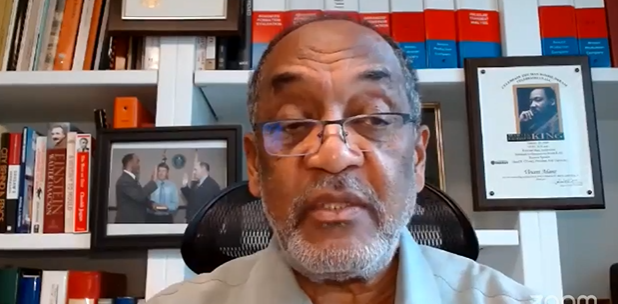

A New York-based non-governmental organization, the Oil and Gas Governance Network (OGGN), has been credited with prompting three U.S. senators to investigate ExxonMobil’s tax practices in Guyana. The senators—Sheldon Whitehouse (Rhode Island), Chris Van Hollen (Maryland), and Jeff Merkley (Oregon)—raised concerns about potential misuse of American taxpayer funds, alleging that ExxonMobil may be exploiting tax loopholes to claim credits for taxes it did not pay in Guyana. The OGGN, led by Professor Kenrick Hunte and Mike Persaud, provided the senators with critical information that led to the inquiry. Dr. Vincent Adams, a former head of Guyana’s Environmental Protection Agency, highlighted the NGO’s role in exposing what he described as a scheme where ExxonMobil allegedly uses fake Guyanese tax certificates to claim U.S. tax credits. The senators’ letter to ExxonMobil CEO Darren Woods questions whether the company directly paid taxes in Guyana or if the Guyanese government covered these payments from its share of oil profits. The inquiry also examines ExxonMobil’s partnership with China’s state-owned CNOOC and its implications for U.S. tax liabilities. The senators have set a deadline of October 23, 2025, for ExxonMobil to respond to their seven detailed questions regarding its tax practices and the 2016 Production Agreement with Guyana. The investigation could have significant implications for U.S. tax policy, potentially saving taxpayers an estimated $71.5 billion over a decade by closing existing loopholes.