In a significant departure from US trade policy, Canada has strategically reduced import tariffs on Chinese electric vehicles in exchange for improved market access for its agricultural exports, particularly canola. This move represents Canada’s latest effort to diversify economic partnerships amid growing concerns over the unpredictable and confrontational trade approach of the Trump administration.

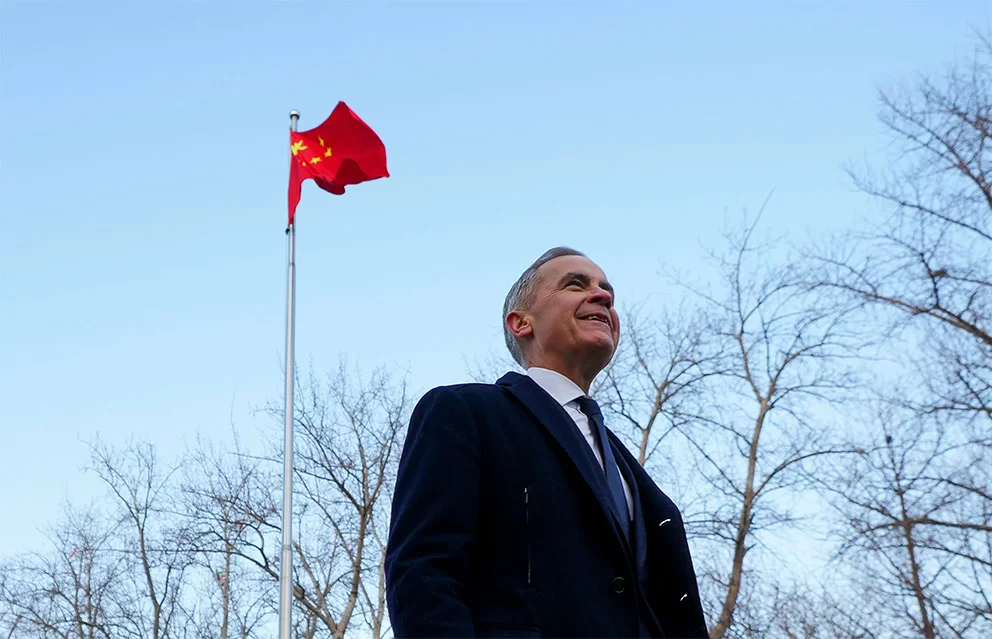

Prime Minister Mark Carney’s government announced the tariff reduction, which lowers the previous 100% duty on Chinese EVs, as part of a broader bilateral agreement with China. The arrangement includes quota limitations, capping Chinese EV imports under the reduced tariff at approximately 49,000 vehicles initially, with gradual increases to around 70,000 over a five-year period.

The decision reflects Canada’s calculated response to what trade experts identify as increasingly volatile US trade relations under President Trump. Since taking office, Trump has overturned seven decades of US trade policy favoring freer commerce, imposing substantial tariffs on imports from virtually every trading nation while specifically targeting sectors including steel and automobiles.

Canada has frequently been subject to Trump’s trade threats, including an October announcement of planned tariff increases on Canadian imports—retaliation for a critical advertisement from Ontario province—though these were ultimately not implemented. Existing tariffs on Canadian steel and aluminum remain in effect.

This strategic shift carries considerable political risk for Carney, potentially creating friction with the Trump administration ahead of crucial negotiations to renew the USMCA trade agreement with the United States and Mexico. The trilateral pact remains vital to Canadian economic interests, with 75% of Canadian exports destined for US markets.

Carney has defended the arrangement by emphasizing China’s technological advantages in electric vehicle production and the necessity of international cooperation to develop a competitive Canadian EV sector. However, critics including Ontario’s premier have raised concerns about potential impacts on Canadian auto workers and warned that the agreement could provide China with excessive market influence.

The development occurs alongside similar diversification efforts by other US trading partners. The European Union has pursued new trade agreements with Mercosur nations, while China has successfully expanded export markets across Europe and Southeast Asia—achieving a record $1.2 trillion trade surplus in 2025 despite US tariffs.

Trump maintains that his tariff policies strengthen US treasury reserves, protect domestic industries, and attract investment. However, his application of tariffs has frequently appeared arbitrary and unpredictable, including recent threats against Brazil over its treatment of political ally Jair Bolsonaro and new tariffs targeting countries that declined to support US interests regarding Greenland.

Canada’s economic repositioning demonstrates how Trump’s trade policies are reshaping traditional alliance dynamics, driving US partners toward strengthened economic ties with China—America’s primary economic competitor—while complicating future negotiations on critical agreements like USMCA.