The International Monetary Fund (IMF) has issued a cautionary assessment regarding Antigua and Barbuda’s fiscal outlook for 2026, highlighting significant concerns about revenue stability following the government’s decision to implement a temporary sales tax reduction. According to the IMF’s concluding statement from its Article IV consultation mission, the planned budget framework would typically achieve a primary surplus of approximately 1.6% of GDP—within the government’s target range of 1.5% to 2%—under baseline macroeconomic assumptions.

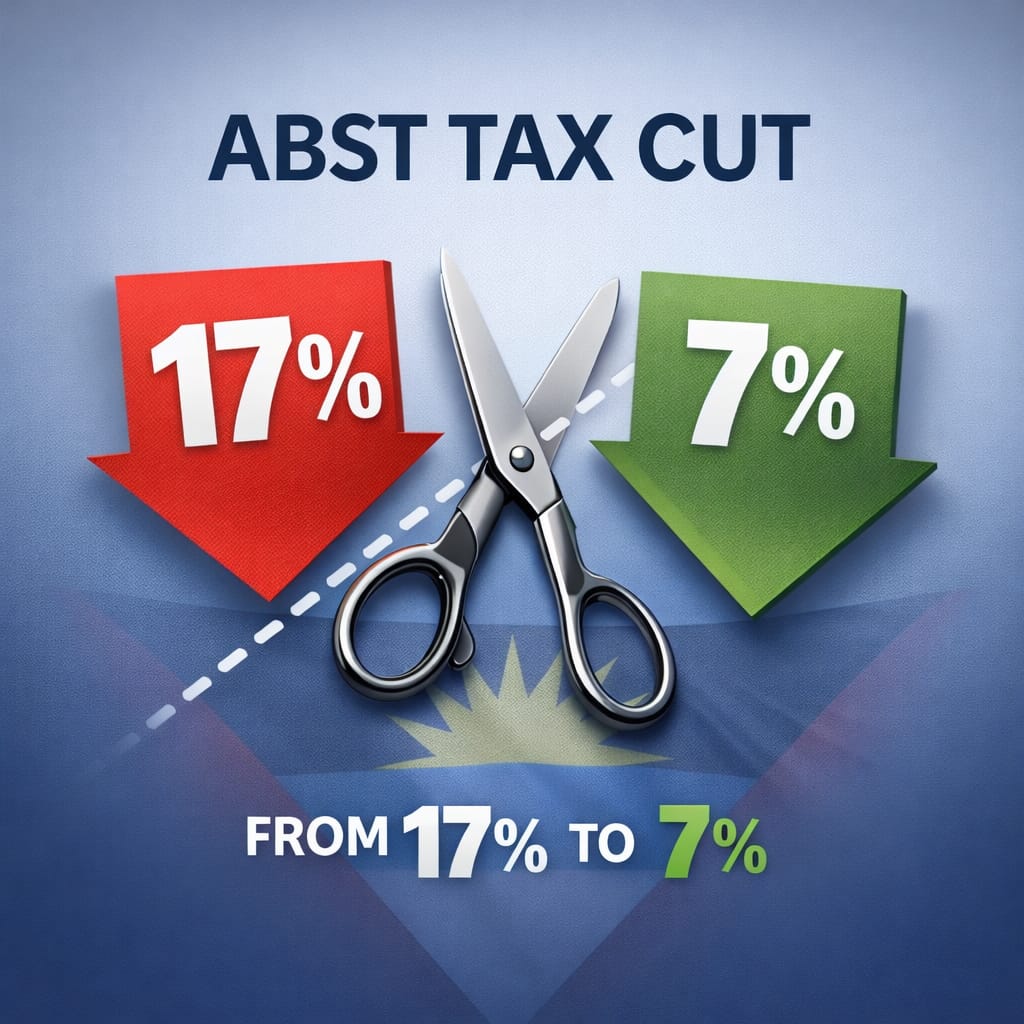

The critical concern centers on the recently announced temporary reduction of the Antigua and Barbuda Sales Tax (ABST) from 17% to 7%, whose implementation details and duration remain unspecified. IMF analysts warned that this fiscal measure could substantially undermine revenue performance at a crucial juncture when the nation seeks to strengthen its fiscal buffers, reduce financing requirements, and establish a sustainable downward trajectory for public debt.

The Fund’s assessment noted that despite recent improvements, underlying revenue collection continues to fall short of government targets and lags behind regional counterparts. Restoring the ABST rate promptly was identified as essential for progress toward the administration’s goal of raising tax revenues to approximately 20% of GDP and maintaining a primary surplus aligned with medium-term fiscal objectives.

Emphasizing the importance of sustainable fiscal practices, the IMF stated that robust revenue mobilization would alleviate financing pressures, support debt reduction initiatives, and enhance economic shock resilience. The institution specifically cautioned against dependence on temporary measures, noting that such approaches could potentially weaken the credibility of the overall fiscal framework.