JMMB Real Estate Holdings Limited, the property development subsidiary of the JMMB Group, is forging ahead with two significant commercial projects in Kingston, marking a strategic expansion into the non-financial sector. The developments, located on Harbour Street in downtown Kingston and Haughton Avenue in New Kingston, are currently in the tender phase, with contractors being selected. While the company has not disclosed the exact costs, it confirmed that construction is slated to begin in the fourth quarter of the 2025/26 financial year. The Harbour Street project is expected to take 18 to 20 months, while the Haughton Avenue development will require 22 to 24 months to complete. Both projects received statutory approvals earlier this year and are part of JMMB’s broader strategy to monetize its $4-billion land bank through high-value commercial real estate. The Harbour Street development will renovate 35,000 square feet of office space, while the Haughton Avenue project will feature a 10-storey building with parking and 45,000 square feet of modern offices. The latter currently houses JMMB’s head office, JMMB Bank (Jamaica) Limited, and JMMB Investments. JMMB has set a profit hurdle rate of 15% for each project, reflecting its focus on market-based returns rather than passive asset appreciation. The company plans to finance the projects independently, seeking partnerships and funding on favorable terms. Upon completion, the properties will either be sold floor-by-floor or leased on medium-term agreements, aligning with JMMB’s long-term investment strategy. This approach has already proven successful at the company’s first completed project at 102 Hope Road and 1 Liguanea Avenue, which began generating rental income last financial year. JMMB Real Estate reported a net profit of $332 million for the 2024/25 financial year, contributing $760 million in income to the group through rental earnings, property sales, and revaluation gains. Group CEO Keith Duncan highlighted the subsidiary’s self-sufficiency, emphasizing its role as a growth engine for the JMMB Group. With design work underway for additional projects in Mandeville and Montego Bay, JMMB Real Estate is poised to play a pivotal role in the group’s diversification strategy.

分类: business

-

NCB says services restored after system challenges

KINGSTON, Jamaica — The National Commercial Bank (NCB) has successfully restored its services across all platforms following significant system disruptions earlier on Wednesday. The bank confirmed the resolution after being contacted by Observer Online, addressing widespread complaints from customers who faced difficulties accessing their accounts via the NCB mobile app and website.

-

BANKS PUSH BACK AGAINST REGULATORY ONSLAUGHT

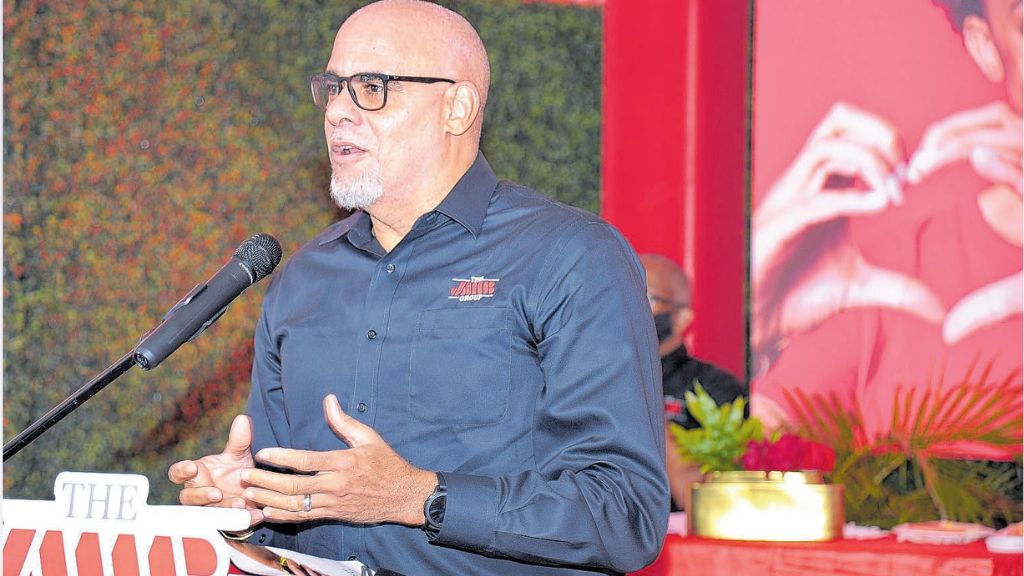

Jamaican financial institutions are pressing regulators to synchronize the implementation of new capital and liquidity regulations, citing the rapid pace of reforms as a significant compliance burden that could erode profitability. Keith Duncan, CEO of JMMB Group Ltd, one of Jamaica’s largest financial entities, emphasized this concern during the company’s 12th annual general meeting (AGM) on Friday. Duncan highlighted that over 100 policy reforms have been introduced in the past decade, creating substantial operational challenges for the sector. While these measures aim to enhance financial stability, their accelerated rollout has strained resources, particularly for smaller institutions. The Bank of Jamaica (BOJ) is currently advancing a series of reforms, including Basel III capital standards, a ‘twin peaks’ regulatory model, and new liquidity requirements for financial holding companies (FHCs). These changes, though beneficial in the long term, are driving up costs and limiting capital deployment flexibility. Duncan urged regulators to adopt a collaborative approach, ensuring reforms are sequenced to minimize the burden on the industry. The BOJ is also developing a special resolution regime (SRR) to address failing financial institutions, though its funding mechanism remains contentious. Additionally, the Financial Services Commission (FSC) has introduced reforms to exposure limits for collective investment schemes and dividend declarations by securities dealers. While these measures aim to strengthen the financial system, they may lead to higher compliance costs, potentially passed on to consumers. The JMMB Group CEO called for a balanced regulatory framework to safeguard profitability and shareholder returns.

-

Jamaica’s inflation rises by 0.8% in September, driven by food and housing

KINGSTON, Jamaica — Jamaica’s consumer prices surged by 0.8 per cent in September, according to the Statistical Institute of Jamaica (STATIN). This increase, driven by escalating costs in food, housing, and education, has elevated the annual point-to-point inflation rate to 2.1 per cent for the period spanning September 2024 to September 2025. The education sector witnessed the most pronounced monthly price hike, soaring by 5.6 per cent, primarily due to higher tuition fees at private primary schools as the new academic term commenced. The housing, water, electricity, gas, and other fuels category also saw a 1.0 per cent rise, reflecting increased electricity rates and rental expenses. Food and non-alcoholic beverage prices climbed 0.9 per cent, largely influenced by higher costs for agricultural produce such as sweet potatoes, tomatoes, carrots, and cabbages. Over the twelve months leading to September 2025, the housing division and restaurant and accommodation services were the primary contributors to the 2.1 per cent inflation rate, with increases of 4.8 per cent and 4.1 per cent, respectively. Food and non-alcoholic beverages experienced a more modest annual rise of 0.7 per cent. Regional disparities in inflation were evident, with the Greater Kingston Metropolitan Area recording the highest monthly increase at 1.0 per cent, compared to 0.8 per cent in other urban centres and 0.6 per cent in rural areas. Additional sectors facing upward pressure included transport, which rose 0.3 per cent due to higher petrol prices and toll fees, and personal care goods and services, which increased by 0.5 per cent. These rises were partially mitigated by stability or deflation in other categories. The information and communication division remained unchanged for the month but declined by 5.8 per cent year-on-year, while insurance and financial services showed no monthly or annual variation. The Consumer Price Index (CPI), which tracks changes in the general level of prices for goods and services purchased by households, underscores the ongoing economic challenges faced by Jamaican consumers.

-

Jamaica eyes new port in St Thomas to tap Guyana’s building boom

The Port Authority of Jamaica (PAJ) is actively considering the development of a new export port in St Thomas, a strategic move aimed at positioning Jamaica as the leading supplier of construction materials across the Caribbean. This initiative is particularly targeted at Guyana, where an oil-driven infrastructure boom has created unprecedented demand for aggregates, limestone, and cement. PAJ Chairman Alok Jain revealed these plans during a recent address at the Institute of Chartered Accountants of Jamaica (ICAJ) annual business conference, emphasizing the need for additional ports to meet regional demands. While a specific timeline remains undisclosed, Jain highlighted the importance of locating ports near mining sites to minimize transportation costs and logistical challenges. The St Thomas port is envisioned as a dedicated bulk export facility, designed to streamline the movement of heavy materials to regional buyers. This development aligns with Prime Minister Andrew Holness’s March 2023 call for local quarry operators to expand production to serve Caribbean markets, particularly Guyana. Guyana’s infrastructure projects have surged in recent years, driven by its oil wealth, leading to a 250% increase in gravel and crushed stone imports in 2023, totaling $47 million. While Suriname’s State-owned Grassalco has been a primary supplier, Guyana has also sought materials from Jamaica and other Caribbean nations. The proposed St Thomas port is part of a broader strategy to transform Jamaica into a global logistics hub, with Jain envisioning the island as the fourth global logistics node after Singapore, Dubai, and Rotterdam. This ambition is supported by significant investments in Jamaica’s port infrastructure, including over $400 million in the Kingston Freeport Terminal since 2016 and the development of the Caymanas Special Economic Zone, a modern logistics and light-manufacturing hub. Jain believes that shifting global trade dynamics, including tariff upheavals and supply chain disruptions, present a unique opportunity for Jamaica to leverage its geographic advantage and emerge as a key player in international trade.

-

Observer and Gleaner move to sign joint venture agreement

In a landmark move aimed at optimizing operational efficiency, Jamaica Observer Limited (JOL) and Gleaner Company Media Limited (GCML) have announced plans to establish a formal joint venture (JV) by the end of the calendar year. This collaboration follows the signing of a Memorandum of Understanding (MOU) in early August, which initiated a feasibility study into shared logistics and production services. The MOU explored the potential for consolidating printing, distribution networks, and other operational processes to achieve cost savings, improved delivery timelines, and enhanced consumer service.

Anthony Smith, Chief Executive Officer of the RJRGleaner Communications Group, emphasized the strategic nature of the partnership, stating, ‘Our JV discussions have focused on coordinating efficient printing and distribution logistics, as well as establishing processes that ensure the stability and integrity of both operations.’

Dominic Beaubrun, Managing Director of JOL, highlighted the transformative potential of the venture, noting, ‘This JV represents a practical and forward-thinking approach to preserving the industry. Our companies recognize the exponential benefits this collaboration will bring.’

Despite the joint venture, both companies will retain their independence, with separate ownership, operations, and editorial control. The Gleaner, established in 1834, and the Jamaica Observer, founded in 1993, will continue to deliver high-quality journalism and maintain their unique identities while leveraging the efficiencies of the shared logistics model. This partnership marks a significant step in the evolution of Jamaica’s media landscape, setting a precedent for innovative collaboration in the industry.

-

VMIL aims AI at cost and service goals in digital overhaul

VM Investments Limited (VMIL) is spearheading a digital revolution in its operations, leveraging artificial intelligence (AI) and advanced technologies to enhance efficiency and expand its regional footprint. Through a strategic partnership with overseas technology firm Abacus, VMIL is integrating AI into its call-center functions, research, and risk management teams, automating routine tasks to free up human resources for higher-value advisory roles. This initiative aligns with a broader industry trend, as global financial institutions like Citi are rapidly adopting generative AI to gain a competitive edge. Alison Mais, VMIL’s Chief Operating Officer, emphasized the importance of a digital-first approach, stating that 58% of clients now use the company’s core client management system, with 90% of equity transactions conducted on the J-Trader platform. These platforms provide real-time access to statements, rates, and transaction capabilities, replacing outdated manual communication channels. VMIL’s digital infrastructure is also facilitating its expansion into the Eastern Caribbean, with a recently approved investment advisory license in Barbados enabling virtual client onboarding. This strategy allows the company to serve regional clients efficiently without the need for physical presence, reducing costs while maintaining compliance and governance standards. Despite significant upfront investments in technology, VMIL views AI adoption as essential for long-term competitiveness. The company reported a 31.6% rise in second-quarter revenue to $653.8 million, driven by growth in fees and investment gains, though it posted a net loss of $6.7 million due to increased operating expenses from its digital transformation. CEO Rezworth Burchenson highlighted the importance of technology in product development and revenue diversification, pointing to the growth of VMIL’s asset management platform, which now includes unit trusts, mutual funds, private portfolios, and alternative investments like real estate and private equity. The company’s digital transformation is central to its strategy of building a scalable, modern financial services platform that meets the evolving needs of regional and diaspora clients. VMIL’s aggressive digital push positions it at the forefront of a transformative trend in the financial sector, mirroring the strategies of global institutions like Citi. By embedding AI and digital tools into its operations, VMIL aims to drive efficiency, manage risk, and ensure profitable growth in a rapidly changing market.

-

Margaritaville Caribbean’s IPO plans remain distant prospect

Margaritaville Caribbean Group has indicated that its plans for an initial public offering (IPO) of its Jamaica business remain uncertain, with Chairman Ian Dear declining to provide a specific timeline. The IPO, first proposed in 2023, was intended to raise between US$4 million and US$5 million for expansion through a listing on a major regional exchange. However, Dear emphasized that the IPO remains in the company’s “very near future” but offered no concrete updates.

Margaritaville Caribbean operates three flagship locations in Jamaica—Ocho Rios, Montego Bay, and Negril—which have faced significant operational challenges in recent years. These include pandemic-related disruptions and storm damage at the Montego Bay venue, which was temporarily out of commission but has since partially reopened. Dear expressed optimism, stating that the Montego Bay location is “back on track” and expected to be fully operational by the end of the year. Additionally, the damaged cruise pier in Ocho Rios, crucial for customer traffic, is anticipated to reopen soon, potentially boosting revenues.

Despite the IPO delay, Dear highlighted the group’s strong operational performance, particularly in its listed subsidiary, Margaritaville (Turks) Ltd. For the year ending May 31, 2025, the subsidiary reported a net profit of US$1.6 million, a 137% increase from the previous year, driven by a 22% revenue growth to US$9.6 million. The gross profit margin also expanded to 70.9%, reflecting improved financial management. However, cash flow challenges persist, with net cash from operations at just US$264,673, largely due to a US$2.43-million increase in the “Due from related companies” segment, now the largest asset on the subsidiary’s balance sheet.

Dear remains optimistic about the group’s prospects, stating, “We are very bullish on Jamaica. We see that our tourism product is growing… all of our locations in Jamaica are doing quite well now.” The focus remains on operational recovery and financial discipline as the group navigates its path forward.

-

Master Mac Food adds 15th store in latest round of expansion

Master Mac Food Store, a prominent grocery chain, is poised to open its 15th location and 5th supermarket on Thursday, October 16, marking a significant milestone in its expansion strategy. The new superstore, situated at 108-110 Constant Spring Road, spans approximately 40,000 square feet, making it the largest and most advanced outlet in the company’s 30-year history. Located near popular establishments like Furniture Land, Carmen’s Corner, and Taboo nightclub, the store is part of a larger commercial complex on a 2.5-acre property owned by the company for several years.

The superstore will feature unique additions such as a bakery and deli, alongside a wider variety of grocery items, enhancing the shopping experience for customers. Owner Raymond McMaster emphasized the strategic location and potential for strong returns, though he declined to disclose the exact investment cost. The development aligns with the increasing residential and commercial activity in the Constant Spring area, prompting the company to activate the property’s potential.

As the anchor tenant, the supermarket is surrounded by 20 other commercial units, many of which are already leased or preparing to open. These include retail shops, professional services, and eateries like the popular Mystic Thai, set to open in November 2025. The new store is expected to create 75 jobs, bringing the company’s total employment in Jamaica to approximately 600.

Founded in the late 1980s, Master Mac Food Store remains a family-run enterprise, with McMaster and his wife Wendy leading the business alongside their children, who are being groomed for future leadership. While there are no immediate plans for further expansion, the company remains open to opportunities, particularly in St Thomas, which is emerging as a new development frontier.

The Constant Spring superstore aims to cater to a diverse demographic, offering competitive pricing, a broad product selection, and a comfortable shopping environment. McMaster expressed optimism about the store’s potential to deliver value and a superior shopping experience, reinforcing the company’s commitment to customer satisfaction.

-

CL Financial shareholders welcome halt on Trincity Mall sale

In a significant development, the Trinidad and Tobago government has intervened to halt the controversial sale of Trincity Mall, a move hailed by businessman Carlton Reis as “the start of justice” and a long-overdue crackdown on white-collar crime. Reis, who controls a majority of the voting rights in CL Financial Ltd (CLF), praised the government’s action, emphasizing the need for accountability in the liquidation process of the once-dominant conglomerate. The injunction, granted by Justice Kevin Ramcharan on October 13, stopped the sale just minutes before its completion, following years of alleged mismanagement and irregularities. Reis, representing Dalco, CLF’s largest shareholder, revealed that his group had previously urged a criminal probe into the sale of CLF assets, including Trincity Mall, which was reportedly sold for $505 million—nearly half its 2021 court-approved valuation of $900 million. He criticized the liquidation process as lacking transparency, accusing state-appointed overseers of “corporate dismantling” and selling assets below value. Reis also highlighted missed opportunities, such as a proposed medical tourism and retirement hub in Tobago, which could have spurred economic growth. He expressed hope for dialogue with the government, particularly with the Prime Minister, Attorney General, and Finance Minister, to rebuild CL Financial and contribute to national development. The High Court will resume discussions on the injunction’s terms on October 27. Reis further lauded the recent election victory of the United National Congress (UNC) under Kamla Persad-Bissessar, describing it as a turning point for accountability and reform.