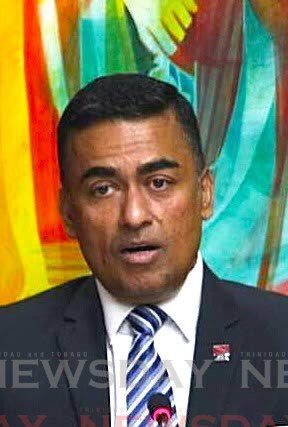

In a significant development for Trinidad’s public sector, Finance Minister Davendranath Tancoo has issued a compelling appeal to public servants receiving partial back payments, emphasizing the critical importance of financial prudence. The minister’s advisory comes amidst ongoing economic pressures and rising living costs, urging recipients to prioritize saving and long-term financial security over immediate expenditure.

The backdrop to this financial advisory stems from the recent memorandum of agreement signed between the Public Service Association (PSA) and Chief Personnel Officer Dr. Daryl Dindial on December 2. This landmark agreement secured a ten percent wage increase for public servants, with new salaries scheduled for January implementation and an advance on arrears promised before December 23. Notably, the complete $3.8 billion in back pay will not be distributed in full cash payments immediately, with the initial disbursement capped at approximately $500 million for the PSA’s 80,000 members.

Financial experts have reinforced the minister’s message with practical guidance. Ian Chinapoo, Group CEO of Guardian Group with three decades of financial expertise, introduced ‘The 4T Framework’ for managing windfall payments. His comprehensive approach emphasizes emotional regulation (Take a breath), financial assessment (Think out loud), strategic debt management (Tactical moves), and future-oriented investing (Target your future). Chinapoo specifically recommends allocating no less than 50% of back pay to secure investments like mutual funds, stocks, and government bonds.

Adding depth to the financial counsel, Miguel Martinez, President of Guardian Asset Management, warned against the psychological trap of treating lump sums as ‘found money.’ He advocated for a balanced allocation strategy dividing funds between enjoyment, debt reduction, and savings/investments. Martinez particularly emphasized building emergency reserves covering six months of income and pursuing purpose-driven investing through professionally managed funds with strong track records and transparent fee structures.

Both experts concur that this disbursement presents a unique opportunity for public servants to establish lasting financial stability, transform their economic outlook, and create intergenerational wealth through disciplined financial management and strategic partnership with reputable financial institutions.