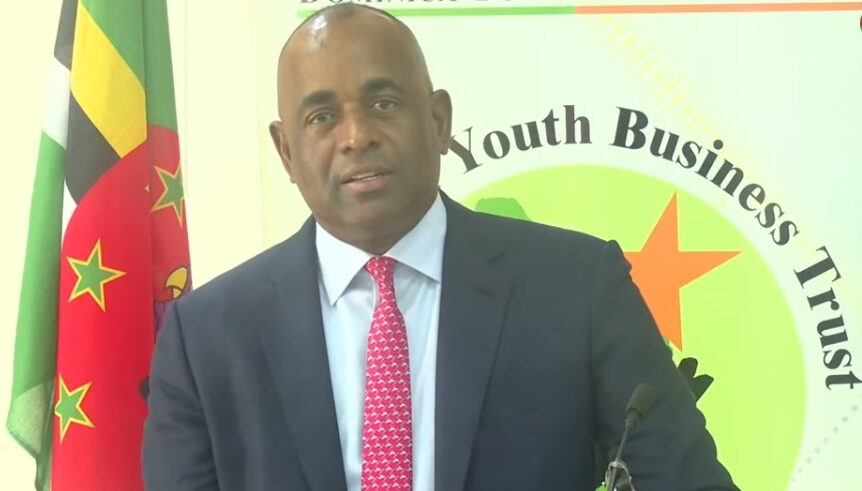

In a significant policy address, Prime Minister Roosevelt Skerrit has declared comprehensive reforms for the Dominica Youth Business Trust (DYBT), calling for its fundamental restructuring after 21 years of operation. Speaking at the Trust’s 21st Graduation and Awards Ceremony at the State House Conference Centre, Skerrit questioned whether the current DYBT model remains “fit for purpose” in today’s economic climate.

The Prime Minister outlined several transformative measures scheduled for implementation in 2026. Most notably, he proposed doubling the maximum loan amount for young entrepreneurs from $20,000 to at least $40,000 per applicant, arguing that current funding levels often provide only “half or a third” of the capital needed to properly launch a business venture.

Skerrit also announced dramatic reductions in interest rates, criticizing the current 6-9% rates as “too high, especially for start-up businesses.” He committed to capping rates at no more than 3% through negotiations with financial institutions and extending this same rate ceiling to the AID Bank for its borrowers.

The restructuring plan includes significant organizational changes: upgrading the coordinator position to Chief Executive Officer, enhancing staff qualifications and compensation, and reviewing the Board of Trustees to grant them “greater flexibility and authority.”

In a bold financial move, the government will clear approximately $500,000 in existing debts owed by program participants, effectively providing a fresh start for both the Trust and its beneficiaries. Additionally, the Prime Minister pledged enhanced support for business plan development, ensuring that graduates receive assistance in modifying proposals to meet financial institution requirements rather than facing outright rejection.

These sweeping changes represent the most substantial overhaul of the youth entrepreneurship program in its two-decade history, signaling the government’s renewed commitment to fostering young business talent in Dominica.