immediate relief and long-term rebuilding, working through experienced partners such as the American Friends of Jamaica, Food for the Poor Jamaica, Unicef Jamaica, and the Global Empowerment Mission. Shinelle Grant-Sealey, Guardian Group’s vice-president for environment, social and governance, emphasized the organization’s regional commitment to recovery and resilience, stating that the donation is an immediate investment in stability for affected families and institutions. Guardian Group has also provided care packages and internal support for its employees in Jamaica impacted by the storm. With operations across TT, Jamaica, Barbados, and the Dutch Caribbean, the group remains dedicated to helping Caribbean communities rebuild and recover.

-

Shaping a sustainable bioeconomy for Caricom

The Caribbean’s economic narrative has long been shaped by its exports—oil, gas, tourism, and rum. However, the region’s future prosperity hinges on empowering its women, innovators, and small enterprises. This was the central message delivered by Vashti Guyadeen, CEO of the TT Chamber of Industry and Commerce and President of Caribbean Women in Trade (CWIT), at the Caribbean Women in Trade conference in Saint Lucia.

-

General Accident acquires Beacon Insurance

In a landmark move reshaping the Caribbean insurance landscape, General Accident Insurance Co (Jamaica) Ltd has finalized its acquisition of Beacon Insurance Company Ltd. The transaction, completed on October 31, saw General Accident’s parent company, Musson (Jamaica) Ltd, acquire 100% of Beacon’s shares. Once regulatory approvals are secured, Beacon will operate as a subsidiary of General Accident, marking a significant expansion of the latter’s presence in Trinidad and Tobago (TT) and Barbados, while also granting access to new markets in Dominica, Grenada, St Kitts, St Lucia, and St Vincent. The merger is projected to elevate General Accident’s annual gross written premiums to over J$32 billion. Despite the acquisition, both brands will continue to operate independently in TT and Barbados, with Beacon’s existing management, led by CEO Christopher Woodhams, remaining intact. Woodhams will now report directly to General Accident Group CEO Sharon Donaldson and oversee the combined operations in TT. Additionally, Woodhams and Beacon director Christian Hadeed will join General Accident’s board, while the Hadeed family, founders of Beacon, will become minority shareholders in General Accident. This strategic partnership aims to preserve Beacon’s core values and ensure continuity within the broader regional group. Gerald Hadeed, Beacon’s founder, expressed confidence in the alignment of both companies’ insurance principles, emphasizing their shared commitment to client service and investment in people and technology. General Accident chairman PB Scott praised Beacon’s leadership and performance, highlighting the opportunity to create a powerful platform across the Caribbean. Founded in 1981, Beacon has been a dominant player in TT’s insurance sector, specializing in motor, property, and casualty insurance. General Accident, headquartered in Kingston and listed on the Jamaica Stock Exchange, has steadily expanded its regional footprint through strategic acquisitions.

-

The business of dignity

As individuals age or face mobility challenges due to illness or injury, the ability to perform basic tasks like getting out of bed or moving to a wheelchair becomes increasingly difficult. Recognizing this universal need for dignity and independence, Neala Persad, Director of Sales and Administration at Access Mobility MedCare, has dedicated her career to providing innovative home accessibility solutions. One such groundbreaking product is the UpLyft, a self-transfer system designed to enhance the quality of life for those with limited mobility. Launched in Trinidad and Tobago on October 8 at the Kapok Hotel, the UpLyft represents more than just a business venture—it’s a mission to restore dignity and independence to individuals facing physical challenges. The UpLyft, constructed with high-carbon steel and an electromechanical screw drive system, can safely transfer individuals weighing up to 330 pounds (136 kg) from a supine position to a wheelchair without the need for nursing assistance. Its user-friendly design allows individuals to operate the system independently, further promoting autonomy. While initially designed for medical facilities, the UpLyft is also available for home use, with leasing options starting at $750 per month. Access Mobility MedCare, headquartered in Canada, has expanded its operations to Trinidad and Tobago, driven by Persad’s passion and strong alliances within the medical community. The company’s broader portfolio includes bathroom modifications, ramps, stair lifts, and porch lifts, positioning it as a leader in mobility solutions. Persad emphasizes the importance of planning for ageing and mobility challenges, advocating for mental health support and strong community networks to complement physical accessibility solutions. The UpLyft is not just a product; it’s a testament to the belief that everyone deserves to live with dignity and independence, regardless of their physical limitations.

-

LJ Williams posts narrower loss

LJ Williams Ltd, the parent company of The Home Store Ltd, has disclosed a slight enhancement in its financial performance for the six months ending September 30. Despite a decline in turnover from $73.30 million to $71.35 million compared to the previous year, the company has managed to reduce its losses. The group reported a pre-tax loss of $488,000, a significant improvement from the $974,000 loss recorded in the same period last year. According to the condensed financials released on November 6, the half-year sales amounted to $71.355 million, with an operating profit of $2.14 million, which was offset by finance costs of $2.63 million. After accounting for taxation and minority adjustments, the net loss attributable to shareholders was $867,000, with a total comprehensive loss of $875,000. Total assets were reported at $225.71 million, bolstered by non-current assets of $145.14 million and current assets of $80.57 million. Management credited the improved loss position to cost-cutting measures implemented in response to a challenging retail environment. Chairman Lawford Dupres noted that the reduction in losses represents an improvement over the previous year’s performance. He highlighted weaker consumer spending and limited access to foreign exchange as significant challenges for the distribution business. Operational adjustments included reducing the number of Home Store outlets to focus resources on higher-performing locations and lower overhead costs. The Home Store operation in Guyana exceeded budget expectations, while the Food & Allied division, the company’s mainstay, achieved a 7.5% sales growth. Conversely, the Hardware division experienced weaker sales, partly due to reduced exports, whereas the Shipping division saw a 17% increase in sales compared to the previous period. Retained earnings were $44.398 million, and reserves stood at $34.597 million. The group’s statement emphasized that foreign exchange availability will remain a critical factor for the import distribution business in the coming months, with management continuing to prioritize cost control and focus on outlets with greater potential.

-

McDonald’s Trinidad, Heroes Foundation celebrate ‘Great Day’

McDonald’s restaurants in Trinidad are set to celebrate their ninth annual ‘Great Day’ on November 7, a hallmark event dedicated to fostering community unity and empowering the nation’s youth. This year, the fast-food giant continues its longstanding partnership with the Heroes Foundation, a local non-profit organization focused on mentoring and personal development for young people.

-

Journey to destination chocolate

Ashley Parasram, the visionary director of the Trinidad and Tobago Fine Cocoa Company, has dedicated the past decade to revitalizing the islands’ cocoa industry. His journey began in 2012 when he returned to his birthplace, Trinidad and Tobago, after years abroad. With a background in sustainable development and forestry management, Parasram was drawn to the potential of cocoa as a catalyst for economic and cultural revival.

-

Sam Bankman-Fried lawyers seek to overturn his fraud conviction

In a pivotal hearing before the US Federal Appeals Court, judges expressed skepticism over arguments presented by lawyers for Sam Bankman-Fried, the disgraced former cryptocurrency tycoon, who is seeking to overturn his fraud conviction and secure a new trial. Bankman-Fried’s defense team, led by attorney Alexandria Shapiro, argued that the initial trial was “fundamentally unfair,” claiming that Judge Lewis Kaplan improperly restricted Bankman-Fried’s testimony, thereby favoring prosecutors. Shapiro contended that the prosecution’s narrative was “morally compelling” but misleading, emphasizing that nearly all FTX creditors had been repaid 120% of their investments, with $8 billion already returned and an additional $1 billion in legal fees covered. Bankman-Fried’s legal team also argued that key evidence supporting his claim that FTX had sufficient funds to cover customer withdrawals was excluded, rendering the verdict unjust. However, the appellate judges appeared unconvinced, with one noting “very substantial evidence of guilt” in the trial record. Judge Barrington Parker questioned whether the jury’s verdict would have differed even if Bankman-Fried had been allowed to testify about his lawyers’ involvement in drafting certain documents. Bankman-Fried, once hailed as a billionaire cryptocurrency mogul and founder of FTX and Alameda Research, saw his empire crumble when it was revealed he had misused billions in customer funds to cover losses, finance political donations, and support personal and corporate spending. In March 2024, he was sentenced to 25 years in prison, three years of supervised release, and ordered to forfeit $11 billion after being convicted on seven charges, including wire fraud, securities fraud, and money laundering. Prosecutors described his actions as one of the largest financial frauds in US history, with Judge Kaplan condemning his “exceptional greed and disregard for the truth.” Meanwhile, reports suggest Bankman-Fried’s inner circle has lobbied former President Donald Trump for a pardon, though it remains unclear whether Trump is considering the request.