Suriname has successfully raised approximately $1.6 billion through an international capital market operation, marking a significant milestone in its financial recovery journey. Facilitated by BofA Securities (Bank of America), this refinancing initiative aims to restructure existing state bonds and signifies Suriname’s return to the global capital market. While the final settlement is expected on November 6, the transaction is already being hailed as a pivotal step in restoring financial confidence in the country.

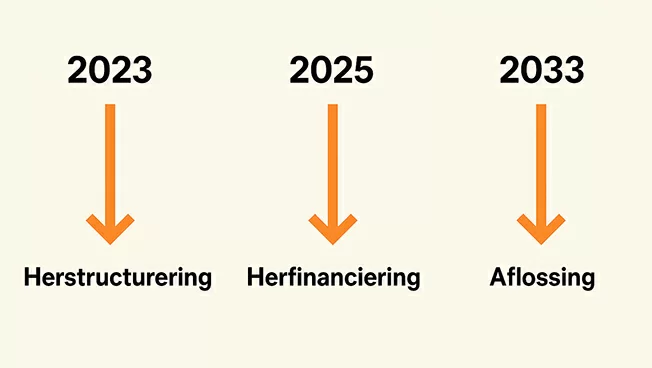

This operation is not a new loan but a refinancing of the 7.95% Cash/PIK Notes due 2033, issued following the 2023 debt restructuring. Investors were invited to tender their existing bonds at a fixed price of $1,002.50 per $1,000 nominal value. The proceeds from the new bond issuance will be used to repay older, more expensive debts, thereby shifting payment obligations to a later period when Suriname anticipates increased revenue from its oil sector. The primary goal is to alleviate budgetary pressure in the coming years without adding to the nation’s total debt burden.

A senior government official emphasized that the operation is designed to ‘create breathing space for the state’s finances,’ allowing Suriname time to grow rather than merely delay borrowing. The transaction was meticulously planned, with the invitation to tender issued on October 23 and results finalized on October 30. The operation was executed through the Automated Tender Offer Program of the U.S. DTC, ensuring transparency and compliance with market regulations.

The refinancing offers immediate liquidity benefits by replacing high-interest bonds with lower-rate, longer-term debt, reducing annual interest expenses. This creates fiscal flexibility for government spending in the coming years. However, experts caution that the strategy’s sustainability hinges on the timely realization of oil revenues and the government’s ability to channel freed-up resources into productive investments.

The successful $1.6 billion raise underscores restored investor confidence, bolstered by Suriname’s improved credit rating. While the exact interest rate remains undisclosed, it is reportedly favorable compared to previous issuances. Notably, the refinancing was conducted independently of an IMF program, though the country continues to receive technical assistance from the fund.

While the operation is a technical and diplomatic triumph, analysts warn that refinancing is not a structural solution but a temporary relief. Its success depends on budgetary discipline, political stability, and the timely inflow of oil and tax revenues. The government has pledged to release further details on the bond’s terms and repayment structure this week, providing clarity on the next steps in Suriname’s financial policy.

Symbolically, this operation represents Suriname’s first independent access to the international capital market since the 2023 restructuring, signaling regained credibility in financial management. It aligns with broader efforts to drive structural economic reforms and strengthen ties with international financial institutions and investors.

The challenge now lies in leveraging this financial breathing space to foster sustainable growth, ensuring future governments are not compelled to refinance old debts. This operation underscores that financial recovery begins not with loans but with trust—a trust that, once regained, must be carefully nurtured.