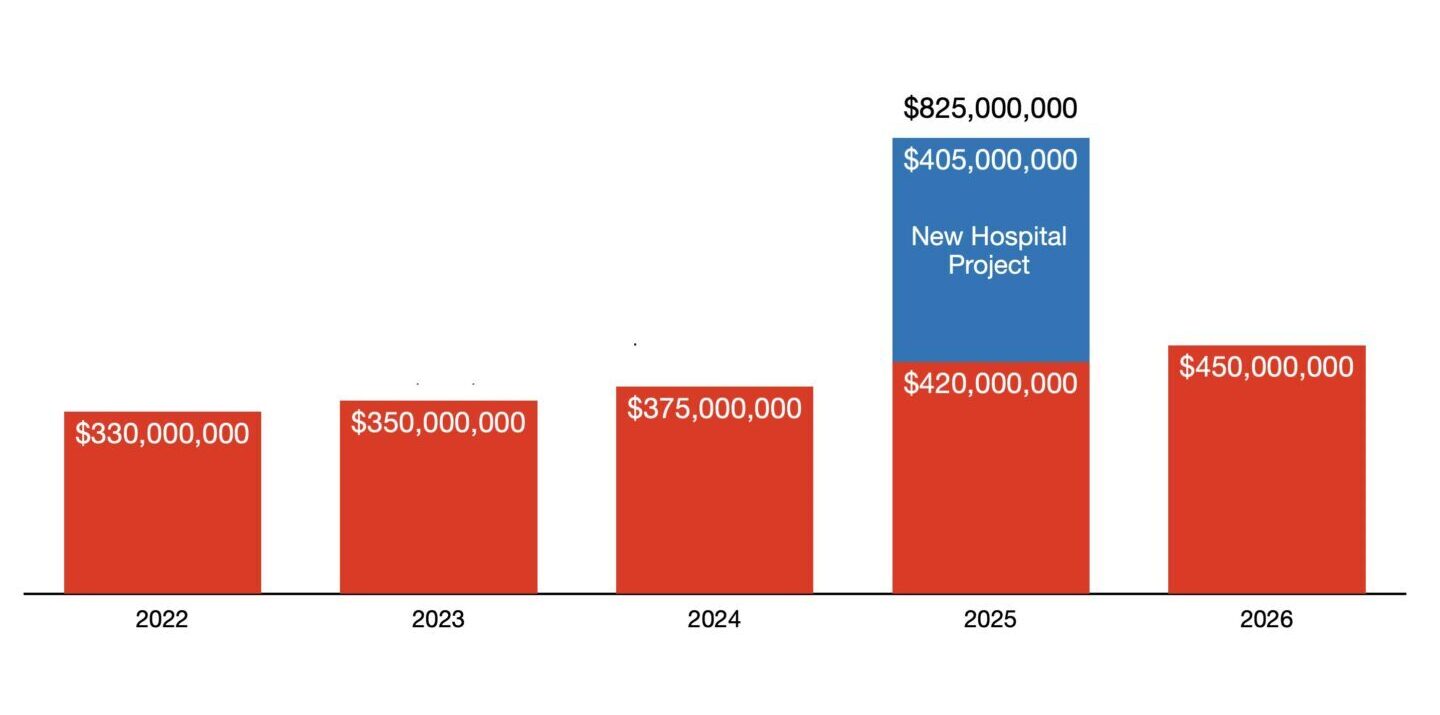

The Grenadian Parliament has enacted substantial increases in national borrowing capacity through its Budget Loan Authorisation Act, revealing a significant expansion of the country’s fiscal framework from 2022 to 2026. Financial analysis indicates the government’s authorized borrowing limit has escalated by EC$120 million during this period, with the most dramatic single-year increase scheduled for 2025—a year that will see an extraordinary EC$825 million authorization that includes separate funding for a major hospital development project.

This legislative mechanism, routinely approved alongside annual budget presentations, empowers the Finance Minister to secure financing through diverse instruments including international loans, bond issuances, promissory notes, and other debt vehicles. The escalating borrowing authorities correspond with a parallel 45% growth in overall budget expenditures, which are projected to reach nearly EC$2 billion by 2026 compared to EC$1.35 billion in 2022.

Detailed examination of the authorization timeline shows progressive annual increases: EC$330 million (2022), EC$350 million (2023), EC$375 million (2024), followed by the exceptional EC$825 million allocation for 2025—comprising EC$420 million for general budgeting plus EC$405 million specifically earmarked for hospital infrastructure—before moderating to EC$450 million in 2026.

The government maintains borrowing relationships with multiple international financial institutions, including the World Bank’s International Development Association, Caribbean Development Bank, Eastern Caribbean Central Bank, and the Saudi Fund for Development—from which Grenada secured a US$100 million loan in October 2023. Notably, despite parliamentary requirements mandating disclosure of loan agreements, few such documents have been formally presented to legislators, raising questions about transparency in sovereign debt management.

The substantial borrowing increase, particularly the hospital project financing, represents a strategic investment in national infrastructure while simultaneously expanding Grenada’s public debt portfolio. The government has not yet disclosed whether the specifically authorized hospital funding has been activated through actual borrowing arrangements.