The Central Bank of Suriname has initiated a new issuance of Central Bank Certificates (CBCs) aimed at temporarily withdrawing SRD 400 million from circulation. This monetary policy intervention seeks to regulate money supply and maintain economic stability by encouraging both individuals and businesses to deposit funds with the central bank, effectively reducing liquidity in the open market.

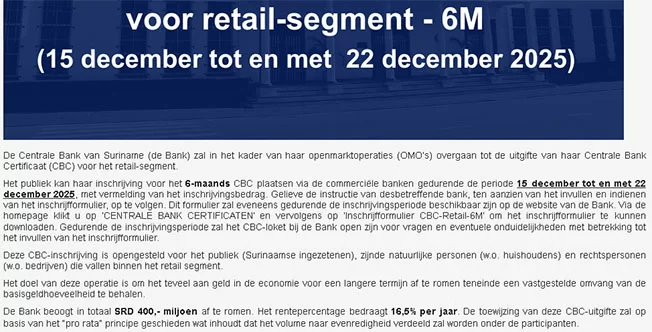

The certificate offering, available through commercial banks from December 15 to December 22, carries a 16.5% annual interest rate with a six-month maturity period. In cases of oversubscription, the available amount will be distributed proportionally among all participants. Application forms are available at commercial banks and can also be downloaded from the Central Bank’s official website.

This move represents a strategic shift in monetary policy following the conclusion of Suriname’s IMF program. The current interest rate of 16.5% is notably lower than rates during the IMF program period, reflecting the central bank’s adjusted approach to economic management. Simultaneously, authorities are developing a new monetary framework and preparing for the issuance of Treasury bills as complementary measures.

The dual-purpose initiative not only provides a secure investment vehicle for citizens and corporations but also serves as a mechanism for the central bank to better balance economic conditions and stabilize foreign currency demand. By temporarily absorbing excess liquidity, the central bank aims to create a more controlled monetary environment while offering attractive returns to investors.