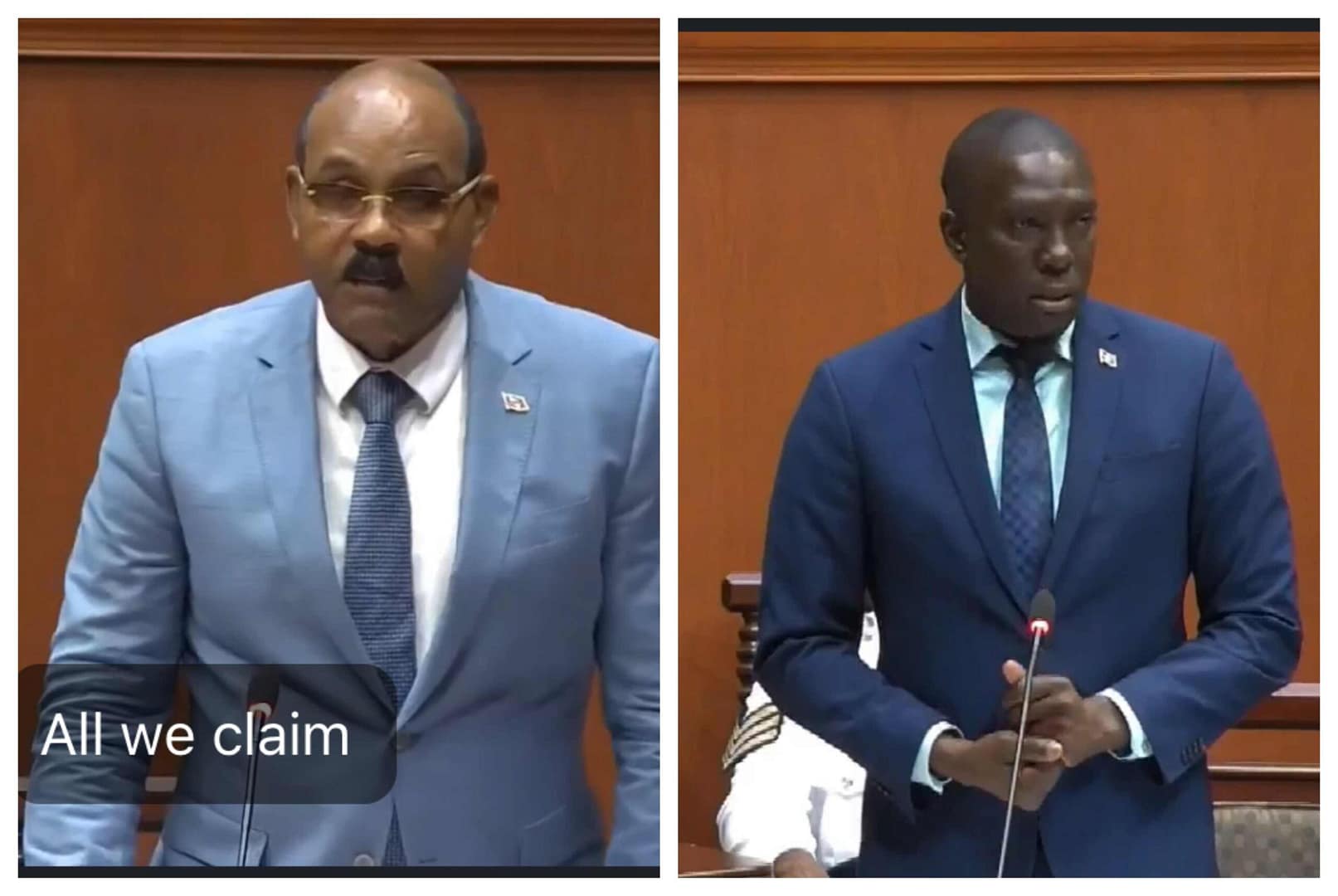

In a significant parliamentary session, Prime Minister Gaston Browne of Antigua and Barbuda has vowed to enhance the transparency of the government’s securities holdings. This commitment comes in response to persistent inquiries from the Opposition regarding compliance with the Finance Administration Act. During Thursday’s House of Representatives meeting, the Member for All Saints East and St. Luke questioned the Prime Minister’s adherence to Section 46(3)(a) of the Act, which mandates the Finance Minister to disclose full details of securities purchased. Browne acknowledged that while the government has historically omitted such filings, the information is publicly accessible through the Eastern Caribbean Securities Exchange (ECSE) and is included in the annual budget statement. He explained that the dynamic nature of securities trading—where bonds may be issued and repaid within short periods—makes frequent reporting cumbersome. However, Browne proposed a biannual update on the government’s outstanding securities to improve transparency. The Opposition also cited Section 46(3)(b), which requires the submission of all security purchase agreements. Browne clarified that such filings would establish a new precedent, as no previous government has submitted these documents to Parliament. He emphasized that the securities in question are publicly traded, not private transactions, and reiterated his administration’s commitment to transparency. When pressed about the government’s shareholdings in entities like Blue Ocean, West Indies Oil Company, and State Insurance, Browne expressed no objection to disclosing these details. He noted that such information is already publicly available through the company registry but affirmed his willingness to present it to Parliament if requested. The Prime Minister further distinguished between frequently traded securities, such as treasury bills, and permanent shareholdings in companies, confirming that the latter could be tabled in Parliament. This exchange marked a rare and substantive discussion on the transparency of government investments and securities reporting, underscoring the Browne administration’s pledge to uphold accountability.

VIDEO: PM Agrees to Provide Securities Information Following Parliamentary Question