The recent closure of Nutrien’s operations in Trinidad has sent shockwaves through the local economy, leaving at least 600 workers unemployed. The global chemicals producer had been a cornerstone of the Point Lisas industrial estate for nearly 30 years, serving as a significant foreign exchange generator. The shutdown, while disheartening, has revealed a complex web of consequences and opportunities. Gerald Ramdeen, Chairman of the National Gas Company (NGC), highlighted a silver lining during a November 17 interview, noting that other producers at Point Lisas are benefiting from the redistribution of resources. ‘Almost all plants on the estate are exceeding their daily contractual quantities due to this redistribution,’ he stated. However, Ramdeen’s optimism is tempered by the challenges he faces, such as securing alternative carbon dioxide supplies for the food and beverage industry. Companies like Proman have stepped in to fill the gap, but the long-term implications remain uncertain. The fallout stems from a contentious $500 million invoice issued by an NGC subsidiary for port and pier fees, a move that has been criticized for its lack of transparency and prior warning. This abrupt action has raised concerns about the government’s approach to managing longstanding business relationships. Energy Minister Roodal Moonilal’s earlier statements about revitalizing strategic partnerships with Nutrien contrast sharply with Ramdeen’s current stance, highlighting a lack of cohesion among officials. Moving forward, a clearer roadmap for Point Lisas post-Nutrien is essential to restore confidence and ensure economic stability.

分类: business

-

Agostini announces 5th extension in share swap offer

Agostini has announced its fifth extension of the closing date for its takeover bid of Prestige Holdings, pushing the deadline to January 20, 2026. The extension was disclosed in a notice issued to the Trinidad and Tobago Stock Exchange on November 18, which was subsequently published on the exchange’s website and in local newspapers. The delay is attributed to the pending approval of regulatory bodies, including the TT Fair Trade Commission, which is reviewing the merger application. Agostini’s share-swap offer, which proposes acquiring Prestige Holdings by trading one Agostini share for every 4.8 Prestige Holdings shares, will remain open until the new deadline. The company has assured shareholders that it will acquire and pay for all deposited shares within the timeframe mandated by securities law. Initially set to close on July 20, the offer has seen multiple extensions, with previous deadlines extended to August 5, September 5, October 21, and November 18. Despite securing the minimum required shareholding on September 10, Agostini continues to navigate regulatory hurdles to finalize the acquisition.

-

War and the impact on Trinidad and Tobago’s SMEs

The deployment of the USS Gerald R Ford, one of the world’s largest aircraft carriers, to the Caribbean has heightened tensions in an already militarized region. This move, coupled with rising US-Venezuela tensions and global shipping instability, has significant implications for Trinidad and Tobago’s economy, particularly its small and medium enterprises (SMEs).

Over the past few months, the southern Caribbean has become a hotspot for military activity, with US naval vessels operating near local waters. This escalation, combined with ongoing global conflicts, has disrupted shipping routes and increased freight costs. For SMEs in Trinidad and Tobago, which rely heavily on imported goods, these developments pose a serious threat to their operations and profitability.

The vulnerability of Trinidad and Tobago’s SMEs stems from their business model: importing goods from abroad, shipping them in, and selling them locally. While this model works well in stable times, it becomes precarious when global events disrupt supply chains. The COVID-19 pandemic offered a glimpse of what can happen when supply chains break down, with skyrocketing freight costs, delayed shipments, and unpredictable lead times. Geopolitical tensions and military conflicts can cause similar, if not more severe, disruptions.

For instance, when an area becomes militarized or classified as high-risk, several consequences follow: freight costs increase due to war-risk premiums, shipments become unpredictable as vessels are rerouted or delayed, marine insurance premiums rise, and consumer behavior shifts as households prioritize essential spending over non-essential goods. These changes create immediate pressure on SMEs, affecting their cash flow, sales, and long-term viability.

Trinidad and Tobago’s SMEs face additional challenges, including persistent foreign exchange shortages, high dependence on imports, thin profit margins, and long supply chains. These factors make the sector highly sensitive to global shocks. The COVID-19 pandemic revealed how quickly things can fall apart, and a major geopolitical event could have even more severe consequences.

To mitigate these risks, SMEs must adopt more resilient business models. This includes diversifying their offerings, reducing dependence on distant supply chains, building hybrid digital and service-based businesses, strengthening regional or local sourcing, and creating more forex-generating enterprises. Resilience is no longer optional in an increasingly volatile global environment.

The decision to pause a promising business venture in light of these risks underscores the need for SMEs to pay attention to the broader environment, not just the strength of their ideas. As the backbone of Trinidad and Tobago’s economy, SMEs must rethink how they build and protect their businesses to survive in an unpredictable world.

-

It’s that Simplex: Automotive Arts, Massy promote new refinishing products for cars

Automotive Art, in partnership with Massy Distribution, is revolutionizing the car refinishing industry with its innovative Simplex line of products. The company is leveraging hands-on training sessions to demonstrate the versatility and efficiency of its paints, targeting end-users directly. Erik Bishop, Business and Product Development Manager at Automotive Art, emphasized the importance of practical demonstrations to gain market trust. ‘The easiest way to advertise the product is by showing it in action,’ he stated during a training session at Massy Distribution in Morvant. Automotive Art, celebrating its 35th anniversary, operates in over 70 countries, including the US, Canada, and the Caribbean. The company specializes in refinishing systems, using advanced European manufacturing techniques to produce durable and UV-resistant paints. Their products, including the 82-400, 82-1600, and 92-2008 clear coats, have undergone rigorous testing in simulated environments, ensuring longevity and high performance. Bishop highlighted the synergy between Automotive Art and Massy, noting their complementary roles in the automotive market. ‘They have the market, and we have the product offering,’ he said, underscoring the strategic partnership.

-

Strengthening the village that supports Trinidad and Tobago small businesses

Small and micro-businesses are the lifeblood of Trinidad and Tobago, driving innovation and sustaining communities. Yet, these enterprises often operate with minimal support, bearing immense responsibilities. Lara Dowell, a Committee Member at NOVA SME Development, highlights the challenges faced by entrepreneurs during the TT Chamber of Industry and Commerce’s 2025 Champions of Business gala. This year’s Global Entrepreneurship Week theme, ‘Together We Build,’ underscores the need for a collaborative approach to bolster small businesses. Entrepreneurs in TT juggle multiple roles—from operations to compliance—while navigating unclear regulations and securing financing. The journey of a small business owner is not one of failure but of resilience in a system that demands too much from individuals. Dowell emphasizes the importance of professional networks, large institutions, and community support in creating a robust entrepreneurial ecosystem. Professional networks provide shared knowledge and mentorship, while large institutions offer procurement power and market access. Communities and families form the emotional backbone, celebrating small wins and offering encouragement. Leadership development is crucial for business sustainability, as emotionally intelligent leaders foster resilient teams. Public-private collaboration is essential to simplify regulations, improve access to financing, and support digital transformation. Dowell calls for a national effort to strengthen the village around small businesses, ensuring their growth and success. By standing together, we can build a future where every entrepreneurial idea has the opportunity to thrive.

-

bpTT completes Cypre project, ready to ‘unlock TT’s energy future’

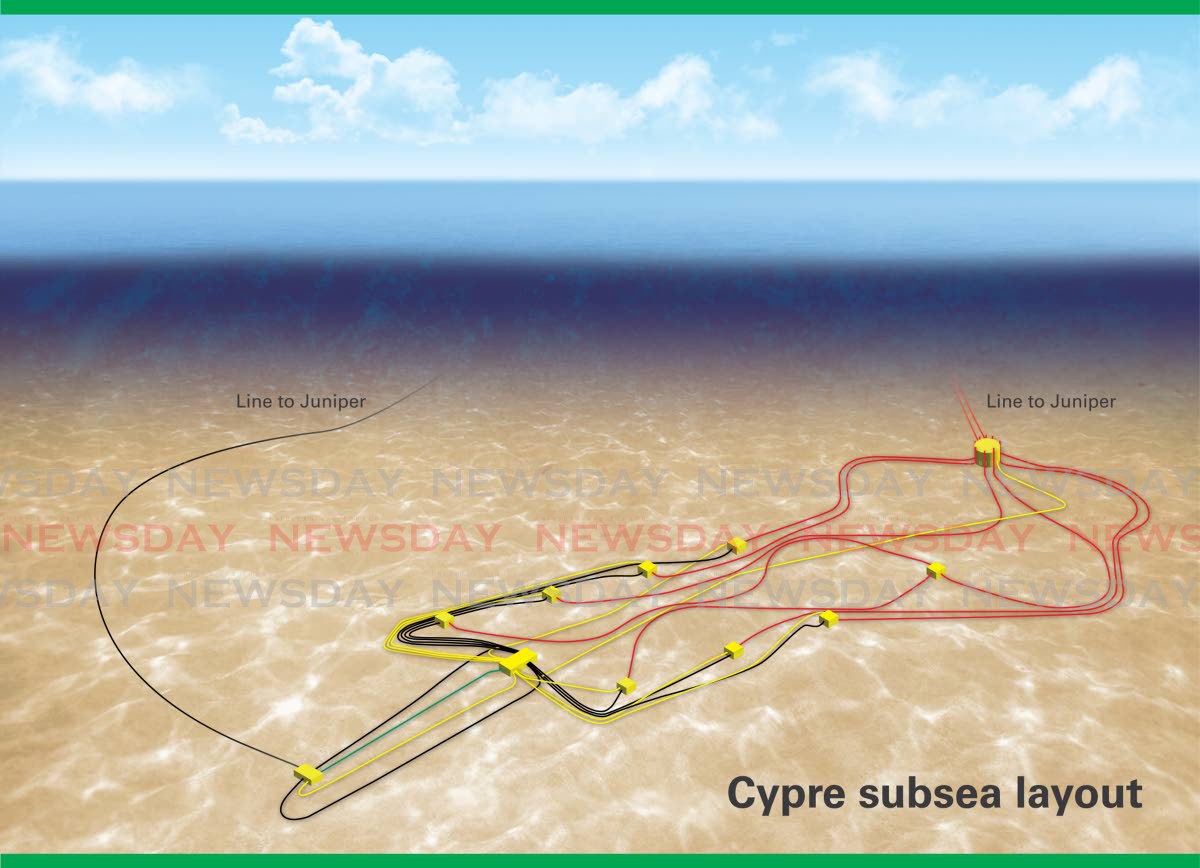

BP Trinidad and Tobago (bpTT) has announced the successful completion of its Cypre gas field development, marking a significant milestone in the region’s energy sector. The project, which involved drilling seven wells tied back to the existing Juniper platform, achieved first gas delivery in April 2025. The final three wells were drilled, completed, and commissioned recently, bringing the entire development to fruition. At its peak, Cypre is expected to produce approximately 45,000 barrels of oil equivalent per day, equivalent to 250 million standard cubic feet of gas daily. This makes Cypre bpTT’s third subsea development. David Campbell, bpTT president, emphasized the project’s success as a testament to the company’s commitment to maximizing production from the Columbus Basin and its ongoing investment in Trinidad and Tobago’s energy sector. The Cypre gas field, located 78 kilometers off the southeast coast of Trinidad in the East Mayaro Block, is entirely owned by bpTT, a joint venture between bp (70%) and Repsol (30%). Former Energy Minister Stuart Young lauded the project’s completion, highlighting its importance in offsetting the natural gas decline in the region. The development, negotiated between 2017 and 2023, underscores bpTT’s dedication to unlocking Trinidad and Tobago’s energy future.

-

Igniting potential: Why mentorship matters more than ever

In a significant move to bolster professional development and leadership in the Caribbean, two prominent mentorship programmes have been launched. The Human Resource Management Association of TT (HRMATT) initiated its Youth Mentorship Programme on October 4, followed by the Arthur Lok Jack Global School of Business Alumni Association (ALJGSBAA) on October 11. These initiatives aim to bridge the gap between academia and industry, fostering the next generation of leaders.

HRMATT’s programme targets ambitious youth aged 16-35, connecting them with seasoned professionals to build workplace readiness, career direction, and networking opportunities. The six-month programme, starting at the Cipriani College of Labour and Co-operative Studies, is designed to provide crucial guidance often missing for newcomers in the workforce.

The ALJGSBAA’s initiative, exclusive to its current students and alumni, pairs mentees with accomplished graduates, including C-Suite leaders and entrepreneurs. This programme focuses on guiding students through academic and professional challenges, expanding networks, and facilitating knowledge transfer across generations.

Both programmes underscore the importance of mentorship in today’s rapidly evolving workplace. Mentorship offers human insight, lived experience, and encouragement, which are invaluable in navigating the complexities of modern career paths. These initiatives not only benefit mentees but also provide mentors with opportunities to give back, share wisdom, and leave a lasting legacy.

The alignment in leadership between HRMATT and ALJGSBAA creates opportunities for collaboration, joint events, and expanded mentorship networks. The programmes have garnered support from various partners, highlighting the significance of mentorship as a national priority. However, there is a call for more partners to join this transformative movement.

As these initiatives look to the future, their vision is clear: to expand reach, deepen impact, and unlock the potential of emerging talent across Trinidad and Tobago. Mentorship is more than guidance; it is a catalyst for transformation, building a vibrant, interconnected ecosystem that empowers individuals and strengthens the region.

-

Why you should purchase critical illness insurance

Critical illness insurance is a financial safety net designed to provide a lump-sum payment upon the diagnosis of a severe medical condition such as cancer, heart attack, or stroke. Unlike traditional health insurance, which primarily covers medical expenses, this policy offers flexibility in how the funds are utilized—whether for hospital bills, income replacement, daily living costs, or long-term financial planning. This type of insurance is particularly valuable as it addresses the broader economic impact of serious illnesses, which can disrupt earnings and deplete savings. Globally, the critical illness insurance market was valued at $192.3 billion in 2022 and is projected to expand significantly in the coming years. Despite its importance, only 12% of adults in the UK, for instance, have such coverage, even though one in three individuals is likely to face a critical health condition in their lifetime. In Trinidad and Tobago, non-communicable diseases like heart disease and cancer are leading causes of mortality and healthcare demand, underscoring the relevance of this insurance. For families, especially those reliant on a single income, critical illness insurance ensures financial stability during challenging times. Purchasing a policy early, while young and healthy, can also result in lower premiums. Ultimately, this insurance is not just about preparing for the worst but about protecting one’s legacy, dignity, and future.

-

Recovery in economic confidence stalls in Q3

The latest Global Economic Conditions Survey (GECS), jointly conducted by the ACCA and IMA, has revealed a slight decline in confidence among global accountants in the third quarter of 2025, following a modest recovery in the previous quarter. The survey highlights persistent caution regarding global economic prospects, with key indicators such as the Global New Orders Index and Capital Expenditure Index hitting multi-year lows. The Employment Index also remained subdued, reflecting sluggish job markets across several economies. Jonathan Ashworth, Chief Economist at ACCA, noted that while the global economy showed resilience in the first half of 2025, the third quarter’s declines suggest a potential slowdown in global growth in the coming months. Despite this, he emphasized that a major economic downturn is not imminent. Regionally, North America saw a significant rise in confidence, driven by improved sentiment among US accountants, though the forward-looking New Orders Index plummeted to its lowest level since the pandemic’s peak in 2020. Alain Mulder, Senior Director at IMA, highlighted ongoing uncertainty in the US economy, with slowing job markets but solid GDP growth. In contrast, Western Europe experienced a sharp decline in confidence, particularly in the UK, where fears of upcoming tax hikes weighed heavily on sentiment. Meanwhile, Asia Pacific’s confidence improved, buoyed by global economic resilience and reduced tariff-related uncertainty. The survey also underscored the growing prominence of cybersecurity as a critical risk, transcending IT departments to become a governance and cultural issue across sectors and regions.

-

High Court rules in ANSA Merchant Bank’s $30m fraud case

In a landmark ruling, the High Court has adjudicated on the $30 million fraud case involving ANSA Merchant Bank (AMB) and its former employees. Justice Frank Seepersad, in a comprehensive 100-plus page judgment, dismissed claims against four former employees but found former business development officer Dwayne Rojas guilty of breaching contractual and fiduciary duties. Rojas was implicated in a fraudulent loan scheme, colluding with roll-on/roll-off car dealers to defraud the bank of $30 million over two and a half years. The scheme involved falsified job letters and fabricated vehicle documents, with non-existent vehicles listed as loan collateral. Justice Seepersad ruled that Rojas knowingly processed fraudulent applications, causing substantial financial loss to AMB. The court also dismissed cases against Zaria Sankar, Reyvaan Rampersad, Kerry Ramsaroop, and Adriana Ramsingh, citing insufficient evidence of wrongdoing. However, summary judgments were granted against five roll-on/roll-off companies, ordering them to repay $24 million. Justice Seepersad criticized AMB for targeting junior staff while neglecting to hold senior officers accountable. He highlighted the bank’s inadequate internal controls and risk management practices, which facilitated the fraud. The judge recommended that the case be forwarded to the Director of Public Prosecutions and the Commissioner of Police for potential criminal charges. Additionally, he urged the Minister of Trade, Industry, and Tourism to review the operating licenses of the implicated dealerships. The ruling underscores the need for stricter financial oversight and accountability in the banking sector.