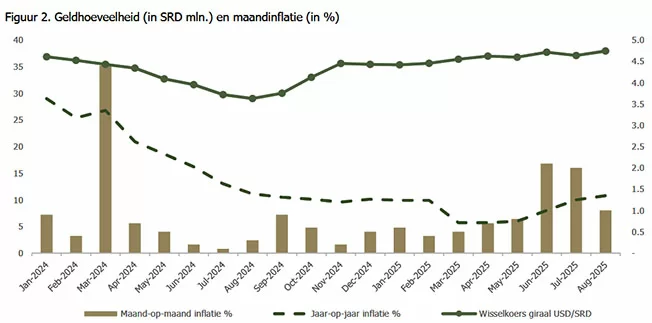

Suriname’s economic landscape is confronting significant challenges in 2025, according to the latest bulletin from the Suriname Economic Oversight Board (SEOB). The nation’s inflation rate climbed to 10.8% in August, primarily driven by the depreciation of the Surinamese dollar and an expanding money supply. The exchange rate continued its upward trajectory through September, reaching approximately SRD 38.4 per US dollar, further exacerbating market uncertainty and price pressures.

Despite maintaining robust international reserves of approximately $1.55 billion—covering 7.2 months of imports and well exceeding the three-month benchmark—the SEOB warns that macroeconomic stability remains vulnerable due to escalating government deficits. The 2026 budget reveals a deficit of SRD 6.3 billion, representing about 3.5% of GDP. Should this shortfall be financed domestically, it could further increase money supply, intensifying both inflationary trends and exchange rate pressures.

The national debt continues to substantially exceed statutory limits, standing at 88.3% of GDP according to international definitions, compared to the legal ceiling of 60%. In response, the SEOB advocates for proactive debt management strategies and divestment from loss-making state enterprises that require substantial subsidies.

Suriname’s banking sector presents a mixed performance picture. While capital adequacy remains strong at 22.3%, non-performing loans have risen to 6.6%, indicating growing repayment difficulties among borrowers. High lending rates of 14.5% continue to discourage investment activity.

The oversight board notes that the 2026 budget largely aligns with policy guidelines outlined in the annual address, particularly for ministries of Finance, Economic Affairs, Justice and Police, and Oil, Gas and Environment. However, weaker coherence is observed in sectors including Health, Land Policy, and Public Works.

Key recommendations from the SEOB include:

– Implementing stronger fiscal discipline and enhanced budget transparency

– Establishing a modern investment framework modeled after Argentina’s RIGI system

– Promoting export growth and economic diversification beyond the mining sector

– Strengthening risk management protocols within the banking industry

– Enhancing operational capacity of the Tax Administration, Customs, and ministerial departments

– Improving coordination between monetary and fiscal policies to stabilize exchange rates

The board concludes that Suriname’s economic recovery remains fragile, emphasizing that consistent policy implementation and clear communication are essential to maintain market confidence.