In a recent social media post on June 8th, 2024, Grayson J. Stedman Jr., a Business Technology Solutions Consultant at Eclypse Technologies, shared a series of recommendations aimed at improving the MoBanking experience offered by the National Bank of Dominica Ltd (NBD). The post garnered significant attention, receiving over 200 reactions, 100 comments, and 70 shares, though NBD has yet to respond. Stedman’s suggestions focus on streamlining user interactions and expanding the app’s functionality, particularly for businesses and individual users. Key recommendations include enabling QR code generation and scanning for peer and merchant additions, eliminating redundant Mobile ID entries during peer transactions, and enhancing transaction details to include sender account numbers and names. Additionally, Stedman proposed integrating real-time notifications for account activities and developing a Point-of-Sale (POS) feature to facilitate faster and more secure transactions. He emphasized the potential for NBD to collaborate with local IT experts or existing POS providers to implement these features, leveraging the bank’s technical expertise while addressing its resource constraints. These improvements, if adopted, could significantly enhance MoBanking’s usability and appeal, particularly for small businesses and self-employed individuals who rely on the platform for financial transactions.

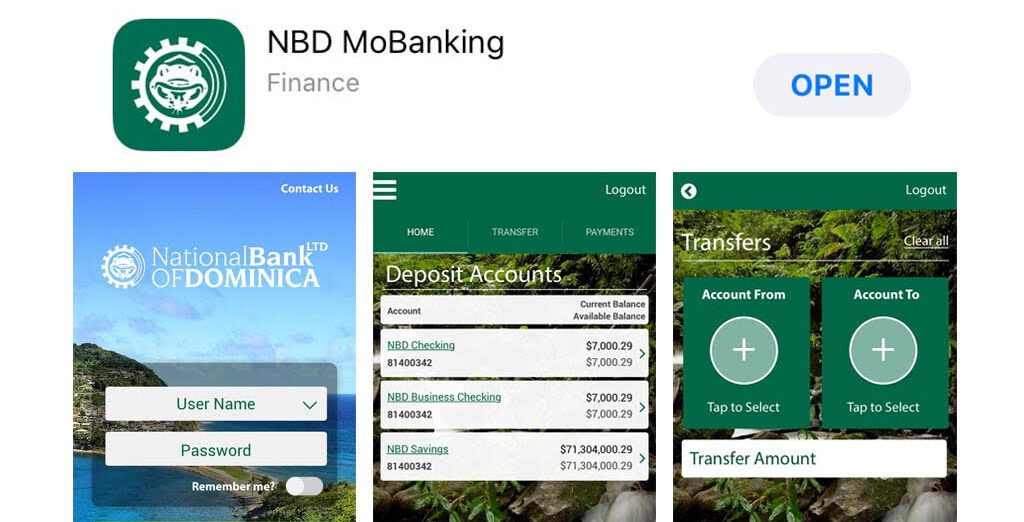

Open letter to National Bank of Dominica: Recommendations on ways to improve the MoBanking experience