The inaugural edition of the Energy Fair, organized by the Ministry of Natural Resources (NH), has concluded on a high note, marking a significant milestone in the region’s push toward sustainable energy solutions. Claudine Saaki, the event’s project lead, highlighted the rapid growth in electricity consumption among both households and businesses. “Many are actively seeking ways to meet their increasing energy demands while simultaneously reducing costs. The fair addressed numerous queries and provided practical solutions,” she stated. The event was held as part of Caricom Energy Month, which this year adopted the theme “Invest, Innovate, Sustain. Leading the Charge in Energy Frontiers.” Held at Utopia Heritage, the fair featured 13 exhibitors from Suriname, France, and China, showcasing a diverse range of energy innovations. These included solar panels for electricity generation, household batteries, and large-scale energy storage systems for businesses and commercial buildings. With the rise of e-bikes and fully electric vehicles, the demand for charging solutions has surged. Visitors explored various options tailored to this rapidly growing user base. Additionally, powerful power banks for charging laptops and other devices on the go were also a focal point. Saaki emphasized the clear need for a repeat of the event, preferably on a larger scale. “We are very pleased with the turnout. The curiosity about alternative energy sources was immense. People are eager to manage their energy consumption more consciously and are looking for energy-efficient devices or cost-saving methods. The fair aimed to inform visitors about the latest innovations in the sector, particularly in clean and sustainable energy,” she added.

分类: business

-

Suriname verkent lidmaatschap Ontwikkelingsbank CAF

In a significant diplomatic engagement, Suriname’s Minister of Foreign Affairs, International Trade, and Cooperation, Melvin Bouva, held a productive meeting with Sergio Díaz-Granados, Executive President of the Development Bank of Latin America and the Caribbean (CAF). The discussions took place during the 4th CELAC-EU Summit in Santa Marta, Colombia, earlier this week. The talks focused on strengthening bilateral cooperation, particularly in areas of sustainable development, economic resilience, and regional integration. CAF, which recently secured an AA+ credit rating, is renowned for providing tailored financial and technical support to its member countries. The Surinamese delegation was briefed on the potential benefits of joining CAF, including access to development financing for critical sectors such as education, infrastructure, and healthcare. Both parties agreed that CAF would soon dispatch a technical mission to Suriname to develop a comprehensive business case for potential membership. Minister Bouva expressed gratitude for CAF’s open and collaborative approach, emphasizing the importance of strategic partnerships in fostering sustainable growth and inclusive development. CAF’s regional reputation as a financial institution that prioritizes the socio-economic realities of its member states further underscores the significance of this potential collaboration.

-

Belize and Mexico Deepen Trade Talks at Corozal Free Zone

In a significant move to bolster economic collaboration, Belize and Mexico convened high-level trade discussions at the Corozal Free Zone this week. Belize’s Prime Minister John Briceño met with officials from Quintana Roo, Mexico, to explore avenues for enhancing bilateral trade and investment. The talks focused on fostering synergy between businesses in Quintana Roo and Belize, with an emphasis on producing goods for the broader CARICOM market. Prime Minister Briceño described the meeting as highly successful, highlighting the shared commitment to deepening economic ties. However, he also addressed ongoing security concerns in the Free Zone, emphasizing the need for enhanced measures to ensure a stable business environment. The Prime Minister revealed that the Ministry of Home Affairs would oversee enterprise activities in the region, enabling the police to play a more active role in maintaining security. This meeting marks a pivotal step in regional economic integration, with both nations expressing optimism about future collaborations.

-

Belize and Mexico Meet to Boost Cross-Border Cooperation

In a landmark meeting held on November 14, 2025, Belize and Mexico took significant steps to enhance cross-border cooperation, addressing a range of issues from gender-based violence to environmental challenges like beach erosion. The discussions also paved the way for a joint policy aimed at boosting and coordinating investment between the two nations, signaling a promising future for economic collaboration. Thea Garcia-Ramirez, Belize’s Minister of Human Development, played a pivotal role in the talks, emphasizing the need for a structured framework to facilitate these initiatives. One of the key outcomes was the introduction of a border pass for residents of five southern Mexican states—Quintero, Chiapas, Tabasco, Yucatan, and Campeche. This pass, which will be issued free of charge, will allow Mexican nationals to travel throughout Belize for up to seven days. Additionally, the Belizean Cabinet has approved the discontinuation of various fees, including exit fees, to make cross-border travel more accessible. Garcia-Ramirez highlighted that easing travel restrictions could attract a significant portion of the 1.2 million annual visitors to the free zone, most of whom are Mexican, thereby boosting Belize’s tourism and economy.

-

What Makes Belize Unique?

Belize is taking a significant step toward enhancing its global image with the launch of its first-ever unified national brand. This ambitious initiative, supported by the Inter-American Development Bank and spearheaded by BELTRAIDE, aims to redefine how Belize is perceived internationally. The 22-week project focuses on attracting investors, fostering trade relationships, and promoting tourism by presenting the country’s unique strengths in a cohesive and compelling manner. Deputy Director of BELTRAIDE, Monique Usher, emphasized the importance of this branding exercise, highlighting its role in consolidating Belize’s identity across various sectors, including tourism, trade, and culture. The initiative involves extensive consultations with both private and public sectors, as well as research and surveys to gather feedback. Key areas of focus include environmental sustainability, which is strongly associated with Belize in both local and international markets. The goal is to create a dynamic and unified brand that effectively communicates Belize’s value proposition to the world.

-

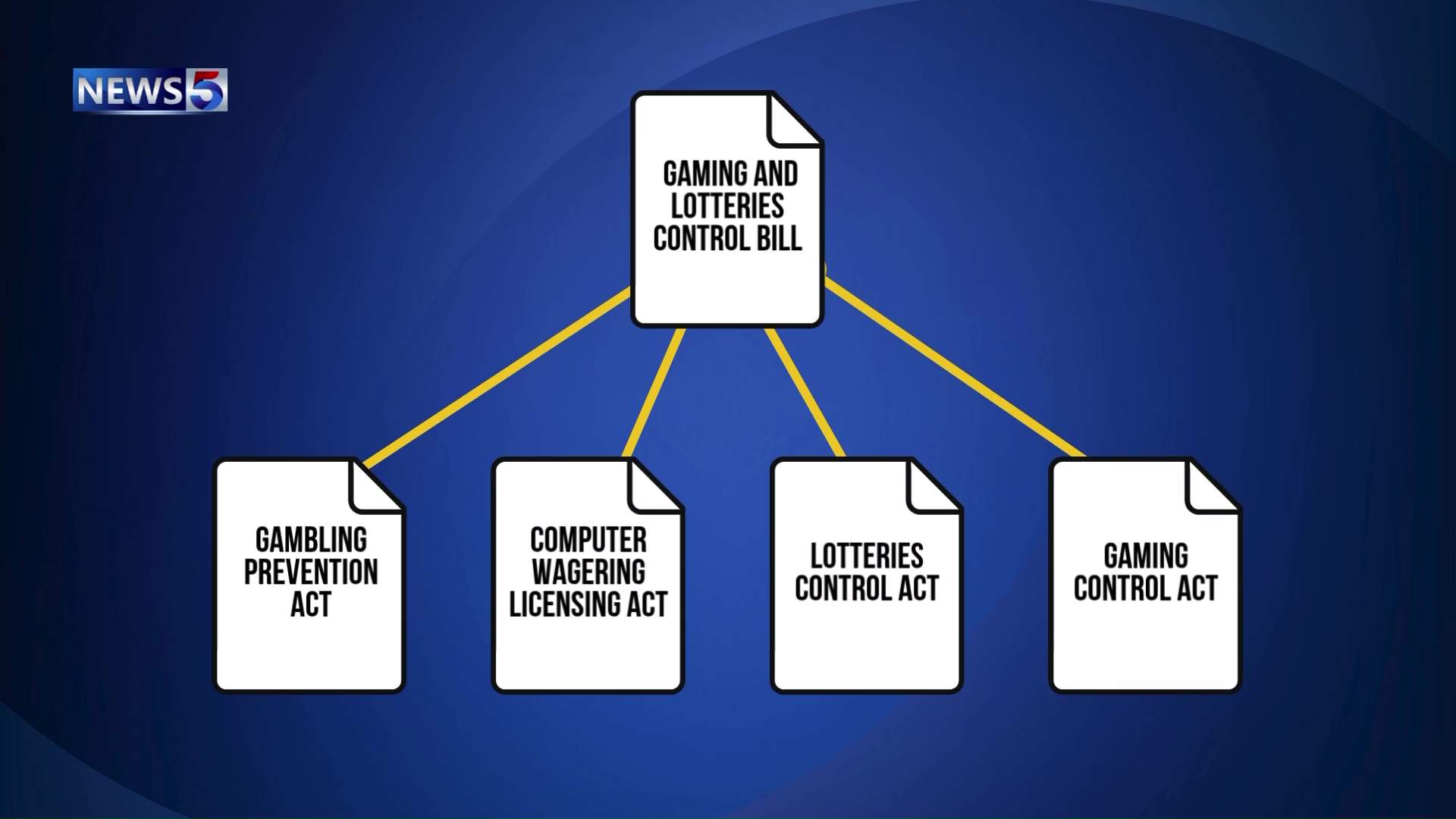

Belize’s Gaming Bill Faces Scrutiny Amid Oversight Scandals

Belize’s proposed Gaming and Lotteries Control Bill 2025, aimed at modernizing the nation’s gambling industry by consolidating four outdated laws, is facing intense scrutiny following a series of oversight failures and scandals. The bill, currently under Senate review, promises enhanced regulation but has been overshadowed by the Caribi Bleu Casino case, where illegal activities, including an unauthorized U.S. dollar ATM and questionable permits, went undetected for months. Critics argue that the bill grants excessive power to ministers without addressing systemic oversight gaps. Senators are advocating for mandatory audits, community involvement in licensing, and greater accountability. The bill has been paused for revisions, but the debate continues as stakeholders demand stronger safeguards to prevent future regulatory lapses. The case of Caribi Bleu Casino, whose owner Rima Ray is now imprisoned in the U.S. for fraud and illegal gambling, has exposed significant weaknesses in Belize’s regulatory framework. The Financial Intelligence Unit, Central Bank of Belize, and Gaming Control Board all failed to detect the illegal operations, raising questions about their effectiveness. Senators, including Patrick Faber and Janelle Chanona, have emphasized the need for transparency and accountability in the revised legislation. The Senate’s decision to shelve the bill for further review underscores the urgency of addressing these issues to restore public trust in the gaming industry.

-

Ocean Oasis Hotel officially opens its doors to the public today

The Ocean Oasis Hotel Dominica, a new 4-star luxury hotel, officially opened its doors to the public today, November 14th, at 3:00 P.M. Located in Castle Comfort on the southwest coast of Dominica, the hotel features 37 oceanfront rooms and a lavish two-bedroom Presidential Suite, all designed with contemporary aesthetics and offering panoramic ocean views. The property also includes a casino, spa, conference center, multipurpose room, gym, waterfront pool, and direct pier access, catering to both leisure and business travelers.

The hotel’s development was facilitated under Dominica’s Citizenship By Investment (CBI) Programme, which aims to boost the island’s economy through foreign investment. Owner Floyd Capitolin emphasized the hotel’s role in addressing the island’s shortage of high-quality accommodations, stating, ‘We are bringing top-of-the-line, first-class rooms to Dominica, comparable to those in Dubai or developed countries.’

Capitolin highlighted the hotel’s diverse amenities, including two in-house dining venues, curated nature and water-based activities, and a mini-spa, ensuring a premium experience for guests. The opening ceremony was marked by a sense of pride and optimism, as the hotel aims to attract both local and international visitors seeking relaxation, dining, and event hosting opportunities.

The Ocean Oasis Hotel is poised to enhance Dominica’s tourism sector, offering a blend of luxury and accessibility in a picturesque coastal setting.

-

High Court rules GRA cannot claim more taxes on Azruddin Mohamed’s Lamborghini, other vehicles in civil court

In a landmark ruling on Friday, November 14, 2025, High Court Judge Gino Persaud declared that the Guyana Revenue Authority (GRA) cannot legally impose additional taxes on luxury vehicles imported by businessman and politician Azruddin Mohamed. The case centered on a 2020 Lamborghini Aventador SVJ Roadster and two 2021 Toyota Land Cruisers, for which the GRA had sought to claim GY$421,057,712 in additional taxes. Judge Persaud ruled that once goods are cleared and taxes paid, the GRA lacks the legislative authority to reassess taxes under the Customs Act or its Fifth Schedule. This decision was based on several local legal precedents cited by Mohamed’s legal team, led by attorneys Siand Dhurjon and Damien Da Silva. The judge also granted an order of Certiorari to quash the GRA’s tax impositions and its demand for the surrender of the vehicles. Additionally, the GRA was ordered to pay GY$750,000 in legal costs to Mohamed by December 31, 2025. The ruling highlighted the GRA’s repeated attempts to delay proceedings, including filing multiple affidavits and applications, which the judge deemed an abuse of the court’s process. The case underscores the limitations of post-clearance tax assessments and reinforces the legal protections for importers once taxes are settled.

-

BYD launched in Saint Lucia, set to feature at EV Lucian Car Expo

JQ Motors has officially introduced BYD, one of the world’s leading electric vehicle (EV) brands, to Saint Lucia, marking a significant milestone in the island’s automotive landscape. The October 25 launch event showcased BYD’s diverse lineup, featuring both full battery electric and plug-in hybrid models, aligning with the global shift toward sustainable and technologically advanced transportation.

Brand Manager Neron Joseph emphasized BYD’s pioneering role in the industry, stating, ‘The automotive sector is undergoing a once-in-a-century transformation, and BYD is at the forefront of this revolution. Their mission, encapsulated in the slogan ‘Build Your Dreams,’ is to create a cleaner, greener future through innovation.’ Joseph highlighted BYD’s origins as a battery manufacturer, which has positioned the brand as a leader in EV technology. ‘Their expertise in energy storage is the foundation of their success in the electric vehicle market,’ he explained.

The event also unveiled BYD’s cutting-edge innovations, including the Blade Battery and e-Platform 3.0, which offer enhanced safety, durability, and efficiency. New models such as the Sealion 7, a full electric all-wheel-drive SUV, and the Yuan Pro, a compact and affordable EV, were introduced to the local market. Joseph also showcased the Vehicle-to-Load (V2L) capability, demonstrating its practicality by powering the event’s DJ setup with a BYD Shark pickup truck.

Gordon Charles, Group CEO of JQ Charles Group of Companies, described the launch as a transformative moment for JQ Motors. ‘The automotive industry is rapidly evolving, and legacy automakers must adapt or risk obsolescence. BYD is leading this charge,’ he said. Charles emphasized that securing the BYD dealership rights reflects JQ Motors’ strategic commitment to sustainability and innovation.

For those who missed the launch, BYD models will be on display at the EV Lucian Car Show on November 15 at the Caribbean Cinemas car park, offering the public an opportunity to explore the vehicles and engage with JQ Motors representatives.

-

Deposit Rates Sink to 15-Year Low

Belizeans are experiencing the lowest returns on their bank deposits in over 15 years, according to recent data from the Central Bank of Belize. The weighted average deposit rate fell to 0.9 percent in September 2025, reflecting a sustained decline in what banks pay customers for savings and time-deposit accounts. This downward trend is primarily driven by savings and time deposits, which constitute the majority of customer funds. Savings accounts now yield between 2.6 and 2.7 percent, while time deposits, often used for fixed-term investments, have dropped to 1.9 to 2.0 percent. Demand and chequing accounts, which typically offer minimal or no interest, have remained stable and play a lesser role in the overall decline. The long-term trend reveals a stark reduction in deposit earnings. In early 2010, the average rate was nearly 6 percent, but by 2020, it had fallen to around 1.3 percent. The continued decrease into 2024 and 2025 indicates that low deposit returns have become a permanent feature of Belize’s banking system. For example, time deposit rates, which stood at 7.4 percent in 2010, have plummeted by 74 percent to 1.9 percent today. Several factors contribute to this shift, including banks’ ample liquidity, which reduces their need to offer high interest rates to attract deposits, and slow lending growth, which diminishes competition for customer savings. For Belizeans, these historically low rates mean that savings grow at a sluggish pace, making it increasingly difficult to keep up with rising living costs. Over the same period, headline inflation has surged by nearly 30 percent, exacerbating the financial strain on households.