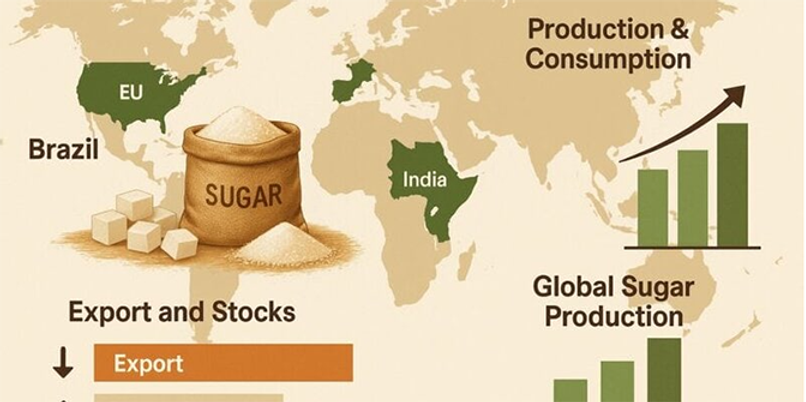

The global sugar market has experienced a dramatic turnaround from the multi-year lows observed in late September and early November, with benchmark prices now surging due to production shortfalls in key exporting nations. This shift has been driven by severe drought conditions in Brazil’s Center-South region, unusually dry monsoon patterns in India, and weather-related stress in Thailand. These disruptions have collectively erased earlier expectations of abundant supply, which had previously pushed prices downward. International agencies, including the International Sugar Organization, now project a significant deficit of 5.47 million metric tons for 2024/25, marking a nine-year high. Private analysts and the USDA also anticipate a multi-million-ton shortfall and a 4.7 percent drop in global inventories by early 2025. Demand remains robust, particularly in emerging markets where consumption of processed foods and beverages is rising. Additionally, growth in ethanol demand adds complexity, as higher crude oil prices incentivize mills to divert cane to biofuel production, reducing sugar availability and amplifying price volatility. The market shift has uneven implications for industry players. While sugar and ethanol groups like Brazil’s Cosan may benefit from stronger prices, food and beverage manufacturers face higher input costs, squeezing margins. Government interventions, such as India’s export restrictions and Mexico’s recent 156 percent tariff on imports, further reshape market dynamics. For Belize, the rebound in global prices could moderate downside risks for cane farmers, though local challenges like disease pressures and potential contraband activity remain concerns. The rally also feeds into broader food inflation dynamics, with economists warning of potential upward pressure on global food prices. Analysts note that sugar markets are historically cyclical, with weather and policy decisions driving pronounced peaks and troughs. While improved rainfall or stronger harvests could soften prices, the current structural tightness suggests heightened volatility through 2026. For Belize, the situation underscores the need for agile policy responses and sustained investment in climate-resilient cane production.