As the holiday season approaches, Campari is captivating the Caribbean with its dynamic ‘Red Passion Holiday Winningz’ campaign. The promotion, currently active in St Vincent and the Grenadines, Suriname, St Lucia, Grenada, and The Bahamas, offers consumers the opportunity to celebrate with a chance to win exciting prizes. Campari, known for its vibrant brand ethos, is not only setting the stage for memorable holiday experiences but also giving back to its loyal customers. Theresa Higgins-Edwards, Campari Export Manager, emphasized, ‘Campari is more than a brand; it’s an invitation to live passionately and celebrate boldly. This season, we’re rewarding that passion by giving back to our consumers who make every celebration unforgettable.’ From now until December 31, every purchase of Campari 750ml or 1 litre bottles from participating supermarkets and wholesalers enters consumers into a draw for weekly cash prizes, supermarket and gas vouchers, and phone cards. Monthly prizes include laptops, iPhones, and Samsung/Apple Watches. The grand prize, available in each market, offers a furniture and appliance shopping spree valued at US$3,500 or utility bills covered up to US$2,400. Higgins-Edwards added, ‘Across the Caribbean, Campari resonates with those who value culture, connection, and energy. This campaign transforms that connection into tangible rewards, ensuring every pour this holiday season comes with the chance to win big.’ Campari continues to embody passion, turning ordinary moments into extraordinary experiences, and invites Caribbean consumers to toast to togetherness, excitement, and bold living.

分类: business

-

Caribbean Development Bank unveils new Trade Guarantee Programme to engage region’s bankers

The Caribbean Development Bank (CDB) has unveiled a groundbreaking initiative, the Trade Finance Guarantee Programme (TFGP), aimed at enhancing trade financing opportunities for businesses across the Caribbean, with a particular emphasis on Micro, Small, and Medium-sized Enterprises (MSMEs). The announcement was made during the Caribbean Association of Banks Annual Conference held at the Hyatt Regency in Trinidad and Tobago.

Dr. Isaac Solomon, Vice President of Operations at CDB, described the TFGP as a pivotal component of the bank’s broader strategy to foster regional economic growth. He emphasized that the programme is designed to mitigate risks for banks and improve access to international markets for local businesses. ‘This Guarantee Programme sits squarely in the middle of our transformation agenda – it is anchored on accelerating transformative financing, advancing opportunities for MSMEs to thrive, and scaling impact through partnerships,’ Dr. Solomon explained.

The TFGP aims to reduce the risk exposure of confirming banks by providing partial guarantees against defaults by issuing banks within CDB’s 19 Borrowing Member Countries. This approach is expected to strengthen relationships with correspondent banks, unlock additional capital, and expand trade finance activities throughout the Caribbean.

Dr. Solomon highlighted the broader significance of trade finance, noting that it serves as a catalyst for economic growth, employment opportunities, and regional resilience. ‘Adequate trade finance is not just a financial service; it is an enabler of growth, job creation, and regional resilience. By enabling more transactions, this programme will directly support efforts to grow exports and increase foreign exchange earnings,’ he stated.

The programme will initially undergo a pilot phase in collaboration with JP Morgan and IDB Invest, targeting 14 banks across six Caribbean nations. The pilot phase will include capacity-building support to enhance the trade finance capabilities of these banks. The ultimate goal is to develop a sustainable, long-term platform that continues to promote trade facilitation in the region.

In addition to the launch, CDB hosted a panel discussion on the future landscape of trade finance in the Caribbean. The session explored how improved access and affordability can stimulate enterprise growth, featuring insights from industry leaders such as Mr. Stephen Thomas of the Caribbean Financial Institutions Team; Ms. Joanna Charles, General Manager of Antigua Commercial Bank; Mr. Bevon Alvarez, General Manager of Republic Bank; and Ms. Lisa Harding, CDB’s Division Chief of Private Sector Development.

CDB reiterated its commitment to collaborating with regional financial institutions to ensure the success of the pilot programme. The bank also positioned the TFGP as a flagship initiative intended to advance trade development across the Caribbean.

-

Why you should purchase critical illness insurance

Critical illness insurance is a financial safety net designed to provide a lump-sum payment upon the diagnosis of a severe medical condition such as cancer, heart attack, or stroke. Unlike traditional health insurance, which primarily covers medical expenses, this policy offers flexibility in how the funds are utilized—whether for hospital bills, income replacement, daily living costs, or long-term financial planning. This type of insurance is particularly valuable as it addresses the broader economic impact of serious illnesses, which can disrupt earnings and deplete savings. Globally, the critical illness insurance market was valued at $192.3 billion in 2022 and is projected to expand significantly in the coming years. Despite its importance, only 12% of adults in the UK, for instance, have such coverage, even though one in three individuals is likely to face a critical health condition in their lifetime. In Trinidad and Tobago, non-communicable diseases like heart disease and cancer are leading causes of mortality and healthcare demand, underscoring the relevance of this insurance. For families, especially those reliant on a single income, critical illness insurance ensures financial stability during challenging times. Purchasing a policy early, while young and healthy, can also result in lower premiums. Ultimately, this insurance is not just about preparing for the worst but about protecting one’s legacy, dignity, and future.

-

Recovery in economic confidence stalls in Q3

The latest Global Economic Conditions Survey (GECS), jointly conducted by the ACCA and IMA, has revealed a slight decline in confidence among global accountants in the third quarter of 2025, following a modest recovery in the previous quarter. The survey highlights persistent caution regarding global economic prospects, with key indicators such as the Global New Orders Index and Capital Expenditure Index hitting multi-year lows. The Employment Index also remained subdued, reflecting sluggish job markets across several economies. Jonathan Ashworth, Chief Economist at ACCA, noted that while the global economy showed resilience in the first half of 2025, the third quarter’s declines suggest a potential slowdown in global growth in the coming months. Despite this, he emphasized that a major economic downturn is not imminent. Regionally, North America saw a significant rise in confidence, driven by improved sentiment among US accountants, though the forward-looking New Orders Index plummeted to its lowest level since the pandemic’s peak in 2020. Alain Mulder, Senior Director at IMA, highlighted ongoing uncertainty in the US economy, with slowing job markets but solid GDP growth. In contrast, Western Europe experienced a sharp decline in confidence, particularly in the UK, where fears of upcoming tax hikes weighed heavily on sentiment. Meanwhile, Asia Pacific’s confidence improved, buoyed by global economic resilience and reduced tariff-related uncertainty. The survey also underscored the growing prominence of cybersecurity as a critical risk, transcending IT departments to become a governance and cultural issue across sectors and regions.

-

High Court rules in ANSA Merchant Bank’s $30m fraud case

In a landmark ruling, the High Court has adjudicated on the $30 million fraud case involving ANSA Merchant Bank (AMB) and its former employees. Justice Frank Seepersad, in a comprehensive 100-plus page judgment, dismissed claims against four former employees but found former business development officer Dwayne Rojas guilty of breaching contractual and fiduciary duties. Rojas was implicated in a fraudulent loan scheme, colluding with roll-on/roll-off car dealers to defraud the bank of $30 million over two and a half years. The scheme involved falsified job letters and fabricated vehicle documents, with non-existent vehicles listed as loan collateral. Justice Seepersad ruled that Rojas knowingly processed fraudulent applications, causing substantial financial loss to AMB. The court also dismissed cases against Zaria Sankar, Reyvaan Rampersad, Kerry Ramsaroop, and Adriana Ramsingh, citing insufficient evidence of wrongdoing. However, summary judgments were granted against five roll-on/roll-off companies, ordering them to repay $24 million. Justice Seepersad criticized AMB for targeting junior staff while neglecting to hold senior officers accountable. He highlighted the bank’s inadequate internal controls and risk management practices, which facilitated the fraud. The judge recommended that the case be forwarded to the Director of Public Prosecutions and the Commissioner of Police for potential criminal charges. Additionally, he urged the Minister of Trade, Industry, and Tourism to review the operating licenses of the implicated dealerships. The ruling underscores the need for stricter financial oversight and accountability in the banking sector.

-

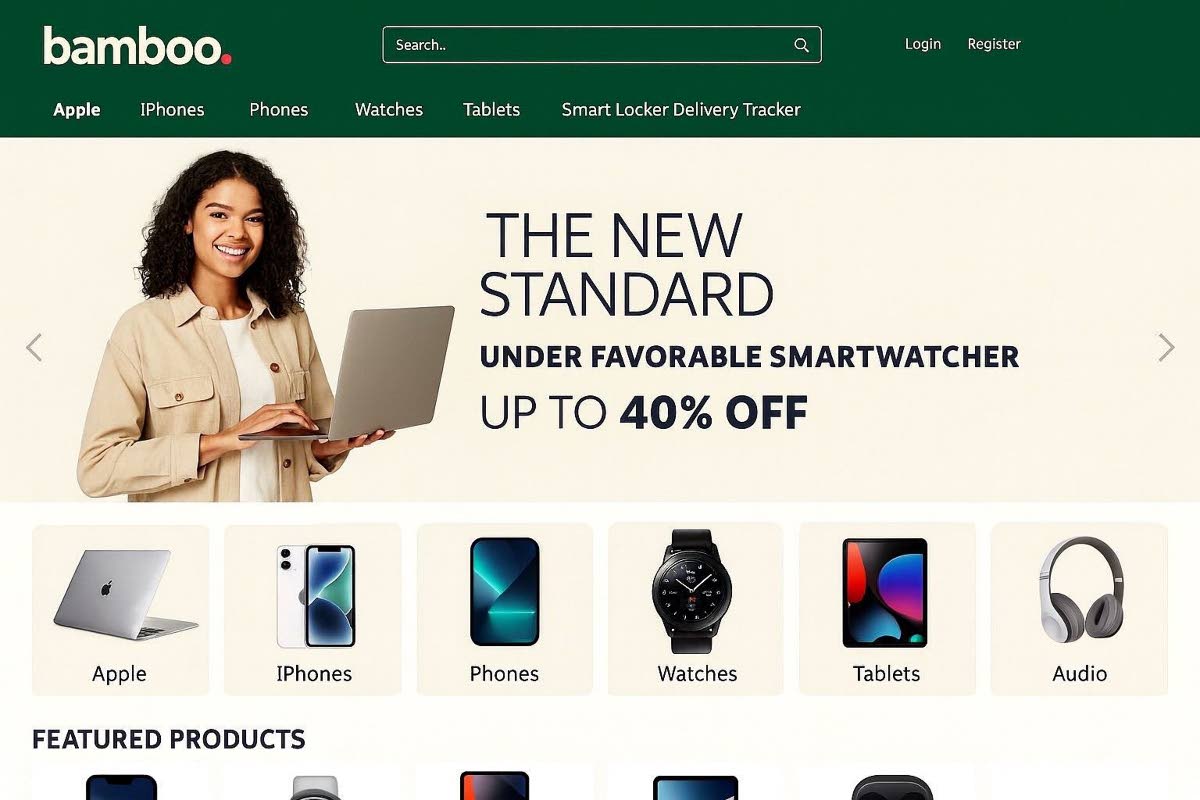

Bamboo gives customers a safe place ‘to cell’

In a world where online marketplaces often expose sellers to risks of fraud and theft, Quincy Richards, the founder and CEO of Bamboo Marketplace, is pioneering a safer alternative. Launching in February next year, Bamboo Marketplace aims to eliminate the dangers associated with face-to-face transactions by offering a secure, cashless platform for buying and selling electronic devices. Richards, an account manager in a telecommunications company, was inspired to create the platform after a close call with a fraudulent buyer during a personal phone sale. His vision is to provide a seamless, contact-free transaction experience, ensuring both buyers and sellers can operate without fear of scams or physical harm. The platform utilizes an ‘Escrow’ system, where funds are held in a digital wallet until the item is delivered via Aeropost’s smart lockers across 14 locations in Trinidad and Tobago. Additionally, Bamboo Marketplace offers a 24-hour warranty and a dispute management team to address any issues post-purchase. With rigorous verification processes, including AI-driven identity checks and device serial number validation, Richards is confident that Bamboo Marketplace will set a new standard for safety in peer-to-peer online transactions. The platform also caters to businesses, offering subscription plans that exempt them from transaction fees and expand their market reach. Richards envisions Bamboo Marketplace becoming the go-to platform for secure online transactions, ultimately eradicating the recurring issue of fraud in the digital marketplace.

-

Quarry operator Guerra arrested under SoE regulations

In a significant development, prominent businessman Danny Guerra was apprehended on November 20 under the state of emergency (SoE) provisions by the Special Investigations Unit. Guerra, the manager of D Guerra Ltd and owner of multiple companies under the D Guerra Group of Companies, faces allegations of unlawful aggregate processing without a license from the Ministry of Energy. This arrest follows a major police operation on October 9, which targeted an illegal quarry in Manuel Congo, Guanapo. The operation led to the shutdown of the site and the confiscation of a multi-million-dollar processing plant, trucks, and heavy machinery. Guerra, along with his son Garvin Guerra and 16 others, was detained during the raid. Earlier, on October 11, Guerra and his son had been charged and granted $50,000 bail each by a Justice of the Peace. Additionally, on October 10, Guerra, his son, a supervisor from D Guerra Ltd, and Carmino Ltd director Rolf Ferriera were taken to St Augustine Private Hospital under police guard for medical treatment after reportedly falling ill during detention. The case has drawn significant attention due to Guerra’s prominent business stature and the scale of the alleged illegal operations.

-

Money Linx: InfoLink prepares for its next three decades

InfoLink Services, the interbank agency responsible for ACH electronic transfers and the Linx cash payments system, marked its 30th anniversary on November 14, 2025, at the Hyatt Regency in Port of Spain, Trinidad and Tobago. The event highlighted both the agency’s achievements and the challenges it faces in an evolving electronic payments landscape. Central Bank Governor Larry Howai praised InfoLink for its critical role in ensuring smooth, secure, and efficient payment processing, calling it a cornerstone of the country’s retail payment system. However, he also emphasized the need for innovation to meet rising consumer demands for faster, more convenient, and secure payment options while maintaining financial stability and inclusion. InfoLink, which began operations in 1994, introduced Linx in 1995, revolutionizing cashless transactions in Trinidad and Tobago. Over the years, it has expanded its services to include Automated Clearing House (ACH) electronic transfers and electronic check clearing, managing 41% of the country’s electronic payments. Despite its success, InfoLink faces increasing competition and the need to adapt to advanced technologies like AI, which are transforming both payment systems and the methods criminals use to exploit them. Glynis Alexander-Tam, InfoLink’s general manager, stressed the importance of collaboration and innovation to meet customer expectations for instant payments and enhanced security.

-

NCB Merchant Bank pushes good governance as key to SME financing

NCB Merchant Bank (TT) Ltd has called on small and medium-sized enterprises (SMEs) to bolster their governance and financial management practices to enhance access to financing and foster sustainable growth. This message was delivered at the SME Power Breakfast event in St Augustine, organized in partnership with the Greater Tunapuna Chamber of Industry & Commerce (GTCIC). The event convened business leaders, policymakers, and investors to explore how transparency and structured management can build SME resilience and attract investment through various financial instruments, including loans, equity, and receivables financing. Christopher Buchanan, Senior Vice President of Investment Banking at NCB Capital Markets Ltd, emphasized that while many entrepreneurs are driven to scale their businesses, sustainable growth requires more than ambition. He stated, ‘Governance is what transforms a good idea into a credible business. Investors and lenders look for discipline – accurate reporting, sound management, and accountability. When these elements are in place, capital becomes more accessible.’ The event was particularly timely, following the release of the 2025 National Budget, which introduced new compliance measures and fiscal adjustments requiring businesses to strengthen their financial practices. Ramon Gregorio, President of the Tunapuna Chamber, praised NCB Merchant Bank’s collaborative efforts, highlighting the importance of dialogue between the private sector and financial institutions. He noted, ‘No business should operate in isolation. Your success depends on the ecosystem around you – banks that understand your risk profile, regulators that enable innovation, and businesses that open doors to opportunity.’ SMEs, which constitute 95% of registered businesses and contribute nearly 30% of Trinidad and Tobago’s GDP, often face significant financing challenges. Buchanan underscored NCB Merchant Bank’s commitment to closing this gap by advocating for stronger governance, which he believes will make SMEs more investible and resilient.

-

Courts approached to purchase Standard Distributors

The Unicomer Group, a leading retail conglomerate, has unveiled its largest Courts Megastore in Trinidad and Tobago, marking a significant milestone in its regional operations. The new store, located on Don Miguel Road in Barataria, spans 4,600 square feet, offering 30% more retail space than its predecessor. The facility also includes a Starbucks outlet, enhancing its appeal as a one-stop shopping destination. The project, which cost nearly $180 million and took 28 months to complete, has created over 60 direct and indirect jobs, adding to the more than 1,000 jobs Courts has generated in the past two decades. During the grand opening on November 19, Unicomer executives expressed their commitment to the Trinidadian market despite ongoing challenges such as the foreign exchange (forex) shortage. Guillermo Siman, executive vice president of Unicomer Group, revealed that the company had declined an offer from Ansa McAl to acquire Standard Distributors, a major competitor, due to overlapping store locations. Standard Distributors, a long-standing Trinidadian business, was recently sold to fintech company Term Finance, ending its 80-year legacy. Both Guillermo and Felix Siman, vice president and managing director of Unicomer’s Caribbean operations, emphasized the importance of competition and market growth. Felix highlighted Unicomer’s strategies to navigate the forex crisis, leveraging its multinational capacity to import products while also expanding partnerships with local vendors. He expressed optimism that the government would address forex constraints to support local businesses. The company’s continued investment in Trinidad and Tobago, including plans to replace the old Megastore with a new retail plaza, underscores its confidence in the market’s future. Felix reiterated Unicomer’s commitment to providing world-class products and services, ensuring that Courts remains a trusted brand in the region.