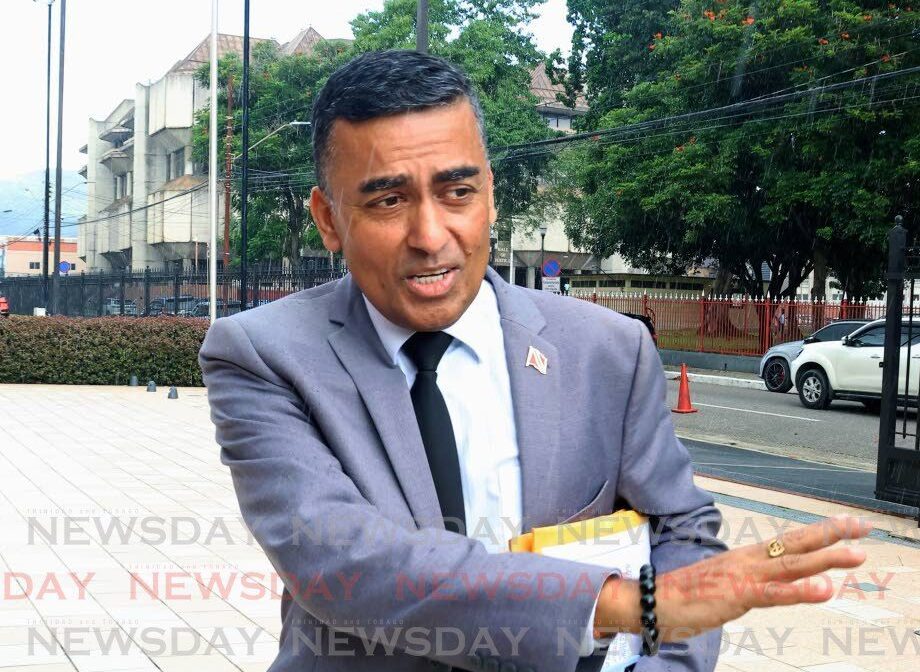

The Trinidad and Tobago government confronts mounting criticism for its failure to implement promised tax exemptions on private pensions that were scheduled to take effect January 1, 2026. Despite clear campaign commitments and parliamentary assurances from Finance Minister Davendranath Tancoo during the 2025-2026 budget reading, pensioners continue to face tax deductions.

Government officials now cite unpreparedness in financial calculations as the reason for the delay, indicating that necessary legislation will only be addressed in February. This explanation has proven unsatisfactory to retirees who structured their financial planning around the administration’s unambiguous pledge.

The situation highlights concerning double standards in governmental urgency. While the administration acted swiftly to halt former minister Stuart Young’s prime ministerial pension, comparable decisiveness has been absent regarding ordinary citizens’ retirement benefits.

Compounding the problem, annuitants must still submit certificates of existence by February 1 to maintain their benefits, ensuring continued tax deductions before parliamentary action. This delay effectively imposes financial penalties on pensioners through governmental indecision.

The writer demands not only explanations but tangible results, including retroactive cash refunds dating to January 1. The failure threatens to transform what was presented as official policy into what appears increasingly reminiscent of political propaganda, undermining trust in parliamentary commitments.