Critical illness insurance is a financial safety net designed to provide a lump-sum payment upon the diagnosis of a severe medical condition such as cancer, heart attack, or stroke. Unlike traditional health insurance, which primarily covers medical expenses, this policy offers flexibility in how the funds are utilized—whether for hospital bills, income replacement, daily living costs, or long-term financial planning. This type of insurance is particularly valuable as it addresses the broader economic impact of serious illnesses, which can disrupt earnings and deplete savings. Globally, the critical illness insurance market was valued at $192.3 billion in 2022 and is projected to expand significantly in the coming years. Despite its importance, only 12% of adults in the UK, for instance, have such coverage, even though one in three individuals is likely to face a critical health condition in their lifetime. In Trinidad and Tobago, non-communicable diseases like heart disease and cancer are leading causes of mortality and healthcare demand, underscoring the relevance of this insurance. For families, especially those reliant on a single income, critical illness insurance ensures financial stability during challenging times. Purchasing a policy early, while young and healthy, can also result in lower premiums. Ultimately, this insurance is not just about preparing for the worst but about protecting one’s legacy, dignity, and future.

标签: Trinidad and Tobago

特立尼达和多巴哥

-

Brazen maxi robbery leaves commuters uneasy ahead of Xmas

A daring robbery on a maxi taxi along the Priority Bus Route (PBR) in Arouca, Trinidad, has left passengers and drivers alarmed, prompting calls for heightened security measures. The incident occurred on November 19 around 4:45 pm, when five men, one armed with a knife, boarded the vehicle as it stopped to drop off a female passenger near Bon Air West. The assailants stole $300 from the driver before targeting passengers, snatching cellphones and cash. Dash cam footage captured a female passenger struggling with one of the robbers over her purse, while others screamed in distress. The suspects fled northward into Bon Air West. Assistant Commissioner of Police (ACP) Rishi Singh confirmed the ongoing investigation but could not confirm any arrests. He urged maxi-taxi drivers to install dash cams and trust their instincts when picking up passengers. Singh also assured the public of increased police presence on the PBR, including routine stops and searches. Passengers and drivers at City Gate expressed their concerns, with many emphasizing the need for vigilance, especially as the holiday season approaches. One driver, previously robbed, highlighted the necessity of continuing work despite the risks. Passengers shared their fears and strategies for staying safe, such as carrying less cash and securing belongings. The incident has underscored the urgent need for enhanced security measures on public transportation routes.

-

CSO: Inflation down in October

The Central Statistical Office (CSO) has revealed that the inflation rate for October 2025, measured by the percentage change in the all items index compared to October 2024, stood at 0.4%. This marks a decline from the previous period, September 2025, which recorded a 0.2% inflation rate compared to September 2024. The all items index for October 2025 was 124.9, reflecting a 0.4% decrease from September 2025. Notably, the food and non-alcoholic beverages index saw a marginal drop of 0.1%, from 152.4 in September to 152.2 in October. Price reductions in key items such as Irish potatoes, pumpkin, pimentos, hot peppers, table margarine, eddoes, onions, tomatoes, ochroes, and fresh steak contributed to this decline. However, price hikes in cucumber, chive, frozen whole chickens, mixed fresh seasoning, fresh whole chickens, bodi, mayonnaise, full-cream powdered milk, celery, and fresh king fish partially offset these reductions. Further analysis showed decreases in clothing and footwear (0.1%), home ownership (0.1%), transport (2%), and recreation and culture (1.9%). Conversely, prices rose for tobacco (0.3%), household equipment and routine house maintenance (0.2%), hotels, cafés, and restaurants (0.6%), and miscellaneous goods and services (0.4%). These mixed trends highlight the complex dynamics influencing the inflation rate.

-

Recovery in economic confidence stalls in Q3

The latest Global Economic Conditions Survey (GECS), jointly conducted by the ACCA and IMA, has revealed a slight decline in confidence among global accountants in the third quarter of 2025, following a modest recovery in the previous quarter. The survey highlights persistent caution regarding global economic prospects, with key indicators such as the Global New Orders Index and Capital Expenditure Index hitting multi-year lows. The Employment Index also remained subdued, reflecting sluggish job markets across several economies. Jonathan Ashworth, Chief Economist at ACCA, noted that while the global economy showed resilience in the first half of 2025, the third quarter’s declines suggest a potential slowdown in global growth in the coming months. Despite this, he emphasized that a major economic downturn is not imminent. Regionally, North America saw a significant rise in confidence, driven by improved sentiment among US accountants, though the forward-looking New Orders Index plummeted to its lowest level since the pandemic’s peak in 2020. Alain Mulder, Senior Director at IMA, highlighted ongoing uncertainty in the US economy, with slowing job markets but solid GDP growth. In contrast, Western Europe experienced a sharp decline in confidence, particularly in the UK, where fears of upcoming tax hikes weighed heavily on sentiment. Meanwhile, Asia Pacific’s confidence improved, buoyed by global economic resilience and reduced tariff-related uncertainty. The survey also underscored the growing prominence of cybersecurity as a critical risk, transcending IT departments to become a governance and cultural issue across sectors and regions.

-

Cabinet amends import restriction on vehicles to 8 years

In a significant policy shift, the government has approved an extension of the permissible age for importing foreign-used private vehicles, including SUVs, sedans, and station wagons powered by gas, diesel, or CNG. The age limit has been increased from three years to eight years from the date of manufacture. Additionally, the permissible age for light commercial vehicles, pickups, and panel vans with diesel engines has been raised from seven years to ten years. These changes were announced during the post-Cabinet media briefing held at the Diplomatic Centre in Port of Spain on November 20. Minister of Transport and Public Aviation, Eli Zakour, emphasized that these measures aim to make vehicle ownership more accessible to the public. He also revealed Cabinet approval for establishing a regulatory framework to manage the registration and use of classic, antique, and vintage vehicles in Trinidad and Tobago (TT). Currently, there is no legal framework for these vehicles, which has limited their lawful use and economic potential. Zakour stated that the Ministry of Transport, guided by international best practices, will develop a policy and legislative framework to regulate this sector, starting with a formal classification and registry system. Addressing concerns about increased traffic congestion due to the policy, Zakour noted that vehicle ownership remains a personal choice, and the government is simultaneously working to improve public transport and road infrastructure. He highlighted ongoing efforts to revive the Public Transport Service Corporation (PTSC), which had 71 discontinued routes and a severe shortage of buses when he assumed office. Zakour also announced plans for a park-and-ride system, allowing commuters to park their vehicles at safe locations in Arima, Chaguanas, Couva, and San Fernando and take buses or maxi-taxis to Port of Spain. Further details will be released on November 21.

-

Address Nutrien fallout more robustly

The recent closure of Nutrien’s operations in Trinidad has sent shockwaves through the local economy, leaving at least 600 workers unemployed. The global chemicals producer had been a cornerstone of the Point Lisas industrial estate for nearly 30 years, serving as a significant foreign exchange generator. The shutdown, while disheartening, has revealed a complex web of consequences and opportunities. Gerald Ramdeen, Chairman of the National Gas Company (NGC), highlighted a silver lining during a November 17 interview, noting that other producers at Point Lisas are benefiting from the redistribution of resources. ‘Almost all plants on the estate are exceeding their daily contractual quantities due to this redistribution,’ he stated. However, Ramdeen’s optimism is tempered by the challenges he faces, such as securing alternative carbon dioxide supplies for the food and beverage industry. Companies like Proman have stepped in to fill the gap, but the long-term implications remain uncertain. The fallout stems from a contentious $500 million invoice issued by an NGC subsidiary for port and pier fees, a move that has been criticized for its lack of transparency and prior warning. This abrupt action has raised concerns about the government’s approach to managing longstanding business relationships. Energy Minister Roodal Moonilal’s earlier statements about revitalizing strategic partnerships with Nutrien contrast sharply with Ramdeen’s current stance, highlighting a lack of cohesion among officials. Moving forward, a clearer roadmap for Point Lisas post-Nutrien is essential to restore confidence and ensure economic stability.

-

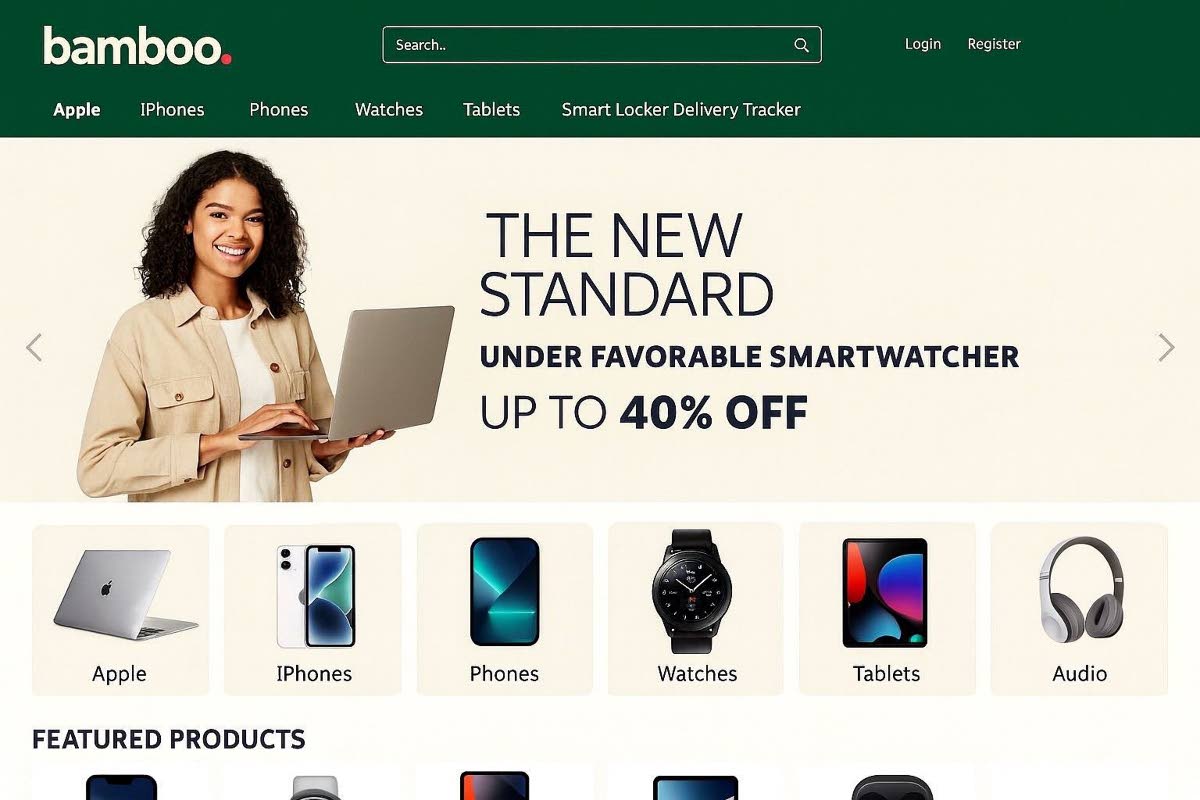

Bamboo gives customers a safe place ‘to cell’

In a world where online marketplaces often expose sellers to risks of fraud and theft, Quincy Richards, the founder and CEO of Bamboo Marketplace, is pioneering a safer alternative. Launching in February next year, Bamboo Marketplace aims to eliminate the dangers associated with face-to-face transactions by offering a secure, cashless platform for buying and selling electronic devices. Richards, an account manager in a telecommunications company, was inspired to create the platform after a close call with a fraudulent buyer during a personal phone sale. His vision is to provide a seamless, contact-free transaction experience, ensuring both buyers and sellers can operate without fear of scams or physical harm. The platform utilizes an ‘Escrow’ system, where funds are held in a digital wallet until the item is delivered via Aeropost’s smart lockers across 14 locations in Trinidad and Tobago. Additionally, Bamboo Marketplace offers a 24-hour warranty and a dispute management team to address any issues post-purchase. With rigorous verification processes, including AI-driven identity checks and device serial number validation, Richards is confident that Bamboo Marketplace will set a new standard for safety in peer-to-peer online transactions. The platform also caters to businesses, offering subscription plans that exempt them from transaction fees and expand their market reach. Richards envisions Bamboo Marketplace becoming the go-to platform for secure online transactions, ultimately eradicating the recurring issue of fraud in the digital marketplace.

-

Flash flooding in Penal, corporation says mitigation works coming

On November 20, flash flooding struck several low-lying areas in the Penal/Debe municipality, leaving dozens of motorists stranded. The incident occurred despite the Penal Debe Regional Corporation (PDRC) receiving a significant 120% increase in funding for fiscal 2026. PDRC Chairman Gowtam Maharaj revealed that detailed mitigation plans are being prepared for the upcoming dry season to address the recurring issue. Speaking at the Debe office, Maharaj acknowledged the success of watercourse clearing efforts initiated earlier this year, which prevented major household flooding. However, he emphasized that more work is needed to resolve bottlenecks caused by encroachments, fallen trees, and outdated infrastructure. The flooding primarily affected areas such as SS Erin Road, Batchyia Village, Patiram Trace, Clarke Road, and Rock Road, with Rock Road experiencing the deepest waters. Maharaj outlined plans for remedial works across all ten municipal districts, which are set to be approved at the council’s statutory meeting on November 27. Collaboration with the Ministry of Works and Infrastructure and the South Oropouche River Basin project is also planned to mitigate future floods. Maharaj expressed relief over the reversal of a previous policy that delayed contractor payments, which he believes hindered progress. With 60% of the municipality located within the Oropouche watershed, the area remains highly flood-prone, with the last major flooding event occurring in September 2024.

-

Movember: Unmasking the silence for men

In a powerful call to action, Dr. Margaret Nakhid-Chatoor, a psychologist and educator, addresses the silent struggles of men in Trinidad and Tobago and beyond. For generations, men have been conditioned to ‘man up,’ to shoulder familial responsibilities, and to mask their vulnerabilities. This societal expectation, while intended to foster resilience, has instead perpetuated a culture of silence, leaving many men to grapple with mental health issues alone.

Movember, an initiative that began in Australia in 2003, serves as a catalyst for change. What started as a playful act of growing moustaches in November has evolved into a global movement aimed at transforming men’s health. The moustache is more than a symbol; it’s a conversation starter, a way to break the silence surrounding prostate cancer, testicular cancer, mental health, and suicide prevention. When someone asks, ‘Why the moustache?’, it opens the door to discussions about health, struggles, and the weight of unspoken pain.

In Trinidad and Tobago, the pressure to remain stoic in the face of unemployment, relationship breakdowns, and loneliness has driven many men to the brink of despair. Rising male suicide rates underscore the urgent need for open dialogue. One young man shared his harrowing experience with anxiety and depression, describing it as a ‘demon inside his head.’ His story is not unique; it reflects the silent battles countless men face daily.

Dr. Nakhid-Chatoor emphasizes that true strength lies not in enduring suffering in silence but in the courage to seek help. ‘Strength is about how much courage it takes to let go of the mask you put on and say, ‘I need help,’’ she writes. Acknowledging pain and vulnerability is not a sign of weakness but an act of bravery. Informal, peer-led spaces, such as gatherings with friends, can be more effective than clinical settings in fostering connection and support.

The message is clear: no one should fight their battles alone. Movember serves as a reminder that every life matters, every voice deserves to be heard, and every pain deserves acknowledgment. Reaching out to men means meeting them where they are—whether in social settings, on the field, or in faith spaces—and reframing mental health as a source of strength and resilience. Simple practices like deep breathing, meditation, and grounding exercises can help manage anxiety and stress, making mental fitness a more acceptable concept.

Dr. Nakhid-Chatoor concludes with a heartfelt plea: ‘The mask of silence has cost too many lives. It’s time to unmask. Take care.’

-

Money Linx: InfoLink prepares for its next three decades

InfoLink Services, the interbank agency responsible for ACH electronic transfers and the Linx cash payments system, marked its 30th anniversary on November 14, 2025, at the Hyatt Regency in Port of Spain, Trinidad and Tobago. The event highlighted both the agency’s achievements and the challenges it faces in an evolving electronic payments landscape. Central Bank Governor Larry Howai praised InfoLink for its critical role in ensuring smooth, secure, and efficient payment processing, calling it a cornerstone of the country’s retail payment system. However, he also emphasized the need for innovation to meet rising consumer demands for faster, more convenient, and secure payment options while maintaining financial stability and inclusion. InfoLink, which began operations in 1994, introduced Linx in 1995, revolutionizing cashless transactions in Trinidad and Tobago. Over the years, it has expanded its services to include Automated Clearing House (ACH) electronic transfers and electronic check clearing, managing 41% of the country’s electronic payments. Despite its success, InfoLink faces increasing competition and the need to adapt to advanced technologies like AI, which are transforming both payment systems and the methods criminals use to exploit them. Glynis Alexander-Tam, InfoLink’s general manager, stressed the importance of collaboration and innovation to meet customer expectations for instant payments and enhanced security.