The Inter-American Development Bank (IDB) has presented a complex economic outlook for Guyana, forecasting simultaneous challenges and strengths in its latest Caribbean Economics Quarterly. While the South American nation’s economy remains fundamentally robust with expected growth averaging 14% between 2026-2030, several headwinds threaten to create economic pressures.

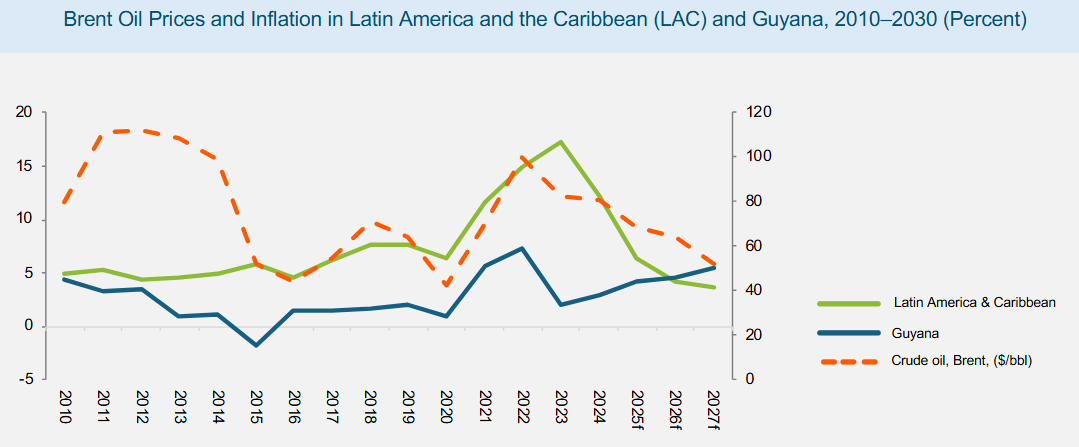

The analysis identifies falling global oil prices—projected to reach approximately US$60 per barrel in 2026—as a dual-edged development. While lower prices typically reduce petroleum revenues, Guyana anticipates offsetting this through expanded production capacity. Three additional oil wells are expected to come online, potentially doubling current output to 1.5 million barrels daily by 2029.

Concerning developments emerge in the trade sector, where Guyana’s terms of trade have deteriorated significantly. According to IMF data referenced by the IDB, the terms of trade index declined by 32.4% in 2023 and 0.3% in 2024, stabilizing at 47% by September 2025. This decline stems from persistent increases in import prices coupled with contracting oil prices.

The bank warns that ongoing global tariff wars and policy uncertainty could further elevate import costs, particularly for food items. With annual food prices already rising 8.2% by August 2025, inflation is projected to reach 3.6%, exceeding the previous year’s 2.9% rate. These factors may increase foreign exchange demand and complicate monetary policy management.

Despite these challenges, the IDB notes Guyana’s oil sector remains profitable above US$28 per barrel—the country’s break-even price. The government has implemented strategic responses including free tertiary education, vocational training programs, and initiatives to encourage re-migration of skilled professionals like teachers and nurses to address human capital needs.

The report concludes that while Guyana’s medium-term economic trajectory appears strong, vigilant monitoring of potential Dutch Disease symptoms—including exchange rate appreciation, non-oil sector competitiveness erosion, and inflationary pressures—remains essential for sustainable development.