In a landmark decision on October 27, 2025, High Court Judge Jan Drysdale ruled that attorney Andrew O. Kola cannot invoke legal immunity in a professional negligence lawsuit filed by businessman Patrick “Paddy” Prendergast. The case arose from Kola’s alleged failure to file a defense in a 2022 civil lawsuit, resulting in a default judgment of $513,740 against Prendergast, who is now seeking $516,700 in damages for negligence and breach of contract. Prendergast, owner of a storage facility in Midway, St. John, had hired Kola to defend him against claims by former business associate Ronald Mind, who accused him of improperly storing items. Despite being retained promptly, Kola reportedly missed the deadline to file a defense and mishandled an application to set aside the judgment, which was dismissed due to non-compliance with court orders. Kola admitted to failing in his duties but argued that his actions were protected by barrister’s immunity under Antigua and Barbuda’s Legal Profession Act and common law principles established in cases like Rondel v. Worsley and Saif Ali v. Mitchell. He claimed that since he had entered an appearance on behalf of Prendergast, he was shielded from liability as an advocate in court. However, Prendergast’s legal team, led by King’s Counsel E. Ann Henry, countered that immunity applies only to in-court advocacy, not preparatory or administrative work. Justice Drysdale sided with the claimant, ruling that Kola’s negligence occurred during pre-trial preparation and procedural compliance, which does not qualify for immunity. She emphasized that the Legal Profession Act distinguishes between advocacy and preparatory work, and extending immunity to pre-trial negligence would be inconsistent with statute and precedent. The case, Patrick Prendergast v. Andrew O. Kola (ANUHCV2024/0018), highlights the limits of professional immunity in Antigua and Barbuda’s legal system, establishing that attorneys can be held liable for pre-trial negligence. The matter was adjourned to November 13, 2025, for further hearings on costs.

作者: admin

-

Simons: Klimaatfinanciering geen liefdadigheid; gedeelde verantwoordelijkheid

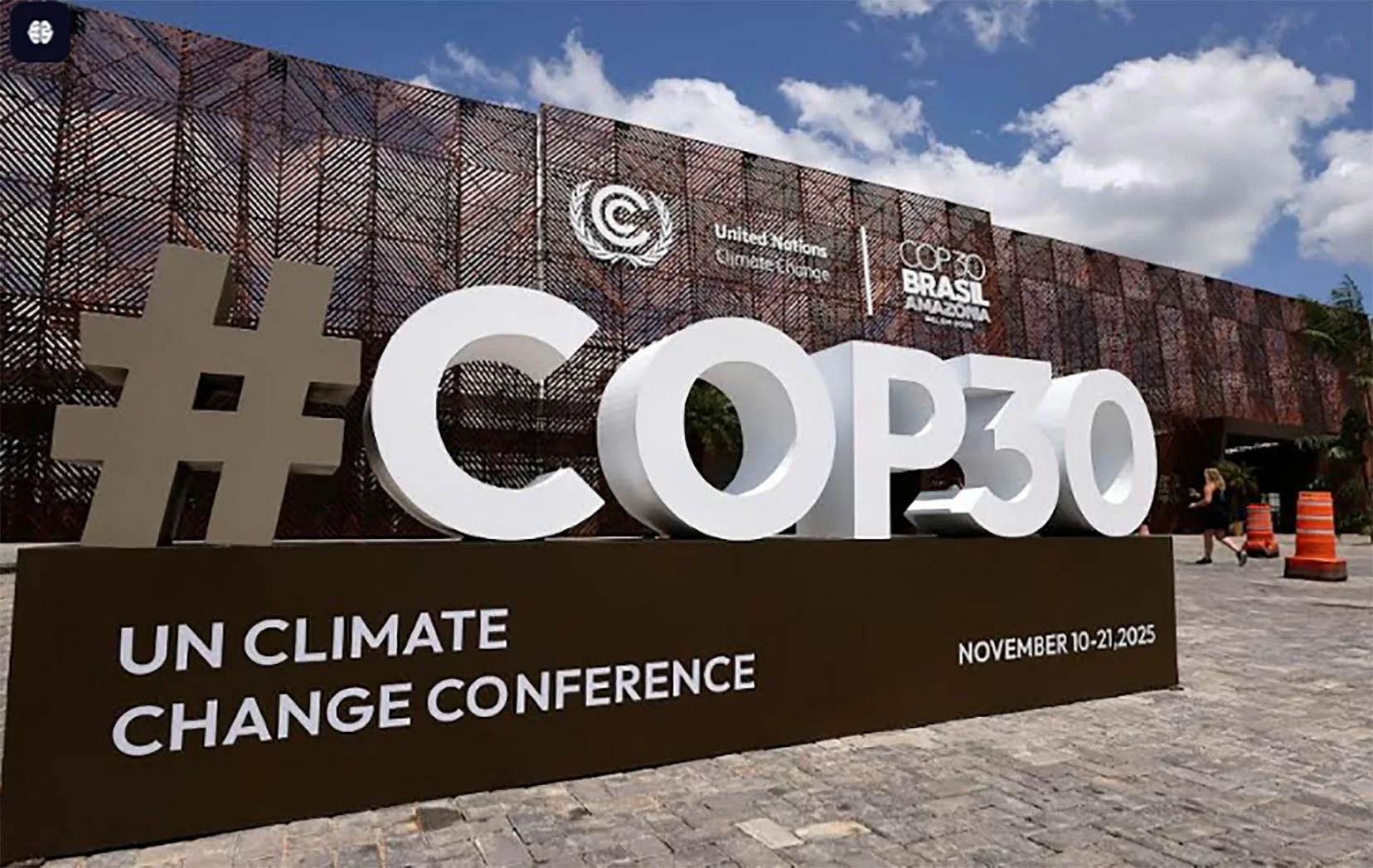

At the Belém Climate Summit in Brazil, President Jennifer Simons of Suriname urged the international community to expedite access to climate financing for High Forest, Low Deforestation (HFLD) countries. Speaking during the summit’s opening session on November 6, Simons emphasized that funding climate action is not an act of charity but a shared global responsibility crucial for collective survival. She highlighted Suriname’s unique position as the country with the highest percentage of forest cover globally, yet stressed that this recognition alone does not bolster the nation’s economy. ‘We remove carbon from the atmosphere but receive no compensation for our efforts, which undermines our ability to preserve our forests,’ she stated. Simons pointed out that 75% of Suriname’s population resides in low-lying coastal areas already experiencing the impacts of rising sea levels. Indigenous and tribal communities inland are also feeling the effects of climate change, including floods, biodiversity loss, and extreme weather. These changes directly threaten livelihoods and key sectors like agriculture and tourism. The President expressed solidarity with countries recently hit by Hurricane Melissa, including Jamaica, Haiti, and Cuba, and called for swift and sustained international aid. Despite Suriname’s contributions to global CO₂ reduction through forest preservation, Simons noted the country’s ongoing challenges in accessing financial mechanisms agreed upon in the Paris Climate Agreement. Suriname has accredited 4.8 million Internationally Transferable Mitigation Outcomes (ITMOs) for 2024 and submitted its Net Zero Forest Reference Emission Level in January 2024, but it awaits official recognition from the UN Climate Secretariat. Simons called for predictable, long-term support for HFLD countries and the urgent removal of financial barriers. She also voiced support for Brazilian President Luiz Inácio Lula da Silva’s Tropical Forest Finance Facility initiative, aimed at achieving equitable climate financing and better recognizing the value of standing forests. Simons detailed Suriname’s recent submission of its Nationally Determined Contribution, reaffirming its commitment to sustainable development and the Paris Agreement. The strategy focuses on diversifying the economy through responsibly managed natural resources, including oil, promoting green growth, and protecting forests. ‘Suriname is doing its part. We expect major emitters to do theirs,’ she concluded, urging world leaders to support and implement the Belém Declaration on combating environmental racism.

-

Returning to Grenada?

For Grenadians who have spent significant time in the United Kingdom, returning home is often a source of pride and accomplishment. However, the transition can be fraught with unexpected challenges, particularly for those maintaining strong ties to the UK, such as property, pensions, or healthcare routines. A common misconception is that spending most of the year outside the UK automatically grants non-resident status for tax and healthcare purposes. In reality, the rules are far more nuanced, and missteps can lead to significant financial consequences.

The UK’s Statutory Residence Test (SRT) is the cornerstone for determining tax residency. This framework evaluates three key elements: day-count rules, ties to the UK, and automatic overseas tests. Spending 183 days or more in the UK in a tax year automatically classifies an individual as a resident. However, fewer days do not guarantee non-residency, as factors like family connections, available accommodation, and past residency also play a role. Even retirees or those with flexible work arrangements may find themselves inadvertently reclassified as residents if they maintain substantial UK ties.

Healthcare residency is another critical area. Many Grenadians assume they can continue using the National Health Service (NHS) as before. However, NHS access is contingent on being ‘ordinarily resident,’ meaning living lawfully and habitually in the UK. Claiming non-residence for tax purposes while using the NHS can trigger scrutiny, potentially leading to charges for treatment and a review of tax status. Simple actions like maintaining a UK GP or scheduling regular check-ups can signal ongoing UK ties, making it essential to align healthcare behavior with declared residency.

From April 2025, the UK will implement significant reforms to its Inheritance Tax (IHT) regime. Under the new rules, individuals previously domiciled in the UK may face IHT on worldwide assets, not just those in Britain. For Grenadians with longstanding UK connections, this could mean assets in Grenada remain subject to UK taxation. To mitigate risks, it is crucial to review domicile status, seek updated guidance, and establish Grenadian domicile where appropriate.

Practical steps to protect non-resident status include reviewing UK ties, limiting unnecessary visits, updating paperwork with Grenadian addresses, documenting life in Grenada, and conducting annual reviews of travel and ties. Seeking professional guidance is also advisable before making significant financial or lifestyle changes.

A cautionary example is the James family, who returned to Grenada after decades in London but kept their UK house, remained on NHS records, and visited their children at university. Despite living in Grenada most of the year, HMRC ruled they were still UK-resident, resulting in unexpected tax liabilities and NHS charges. Simple measures like reducing UK visits and deregistering from the NHS could have prevented these issues.

Establishing non-residence requires consistent alignment across paperwork, habits, and lifestyle. Annual self-checks and conscious decision-making can safeguard finances and peace of mind. Dr. Clifford Frank, a Grenadian tax and legal professional, emphasizes the importance of understanding these complexities for Grenadians living abroad or returning home.