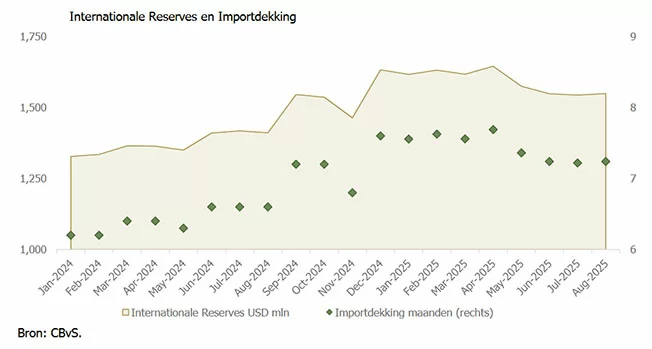

Suriname faces a complex economic landscape characterized by contrasting strengths and vulnerabilities, according to the latest assessment from the Suriname Economic Oversight Board (SEOB). While the nation maintains robust international reserves reaching $1.6 billion—providing approximately 7.5 months of import coverage—this financial buffer exists alongside concerning macroeconomic challenges that threaten long-term stability.

The economy demonstrated concerning stagnation in June 2025, with the Monthly Economic Activity Index showing zero growth. This performance primarily resulted from a sharp contraction in gold production and exports, affecting both large-scale and small-scale mining operations. Reduced processing capacity and inferior ore quality contributed to the sector’s decline, which overshadowed positive developments in trade, insurance, hospitality, and restaurant services.

Inflation continues to present significant headwinds, reaching 11.9% year-over-year in October 2025. Concurrently, the Surinamese dollar depreciated by 0.5% against the US dollar and 0.4% against the euro during the same period, further escalating import costs and diminishing purchasing power for citizens.

Most alarmingly, government debt has surged to 88.8% of GDP, substantially exceeding the statutory benchmark of 60%. To address immediate liquidity constraints, authorities issued international bonds worth $1.6 billion in the fourth quarter of 2025, carrying interest rates between 8.0% and 8.5%. This debt management strategy extends maturities on existing obligations and postpones principal repayments until after 2028, when oil revenues are anticipated to materialize.

The SEOB warns that this approach carries substantial risks. The economy remains highly susceptible to fluctuations in oil and gold prices, inflationary pressures, and exchange rate volatility. Additionally, the absence of a fully operational Savings and Stabilization Fund increases vulnerability to potential Dutch Disease effects, where future oil revenues could inadvertently crowd out other critical sectors including agriculture and manufacturing.

Transparency concerns have emerged regarding the allocation of the newly acquired debt, with no detailed expenditure plan presented to stakeholders. The oversight board emphasizes that clear communication regarding interest and repayment obligations is essential for maintaining confidence among both citizens and international investors.

The SEOB recommends implementing strict fiscal discipline, enhancing anti-corruption mechanisms, and operationalizing crucial institutions including the Savings and Stabilization Fund. Additionally, the board advocates for a comprehensive five-year government financial plan featuring expenditure ceilings and debt sustainability targets.

Economic diversification beyond extractive industries represents another critical recommendation, with emphasis on developing agriculture, fisheries, agro-processing, services, and eco-tourism sectors to foster sustainable growth and export diversification. Only through consistent policy implementation, transparency, and institutional strengthening can Suriname responsibly leverage anticipated oil revenues and secure lasting economic stability.