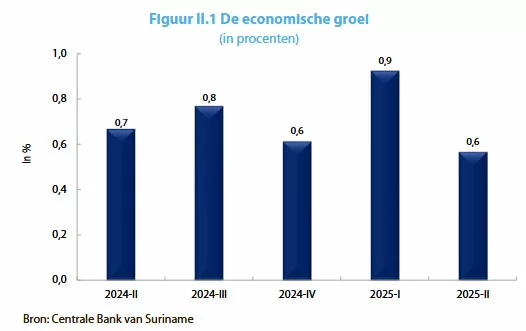

Suriname’s economy demonstrated modest expansion during the second quarter of 2025, though significant vulnerabilities persist due to mounting inflationary pressures, deteriorating fiscal balances, and an increasingly precarious debt situation. According to the Quarterly Report 2025 released by the Central Bank of Suriname (CBvS), the economy grew by 0.6%, representing a slight deceleration compared to the same period in 2024.

The growth was primarily driven by performance in trade, transportation, and hospitality sectors. Conversely, industrial production, mining operations, and agricultural activities contributed negatively to economic output. This decline was largely attributable to reduced gold production and diminished round timber harvesting during the period.

Inflationary pressures reemerged as a critical concern, with quarter-end inflation reaching 3.6% while average inflation stood at 2.4%. The depreciation of the Surinamese dollar, coupled with increased costs for food, transportation, water, and cooking gas, served as primary drivers of price increases. Adverse weather conditions, including persistent rainfall, further exacerbated food price inflation. The central bank anticipates continued inflationary pressure throughout the third quarter of 2025, with recent data indicating a rise from approximately 10% at end-December to 11.4%.

Fiscal metrics revealed concerning developments as government revenues totaled SRD 12.8 billion against expenditures of SRD 15.2 billion, resulting in an overall budget deficit of SRD 2.4 billion. The primary deficit reached SRD 782.5 million. While revenue generation improved through enhanced tax collections, expenditure growth outpaced revenue increases—primarily fueled by personnel costs, subsidy programs, and election-related spending. Temporary purchasing power measures for civil servants and pensioners significantly contributed to this expenditure growth.

The national debt burden escalated to SRD 140.6 billion, equivalent to 95.8% of GDP according to national definitions. Notably, over 80% of this debt is denominated in foreign currencies, creating substantial exposure to exchange rate fluctuations.

In response to these challenges, the CBvS implemented significant interest rate reductions during the quarter to manage high financing costs. While OMO rates declined substantially, the transmission to lower commercial lending rates remained limited. Simultaneously, excess liquidity within the banking system increased markedly, complicating monetary policy implementation.

The central bank’s outlook remains cautious, emphasizing that without structural reforms and improved expenditure management, inflationary pressures, debt accumulation, and budgetary constraints will persist through subsequent quarters. CBvS officials underscored the critical importance of fiscal discipline and economic stability, particularly as the country approaches the post-IMF program period.