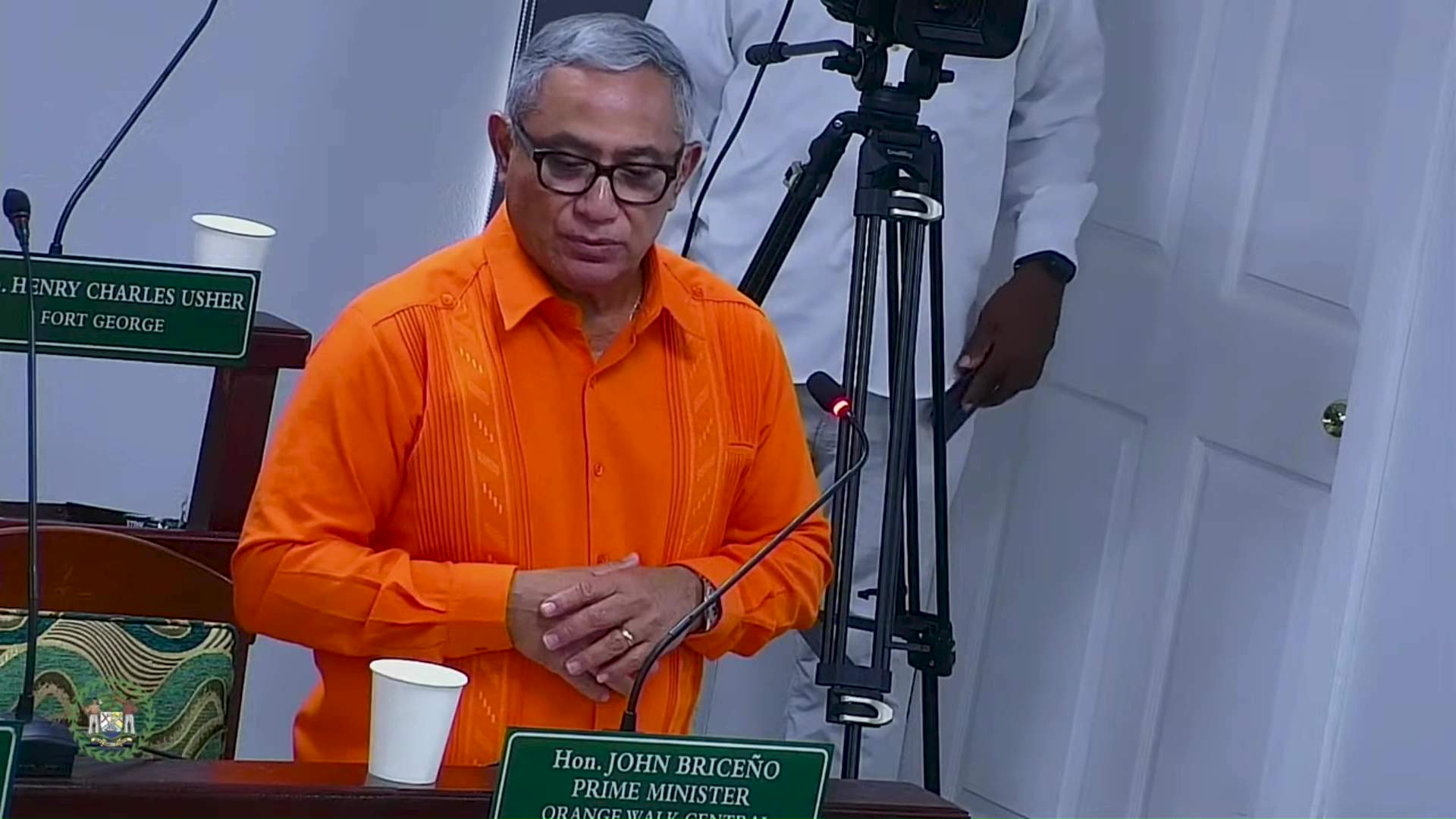

The Belizean government, led by Prime Minister John Briceño, is advancing legislation to prolong substantial tax incentives for ASR/BSI and its BELCOGEN energy facility for an additional two-year period. These tax concessions, originally established in 2012 under prior leadership, provide the corporation with exemptions from business levies and import duties.

Prime Minister Briceño has characterized the sugar sector as confronting severe operational challenges, prompting his administration to advocate for the renewal of these financial incentives. Following a presentation by BSI executives to the Cabinet, Briceño emphasized the industry’s critical situation, citing insufficient sugarcane yields, escalating operational expenses, and the pressing requirement for continued modernization investments in both milling and energy generation infrastructure.

Conversely, Opposition Leader Tracy Panton has raised substantive concerns regarding the fiscal responsibility of extending these tax holidays. While acknowledging the sugar industry’s vital economic role, particularly in northern employment and agricultural sustainability, Panton questioned whether this approach demonstrates balanced policymaking and equitable treatment for all stakeholders. She highlighted the particular irony that despite these substantial tax exemptions, Belizean consumers face potential energy cost increases of nearly fourteen percent currently under consideration by the Public Utilities Commission.

The emerging debate encapsulates broader tensions between industrial support mechanisms and responsible fiscal governance, with significant implications for Belize’s agricultural economy and energy affordability.