In a landmark move towards digital modernization, Trinidad and Tobago has unveiled NOBIS, a national electronic Know Your Customer (eKYC) platform. The initiative, a collaborative effort between the Unit Trust Corporation (UTC), the National Payment and Innovation Company of TT (NPIC-TT), and the Telecommunications Services of TT (TSTT), was formalized through a recent agreement signing ceremony. The platform, developed locally by NPIC-TT’s Innovative Centre, aims to revolutionize identity verification and account onboarding processes by replacing traditional manual methods with a secure, efficient, and paperless system. UTC will be the first entity to implement NOBIS for digital onboarding, reflecting its commitment to customer convenience and trust. TSTT will provide the necessary telecommunications and cloud infrastructure to ensure a seamless national rollout. Dawn Nelson, Vice President of the Innovative Centre, emphasized the system’s scalability and security, underscoring its local development as a testament to Trinidad and Tobago’s technological capabilities. Beyond financial services, NOBIS will be extended free of charge to government ministries and state agencies, enabling a unified digital identity for services such as passport renewals, driver’s license updates, and government fee payments. This initiative positions Trinidad and Tobago as a regional leader in secure and inclusive digital services, setting the stage for a fully digital future.

分类: business

-

Ansa McAL celebrates Guyanese mall opening

Guyana’s retail and cultural landscape is set for a transformative leap with the commencement of the $60 million Chateau Margot Mall, a project spearheaded by Ansa McAL. The groundbreaking ceremony, held recently, was attended by Guyanese President Dr. Mohammed Irfaan Ali, Ansa McAL Chairman Norman Sabga, and Managing Director of Ansa McAL Distribution Inc Guyana, Troy Cadogan. The 110,000 square-foot mixed-use development, located along Guyana’s east corridor, marks a bold new chapter in the nation’s economic and cultural narrative. Designed by internationally renowned architect Varchi, the mall will feature over 60 stores, cultural landmarks, public spaces, premium office suites spanning 24,000 square feet, and nearly 500 parking spaces. The project’s proximity to the historic Chateau Margot Chimney, a symbol of Guyana’s industrial heritage, underscores its commitment to preserving the nation’s past while driving future progress. Ansa McAL has collaborated closely with the National Trust of Guyana to ensure the integrity of the site’s heritage is maintained. Group Chairman Norman Sabga emphasized that the mall is not merely a commercial development but a testament to regional expertise and collaboration. President Ali highlighted the project’s alignment with Guyana’s vision for societal transformation, rooted in human development. As Guyana embraces its moment of growth, the Chateau Margot Mall stands as a beacon of progress and partnership.

-

Give CSO greater role in budget affairs

The Central Statistical Office (CSO) recently announced a decline in inflation to one per cent for the previous month. While this is a positive development, questions arise about the timing of this information, released just four days after Finance Minister Davendranath Tancoo presented the national budget. The budget included fiscal measures directly impacting prices, such as reductions in super gasoline costs and increased duties on alcohol and tobacco. This raises concerns about the CSO’s role in forecasting the effects of such budgetary measures. Currently, the CSO collaborates with government departments in data collection and analysis but lacks a formal role in projecting budget impacts. Historically, the CSO’s data has been somewhat delayed, though this gap has significantly narrowed in recent years. The budget process is inherently forward-looking, with only a minor focus on past reporting. Given the CSO’s annual budget of at least $55 million, there is a strong argument for its involvement in estimating future fiscal impacts. Globally, independent fiscal oversight bodies, such as the UK’s Office for Budget Responsibility and the US Congressional Budget Office, are common. Locally, the establishment of an Economic Resilience Council is underway, but a neutral, independent body outside Parliament is deemed essential for thorough budget scrutiny. Utilizing existing institutions like the CSO and the Central Bank could enhance the timeliness and relevance of fiscal data, ensuring it remains useful rather than outdated.

-

Unleashing the creative industry

Trinidad and Tobago’s 2025/2026 budget has been hailed as one of the most progressive in recent years, addressing key areas such as the green economy, agriculture, marginalized groups, and young families. However, the creative industries have once again been sidelined, reflecting a longstanding pattern of political and institutional neglect. Despite the sector’s potential to generate significant foreign exchange through music, carnival, fashion, and film, it received minimal attention in the budget speech, with only two brief mentions and a few buried items in budget documents. This lack of focus fails to align with international standards or the local reality, where the creative economy could thrive with proper policy, legislative, and institutional support. In response, a coalition of artists has called for a closed-door summit with the government to address these gaps. The budget’s vague references to a ‘Creative Value-Chain Fund’ and enhanced IP protection have left many in the sector confused, especially given the previous administration’s dismantling of key agencies like FilmTT, FashionTT, and MusicTT. These agencies were replaced with a new entity tied to Eximbank, created without stakeholder consultation and with unclear operational mechanics. The creative sector’s underfunding has been a persistent issue, with film grant funding once plummeting to just $1 million—insufficient even for catering on a small foreign production. To unlock the sector’s potential, experts propose several interventions, including a national ‘buy-local’ campaign, the enactment of local content policies, the establishment of a national arts council, increased funding for CreativeTT, and the launch of a national tour company to export Trinidad and Tobago’s creative IP. Additionally, addressing the human crisis among local creatives, building creative hubs, and setting growth targets for Carnival are seen as critical steps. Without these measures, the creative sector’s vast potential will remain untapped, leaving Trinidad and Tobago lagging behind global peers like the UK, where the creative industries generate billions annually.

-

Unlocking the next generation economy

The Trinidad and Tobago Chamber of Commerce (TT Chamber) recently hosted its annual post-budget meeting at the Le Rêve Conference Centre in San Fernando, marking a historic milestone in its mission to strengthen engagement with the nation’s business communities. Under the theme *Unlocking TT’s Next Generation Economy*, the event emphasized the Chamber’s commitment to fostering economic resilience and diversification in a volatile global landscape.

-

BpTT report: Cypre project entering next phase

bpTT, a subsidiary of BP, has made significant strides in its gas development projects in Trinidad, marking a new chapter in the country’s energy sector. Recently, bpTT President David Campbell and Executive Vice President of Gas and Low Carbon Energy William Lin met with Trinidad and Tobago’s Prime Minister Kamla Persad-Bissessar to discuss the progress of two major initiatives: the Cypre gas field and the upcoming Ginger project. The Cypre field, operational since March 2025, is bpTT’s third subsea development, featuring seven wells connected to the Juniper platform via flexible flowlines. Located 78 kilometers off Trinidad’s southeast coast, the field has successfully completed its startup phase, with phase two’s subsea equipment now ready for deployment. The Seven Arctic subsea construction vessel, arriving from Norway, will commence offshore operations in late 2025, further advancing the project’s innovative and reliable framework. Meanwhile, the Ginger project, expected to produce first gas by 2027, will include four subsea wells linked to the Mahogany B platform. At peak production, the field is projected to yield 62,000 barrels of oil per day. Campbell and Lin also toured bpTT’s Galeota and Beachfield facilities, which process offshore gas and liquids for midstream and downstream supply. Campbell emphasized the importance of strong government partnerships, having met with key ministers to discuss unlocking value for Trinidad’s energy industry. ‘Building strong country relationships is foundational to delivering our strategy,’ Campbell stated, underscoring bpTT’s commitment to collaborative progress.

-

Ansa McAL appoints Attzs, Pemberton to board

ANSA McAL Ltd has unveiled significant changes to its leadership structure, appointing Dr. Marlene Attzs and Joel ‘Monty’ Pemberton to its board of directors, effective November 1. The announcement, filed with the TT Stock Exchange on October 22, highlights the company’s commitment to strengthening its governance framework. Dr. Attzs, a distinguished development economist and lecturer at the University of the West Indies, brings expertise in sustainable development, climate resilience, and disaster-risk management. Pemberton, a seasoned energy-sector executive, offers extensive regional and local experience. These appointments come as ANSA McAL navigates a transformative phase, marked by strategic acquisitions and financial recalibration. The company’s latest financial disclosure revealed a 14% decline in profit after tax for the first half of 2025, totaling $310 million compared to $362 million in the same period of 2024. However, second-quarter revenue surged by 12% year-on-year to $1.99 billion, with profit before tax climbing to $217 million from $189 million. Earnings before interest, tax, depreciation, and amortization (EBITDA) also grew by 31% to $409 million. In March 2025, ANSA McAL announced a three-year suspension of dividend payments to channel capital toward expansion and debt reduction, following its $327 million acquisition of Bleachtech LLC, a U.S.-based chlor-alkali manufacturer. Despite initial share price fluctuations post-announcement, the company’s diversified business model and robust balance sheet have since stabilized investor confidence. ANSA McAL, a conglomerate with interests spanning automotive, beverages, construction, financial services, and utilities, remains focused on long-term regional growth and portfolio diversification. The roles of the new board members in specific committees or additional responsibilities have yet to be disclosed.

-

UWI teams up for green hydrogen project

In a landmark move toward sustainable energy innovation, the University of the West Indies (UWI) has entered into a strategic partnership with Japan’s Niterra Co Ltd and Trinidad and Tobago’s Kenesjay Green Ltd (KGL). The collaboration, formalized through a Memorandum of Understanding (MoU) signed on October 15 at UWI’s St Augustine Campus, aims to revolutionize green hydrogen production through advanced Solid Oxide Electrolyser Cell (SOEC) technology. This high-temperature electrolyser system, developed by Niterra, boasts a 30% higher efficiency compared to traditional methods, leveraging steam to generate hydrogen and oxygen. Trinidad and Tobago’s robust petrochemical infrastructure and access to process waste heat at the Point Lisas Industrial Estate make it an ideal location for Niterra’s pilot study. The initiative aligns with UWI’s Hydrogen Research Collaborative (H2RC), established in 2023 to foster academia-industry partnerships in building a viable hydrogen economy for the Caribbean. The partnership will establish a green hydrogen centre of excellence, conduct model-based studies, and develop a dedicated hydrogen laboratory at UWI. The project will also involve the installation and operation of production-scale SOEC electrolysers, with real-world performance data collected over two phases to scale up green hydrogen generation. The MoU was signed by Koichi Arimitsu of Niterra, Dr. Graham King of UWI, and Philip Julien of KGL, with key stakeholders from the Energy Chamber of Trinidad and Tobago in attendance. This collaboration marks a significant step in Trinidad and Tobago’s transition to sustainable energy, positioning the nation as a regional leader in green hydrogen research and low-carbon innovation.

-

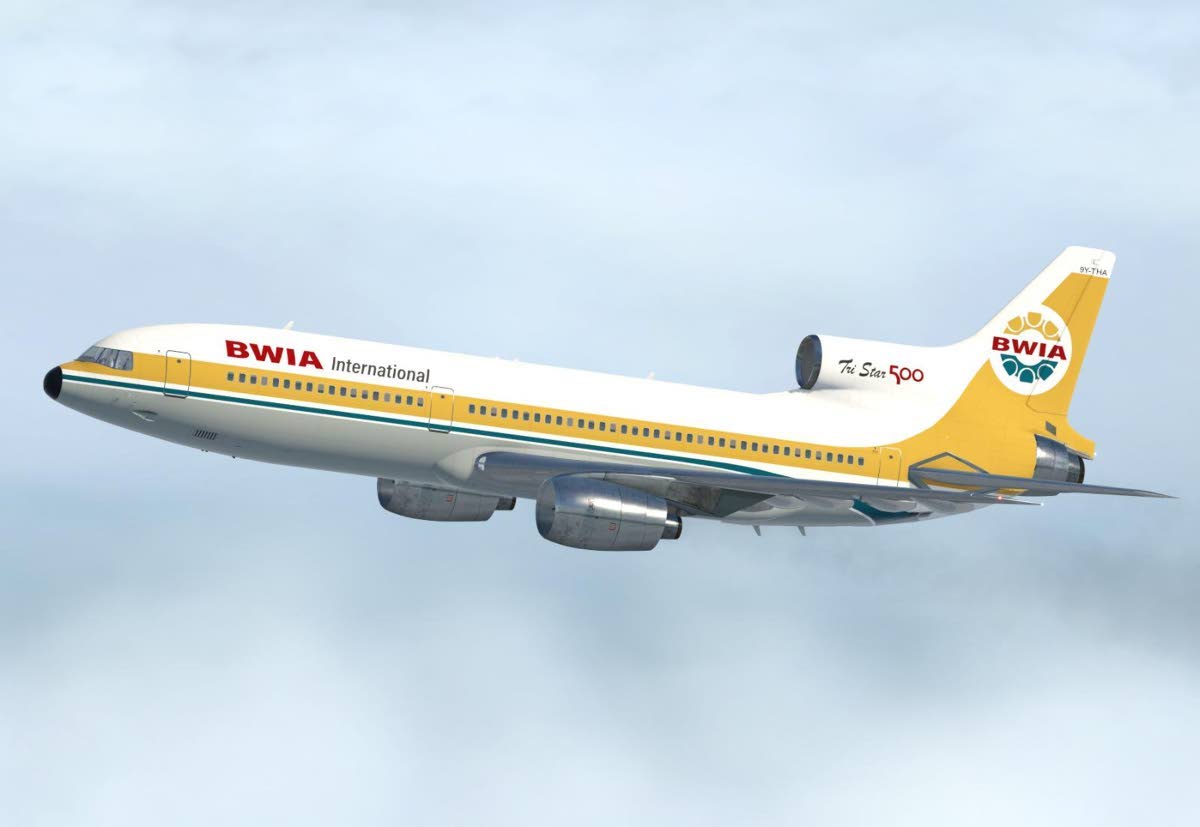

The struggles to establish a regional air carrier

The story of British West Indian Airways (BWIA) is a testament to the resilience and strategic foresight of the Caribbean aviation industry. Established in 1941 during the tumultuous years of World War II, BWIA emerged as a vital lifeline for the British colonies in the West Indies, which were isolated due to the suspension of air services by major international carriers like Pan American World Airways and Royal Dutch Airlines. The UK Air Ministry proposed the creation of a regional airline based in Trinidad and Tobago (TT), a vision that materialized with the involvement of Lowell Yerex, founder of Transportes Aeros Centro Americanoes (TACA).

Yerex, with the support of Lady Young, wife of Governor Sir Hubert Young, initiated BWIA as a public limited liability company in 1943. The airline began operations with two Lockheed Model 18 Lodestar aircraft, offering daily services from TT to Barbados. The initial share capital of $1 million was allocated with 60% to Yerex, 20% to TT, and 20% to the West Indian public. Over time, the shareholding structure evolved, with Yerex selling 40% of his stake to American interests in TACA, prompting a strategic decision to ensure British control over the airline.

BWIA rapidly expanded its route network, connecting islands across the Eastern Caribbean and extending services to Dominica, Jamaica, and Belize by 1944. The airline also secured contracts with the United States Army Engineer Department, operating flights between Miami and Trinidad. Airmail services were introduced, charging five cents per half-ounce letter, further solidifying BWIA’s role in regional connectivity.

In 1947, British South American Airways Corporation (BSAA) acquired BWIA, restructuring it as a private limited company in 1948. The new entity, British West Indian Airways Ltd, inherited exclusive rights to operate inter-island services and carry mail, supported by government subsidies and infrastructure provisions. The merger of BOAC and BSAA in 1949 further strengthened BWIA’s position, integrating operations with British Caribbean Airways Ltd and establishing navigation and engineering schools in Trinidad to enhance technical standards.

By the 1950s, BWIA had fully paid up its issued capital of $2.5 million and expanded its services to include routes between Jamaica and the Cayman Islands, marking a significant milestone in its evolution as a regional aviation leader. The story of BWIA continues in Part II, highlighting its enduring legacy in Caribbean aviation.

-

Global performer at risk

The longstanding partnership between Nutrien, the world’s largest upstream fertilizer producer, and Trinidad and Tobago (TT) is now at risk due to a financial impasse with the state-owned National Gas Company (NGC). The dispute, centered around a $610 million debt owed by companies using the Point Lisas port, has forced Nutrien to initiate a phased shutdown of its operations in the region. This development threatens not only the company’s future but also the livelihoods of hundreds of workers and TT’s reputation as a global leader in the petrochemical sector.

Nutrien, formed in 2018 through the merger of PCS and Agrium Inc., has been a key player in TT’s economy, leveraging the country’s natural gas resources to produce ammonia and urea for global markets. However, declining natural gas production, exacerbated by the COVID-19 pandemic, has strained operations. In 2020, Nutrien announced the indefinite closure of one of its four ammonia plants, and production levels have since fallen significantly from their peak.

Despite these challenges, Nutrien has shown commitment to TT, investing $130 million in 2024 for facility upgrades and maintenance. However, the recent shutdown announcement on October 21, set to take effect on October 23, has raised concerns among local business and energy chambers. The American Chamber of Commerce (Amcham TT) and the Energy Chamber have called for collaboration to resolve the issue, emphasizing the need to maintain TT’s attractiveness as an energy investment destination.

NGC’s subsidiary, the National Energy Corporation (NEC), has issued formal notices to companies with significant arrears, warning of suspended access to port facilities if payments are not cleared. NEC has also mandated that service tariffs be paid exclusively in US dollars, a move that has added to the financial pressure on operators.

Minister of Energy Roodal Moonilal confirmed ongoing discussions with Nutrien and other stakeholders, but no resolution has been reached. The shutdown’s potential impact on TT’s economy and employment has sparked calls for urgent negotiations to avert a crisis. As the situation unfolds, the fate of Nutrien’s operations in TT remains uncertain, casting a shadow over the country’s petrochemical ambitions.