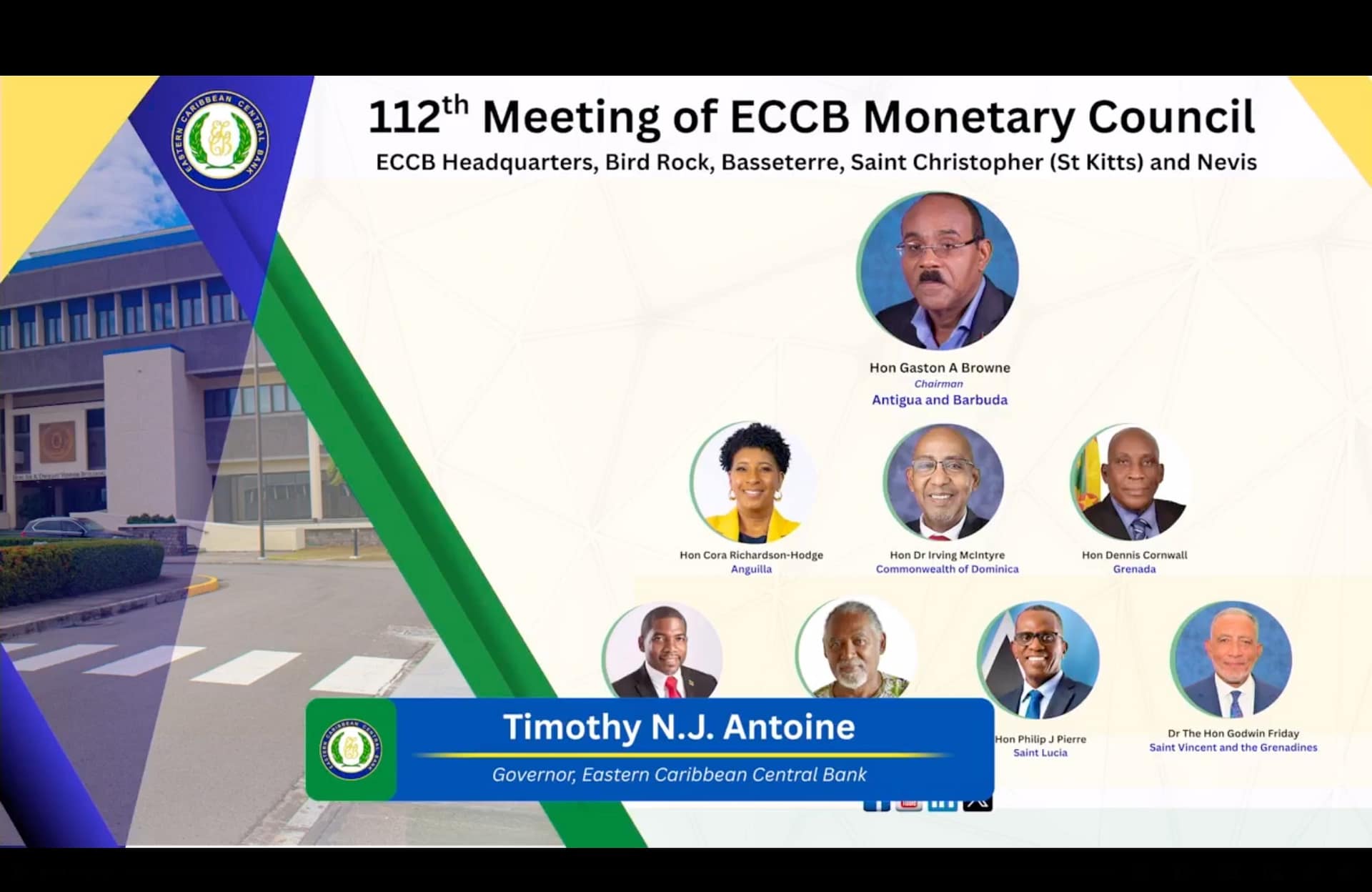

The Eastern Caribbean Central Bank (ECCB) Monetary Council convened its 112th meeting on February 13, 2026, in St. Kitts and Nevis, addressing critical economic challenges and strategic initiatives for the Eastern Caribbean Currency Union (ECCU). Chaired by Honourable Gaston A. Browne, Prime Minister of Antigua and Barbuda, the council’s deliberations occurred against a complex backdrop of global economic shifts and regional structural constraints.

Leadership continuity emerged as a cornerstone of institutional stability with the confirmation of Timothy N.J. Antoine’s reappointment as ECCB Governor for a five-year term commencing February 1, 2026. This decision reflects the region’s commitment to consistent leadership during a period demanding coordinated policy action.

The council reinforced the EC dollar’s formidable stability, reporting a backing ratio of 99.5%—significantly exceeding the statutory 60% minimum—and foreign reserves totaling EC$5.83 billion. The currency peg at EC$2.70 to US$1.00 will celebrate its 50th anniversary in July 2026. In response to stable domestic conditions and moderating global inflation, the council maintained key rates: the Minimum Savings Rate at 2.0% and Discount Rates at 3.0% (short-term) and 4.5% (long-term).

Despite projected global growth of 3.3% in 2026, the council identified persistent risks including geopolitical tensions, commodity price volatility, and disruptions to international trade. The ECCU banking sector demonstrated robust health with high liquidity (EC$1.41 billion in excess liquidity), strengthening capital adequacy, and declining non-performing loans. Five member states are now operational on the ECCU Credit Bureau system.

The council acknowledged that projected ECCU growth of 3.3% for 2026 remains substantially below the 7% annual growth required to double regional output within a decade. This recognition prompted reinforced commitment to the ‘Big Push’ strategy, focusing on five strategic transformation areas: food security, energy security, logistics and connectivity, financial deepening and inclusion, and human capital development.

Significant governance advancements included the enactment of the ECCIRA Agreement into national law, establishing the Eastern Caribbean Citizenship by Investment Regulatory Authority to enhance transparency and due diligence. Concurrently, the council approved suspending DCash 2.0 development to prioritize the Fast Payment System and participation in the CARICOM Payments and Settlement System pilot.

Fiscal concerns emerged regarding debt sustainability, with some member states not on track to achieve the 60% Debt-to-GDP target by 2035. Tourism continued as an economic pillar with 3.3 million visitor arrivals and EC$6.4 billion in expenditure by Q3 2025, though the council emphasized the necessity of moving beyond recovery toward structural competitiveness.

The council scheduled its 113th meeting for July 10, 2026, in Dominica, where Honourable Dr. Irving McIntyre will assume chairmanship. The meeting concluded with consensus on maintaining monetary stability while accelerating structural reforms to build economic resilience across the currency union.