In a bid to ease the financial burden on Belizeans amid rising living costs, Prime Minister John Briceño has announced the introduction of tax-free weekends scheduled for December. The initiative, which will waive the General Sales Tax (GST) on specific dates, aims to provide relief to families as they prepare for the holiday season. The tax-free periods are set for December 6-7 and December 20-21, coinciding with payday cycles to maximize consumer spending power.

分类: business

-

IMF projects 2026 economic acceleration for the Dominican Republic

SANTO DOMINGO – The International Monetary Fund has concluded its Article IV consultation for the Dominican Republic, delivering a broadly positive assessment of the nation’s economic trajectory through 2025. While acknowledging a recent growth deceleration attributed to global financial tightening and worldwide uncertainty, the Fund projects a robust recovery with growth accelerating to 4.5% in 2026, nearing the country’s long-term potential of approximately 5%.

The IMF’s preliminary findings highlight the Dominican Republic’s strong economic fundamentals, which include manageable risks and significant policy flexibility to counteract adverse scenarios. This resilience has been bolstered by expansive fiscal and monetary policies that have stimulated a gradual rebound in key sectors. Notably, credit activity, export volumes, and the vital tourism industry have all demonstrated strengthened performance. Inflation remains well-contained, with an estimated average of 3.7% for the year 2025.

External sector stability is another cornerstone of the assessment. The current account deficit is projected to hold steady at around 2.5% of GDP, a level deemed sustainable as it is fully financed by robust foreign direct investment flows, signaling enduring investor confidence.

Despite a risk profile where external challenges—including volatile financial conditions and vulnerability to climate events—currently outweigh domestic positives, the IMF asserts the country is well-equipped to handle potential shocks. This capacity stems from substantial international reserves, a stable banking sector, and the existence of fiscal space for countercyclical measures.

The consultation placed significant emphasis on the critical need for structural reforms. Key recommendations include advancing a comprehensive tax reform designed to boost government revenues by rationalizing generalized subsidies, all while safeguarding essential social spending. The adoption of a medium-term revenue strategy was advised as a framework for broader fiscal modernization.

Furthermore, the IMF stressed the urgency of fully implementing the national Electricity Pact to reduce substantial sector losses and alleviate fiscal pressures. The Fund also advocated for enhanced governance, labor market flexibility, and social security reforms aligned with the country’s Meta 2036 development plan. Increased public investment in infrastructure, education, and healthcare was identified as vital for fostering more inclusive and competitive growth.

On monetary policy, the Central Bank’s approach was deemed appropriate. The IMF recommended maintaining exchange rate flexibility, limiting foreign exchange interventions to episodes of severe market disruption, and strengthening the monetary transmission mechanism while gradually phasing out extraordinary liquidity support introduced during past crises.

The financial system was recognized as sound with low systemic risk. The IMF encouraged authorities to continue bolstering regulatory and supervisory frameworks, fully implement Basel II and III capital standards, and further enhance policies to combat money laundering and terrorist financing.

-

Grenada finalises investment facilitation categorisation

Grenada is poised to modernize its investment landscape through a pivotal two-day national stakeholder consultation, scheduled for November 17–18, 2025. This hybrid event, blending in-person and virtual participation, aims to finalize the categorization of needs under the World Trade Organization’s (WTO) Investment Facilitation for Development (IFD) Agreement. The workshop is a collaborative initiative involving the International Trade Centre (ITC), the OECS Commission, and Grenada’s Investment Promotion Agency (GIDC), supported by the WTO and funded by the European Union’s RIGHT Programme.

-

Levy vows to pursue JBG’s fraud losses, takes ‘no option off the table’

Jamaica Broilers Group (JBG) is leaving no stone unturned in its quest to recover billions of dollars lost in a multi-year fraud at its US meat division. President and CEO Chris Levy has emphasized that all options, including potential legal action, are on the table to hold those responsible accountable. The company, now stabilized by a new management team and a pending $24-billion refinancing deal, is focused on repairing its balance sheet and seeking redress for the scandal, which forced $46 billion in adjustments. Levy acknowledged the complexity of the situation, stating, ‘No option is off the table,’ while highlighting tax opportunities as a concrete avenue for financial recovery. The company has quantified potential tax benefits and is working to restate its tax positions, though this will involve intricate negotiations with tax authorities. The fraud, described as a ‘coordinated and deliberate’ effort by former US operations leadership to hide costs and inflate profits, was uncovered by a whistleblower. Senior Vice President Ian Parsard revealed that the company is eyeing close to $30 billion in potential tax credits, with even a third of that amount significantly boosting shareholder equity. This recovery effort is crucial to rebuilding JBG’s shattered equity base, recently bolstered by a $40-billion revaluation of its Jamaican assets. Levy assured stakeholders that the internal investigation is complete, but the external mission to seek justice and financial recompense remains a top priority, signaling a potentially protracted next chapter in the JBG fraud saga.

-

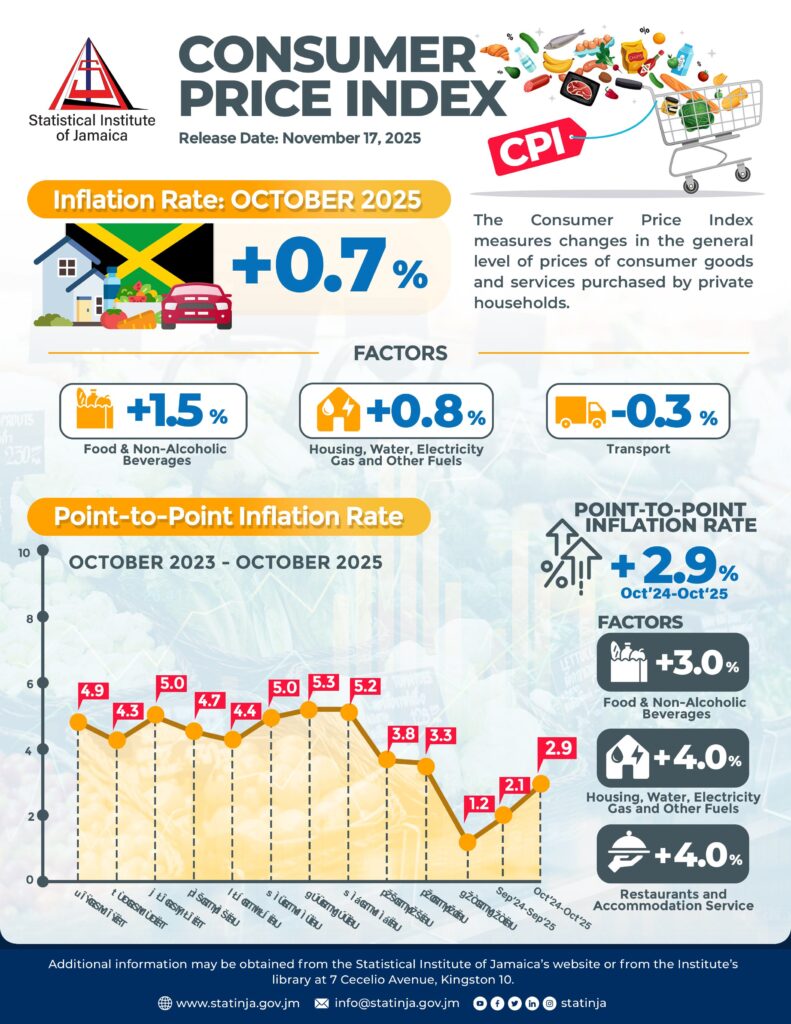

Jamaica’s inflation ticks up in October, driven by food prices

KINGSTON, Jamaica — Jamaica experienced a 0.7% rise in consumer prices in October 2025, primarily driven by increased costs in food and electricity, according to the latest report from the Statistical Institute of Jamaica (STATIN). This uptick pushed the annual inflation rate to 2.9% for the 12 months ending in October. The ‘Food and Non-Alcoholic Beverages’ category saw the most significant surge, climbing 1.5% month-on-month, with vegetables, tubers, and pulses recording a sharp 5.5% increase. Staples like carrots, cabbage, and sweet potatoes became notably more expensive. Additionally, the ‘Housing, Water, Electricity, Gas, and Other Fuels’ category rose by 0.8%, largely due to higher electricity rates. However, some relief came from the ‘Transport’ division, which saw a 0.3% decline due to lower petrol prices. Over the past year, inflation was primarily fueled by three sectors: ‘Food and Non-Alcoholic Beverages’ (3.0%), ‘Housing, Water, Electricity, Gas, and Other Fuels’ (4.0%), and ‘Restaurant and Accommodation Services’ (4.0%). STATIN clarified that the data was collected before Hurricane Melissa, meaning the figures do not account for any potential price impacts from the storm. As Jamaica’s national statistics office, STATIN remains the authoritative source for the country’s economic data.

-

Levy warns of Q3 perfect storm: US meat price collapse and Hurricane Melissa bite into JBG’s recovery

Jamaica Broilers Group (JBG) President and CEO Chris Levy has issued a stark warning about the company’s upcoming third quarter, citing a dual crisis of collapsing US meat prices and the disruptive effects of Hurricane Melissa on its core Jamaican market. Despite a recent operational turnaround that slashed US production costs by a third, Levy emphasized that external shocks now pose the greatest threat to recovery. This warning contrasts sharply with JBG’s strong Q1 performance, which saw a $1.6 billion profit, attributed to the initial success of its operational overhaul. However, Levy cautioned that this momentum is unlikely to continue, predicting a “bumpier” path to full-year recovery. The company’s Q2 results, expected by mid-December 2024, will include a significant $40 billion asset revaluation aimed at rebuilding shareholder equity. Meanwhile, Q3, covering the period ending January 31, 2025, is expected to be particularly challenging, with US meat prices plummeting and Jamaican revenues projected to dip by 5-6% due to the hurricane’s impact. While JBG’s main revenue driver, Best Dressed Chicken, is expected to remain resilient, its Hi-Pro division, which supplies baby chicks and feed, is likely to face significant challenges. Despite operational improvements in the US meat business, falling prices may negate these gains. Levy confirmed that strategic reviews are underway, including potential difficult decisions for the US meat business, with a possible exit still on the table. The company’s ability to navigate these turbulent economic and environmental conditions will be critical to its full recovery.

-

JBG chief questions how auditors missed massive fraud as multiple checks failed to detect $46b irregularities

Executives at Jamaica Broilers Group (JBG) have expressed deep concerns over the failure of multiple audit teams to detect a significant, multi-year fraud within the company’s US operations. CEO Chris Levy highlighted the oversight failure as a critical issue requiring further investigation. The fraud, which involved concealing costs in biological assets and inventory accounts while understating vendor financing, led to a staggering $46 billion in financial adjustments. Despite three layers of auditors—including those from the US banking syndicate and JBG’s own auditors—issuing clean opinions on financial statements, the irregularities were ultimately uncovered by an internal whistleblower. Ian Parsard, Senior Vice President of Finance and Corporate Planning, expressed astonishment at the systemic failure, noting the coordinated efforts by leadership to evade detection. The company has since implemented sweeping reforms, including replacing its US accounting team, changing auditors, and introducing new controls with IBM’s assistance. The new auditors bring specific poultry industry expertise, enabling them to identify irregularities previously overlooked. This case raises broader questions about the effectiveness of audits in complex, multi-jurisdictional organizations and underscores the potential for determined management to bypass even robust financial oversight systems. For JBG, the fallout has been severe, necessitating a complete financial restructuring and eroding shareholder trust.

-

CDB issues inaugural sustainable bond in Swiss market

BRIDGETOWN, Barbados – In a landmark move, the Caribbean Development Bank (CDB) announced on Wednesday the successful issuance of its first-ever sustainable bond, raising 100 million Swiss francs (approximately US $110 million). This five-year bond, carrying a fixed coupon of 0.59 per cent, marks a significant step under the bank’s newly established Sustainable Finance Framework. The issuance, which was met with robust demand, was priced at the top of its initial guidance, with the order book closing within just 90 minutes of opening. The proceeds from this bond will be directed towards funding projects in the bank’s borrowing member countries, focusing on critical areas such as renewable energy, climate adaptation, sustainable water management, and food security. The investor base was predominantly composed of treasury departments, which secured 62 per cent of the deal, followed by asset managers (17 per cent), private banks (11 per cent), and pension plans and insurance companies (5 per cent each). The CDB, which holds an Aa1/AA+/AA+ rating, emphasized that this transaction not only strengthens its yield curve but also underscores its dedication to embedding sustainability into its core operations. Established in 1970, the CDB serves 19 borrowing members across the Caribbean and nine non-borrowing members, including Brazil, Canada, China, and the United Kingdom. As of December 2024, the bank’s total assets were reported at US$2.02 billion.