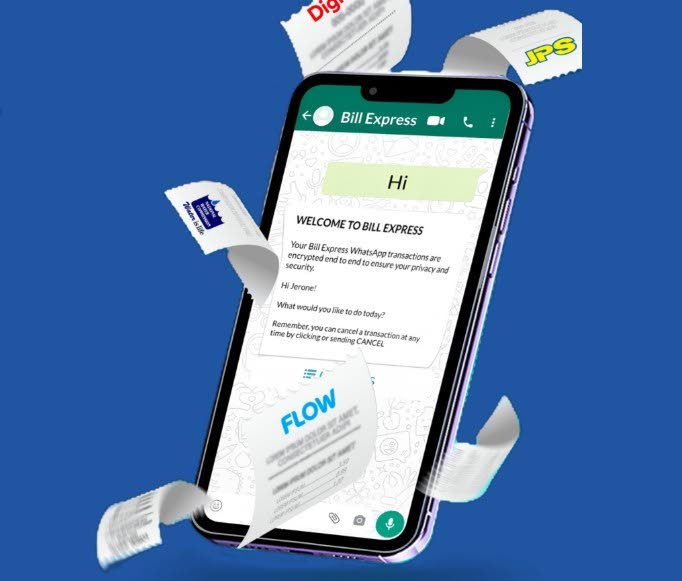

GraceKennedy Money Services (GKMS) has introduced a groundbreaking payment feature through its Bill Express brand, enabling customers to pay bills directly via WhatsApp. This innovative service, named WhatsApp Pay, allows users to manage their financial obligations from anywhere in the world, leveraging the widespread use of WhatsApp as Jamaica’s most popular instant messaging platform. The company emphasized that this move aligns with the growing demand for convenient digital channels and is part of its broader strategy to modernize customer financial management. WhatsApp Pay operates through a designated number, guiding users through a simple, secure, and private payment process. With a transaction fee of $55—lower than in-store rates—the service offers a cost-effective alternative for bill payments and mobile credit top-ups. Since its launch, GKMS has reported encouraging early adoption, with steady growth in transaction volumes and inquiries. The company anticipates increased usage, particularly among younger, tech-savvy users who prefer digital interactions. WhatsApp Pay also targets the Diaspora market, enabling seamless cross-border payments supported by local and international debit or credit cards. Security remains a top priority, with the platform employing encryption, multi-factor authentication, and real-time monitoring to safeguard customer data, ensuring compliance with local and international standards. Developed through a collaboration between GraceKennedy’s internal team and an external provider, WhatsApp Pay reflects the company’s commitment to innovation and customer-centric digital solutions. While GKMS did not disclose specific transaction figures, it clarified that the service is part of a long-term digital transformation strategy focused on enhancing customer engagement rather than short-term profitability. ‘WhatsApp Pay was designed to deliver innovation and convenience, and we are confident it will strengthen our position in the digital payments landscape,’ the company stated.