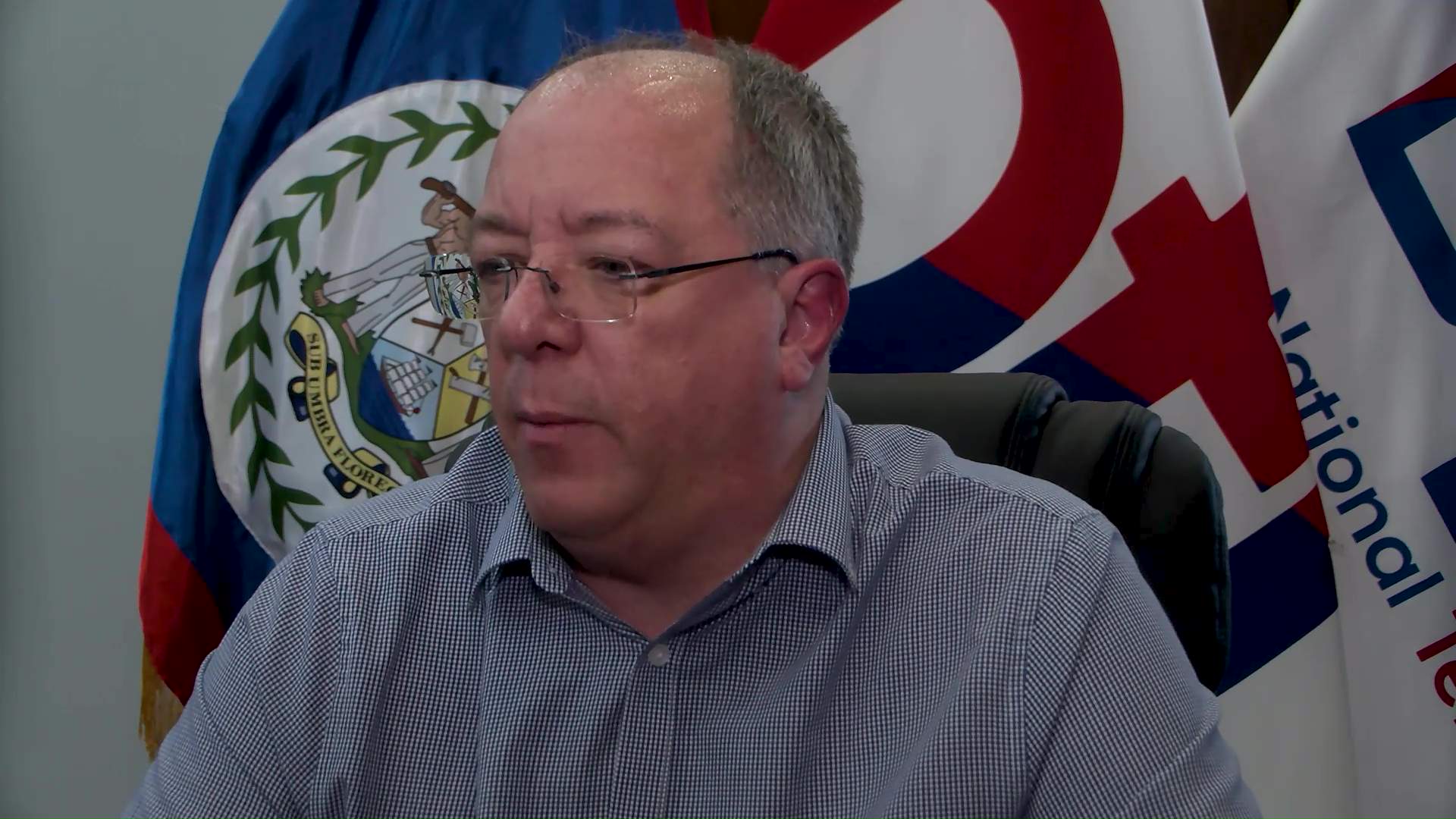

In a strategic move to address mounting public concerns, Belize Telemedia Limited (BTL) has publicly presented its comprehensive rationale for the proposed $80 million acquisition of Speednet. Chief Financial Officer Ian Cleverly, in an exclusive briefing mirroring presentations delivered to Cabinet and stakeholders, articulated a vision of widespread national benefit from the telecommunications consolidation.

The controversial merger, which has sparked street protests and intense public scrutiny, represents according to Cleverly a transformative investment with calculated long-term advantages for consumers, employees, minority shareholders, and the government alike. The financial blueprint projects a remarkably swift investment payback period of just 4.2 years, accompanied by substantial dividend growth and enhanced cash flow capabilities.

Cleverly emphasized that the consolidation would directly address systemic inefficiencies within Belize’s telecom sector. “Consumers are currently bearing the financial burden of duplicated infrastructure and wasted assets,” he stated, outlining plans for implemented consumer protection measures to ensure tangible benefits.

The transaction holds particular significance for approximately 1,500 minority shareholders, with projections indicating a staggering 2,200% return on $5 shares. Beyond financial metrics, the merger promises expanded telecommunications access to remote communities, potentially connecting an estimated 18,000 Belizeans currently without reliable services.

This infrastructure expansion, previously deemed commercially unviable due to excessive rollout costs, becomes achievable through asset redeployment from both companies. The consolidation strategy effectively transforms economic challenges into opportunities for national digital inclusion, positioning Belize for enhanced telecommunications connectivity across previously underserved regions.