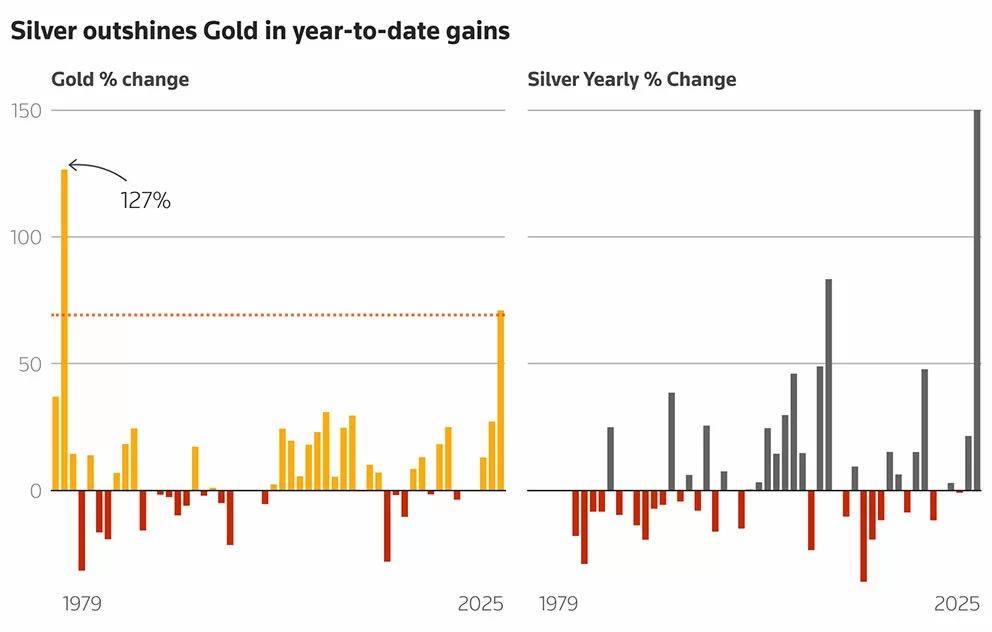

Global precious metals markets witnessed unprecedented milestones as silver, gold, platinum, and palladium all reached historic price levels this trading session. Gold breached the symbolic $4,500 per ounce barrier for the first time on Wednesday, while silver achieved remarkable outperformance with a 150% annual gain that eclipsed gold’s substantial 70% advance.

The spot price of gold climbed 0.2% to $4,494.49 per ounce after briefly touching an intraday record of $4,525.19. February-delivery gold futures in U.S. markets gained 0.4%, settling at $4,523.10. Silver reached an all-time peak of $72.70 before moderating to $72.32 with a 1.3% daily increase. Platinum surged to $2,377.50 then stabilized at $2,312.70, maintaining a 1.6% gain, while palladium retreated 1.5% to $1,830.37 after hitting a three-year high.

Market analyst Fawad Razaqzada of City Index and FOREX.com identified multiple supportive factors: “The absence of negative catalysts combined with powerful positive momentum creates ideal conditions. Fundamental drivers include sustained central bank acquisitions, a weakening U.S. dollar, and persistent safe-haven demand.”

This record-setting performance stems from converging economic forces: escalating geopolitical tensions driving flight-to-safety movements, and growing expectations that the Federal Reserve will implement monetary easing in 2025. President Donald Trump reinforced this outlook Tuesday, emphasizing his preference for interest rate reductions during favorable market conditions.

Non-yielding assets like gold typically benefit from low interest rate environments. Current market pricing indicates traders anticipate two Fed rate cuts next year.

Silver’s exceptional performance reflects robust investment demand, its recent designation as a U.S. critical mineral, and expanding industrial applications. Platinum and palladium, essential components in automotive catalytic converters, posted gains of approximately 160% and over 100% respectively, fueled by mining supply constraints, tariff uncertainties, and investment diversification from gold.

Societe Generale analysts caution that any significant gold price correction would require reduced purchasing from emerging market central banks. Barring such developments, they project the rally will continue, potentially reaching $5,000 per ounce by late 2026.