Property investors and landlords in St. John’s are raising urgent concerns about the financial sustainability of maintaining aging residential buildings under current rent control regulations. During recent municipal consultations, multiple owners detailed how government-mandated caps on rent increases—typically ranging between 10-15%—fail to cover escalating repair costs, material expenses, and labor charges.

The regulatory framework, designed to protect tenants from sudden rent hikes, has inadvertently created a financial straitjacket for property owners. Many report being forced to absorb rising maintenance costs without adequate means to reinvest in their properties. This financial pressure is accelerating physical deterioration rather than facilitating necessary refurbishment in the capital’s older neighborhoods.

The discussion emerged during broader municipal talks addressing urban decay, with property stakeholders emphasizing that enforcement measures alone cannot reverse declining building conditions without parallel financial reforms. Owners argued that the economic realities of property maintenance must be central to any effective urban renewal strategy.

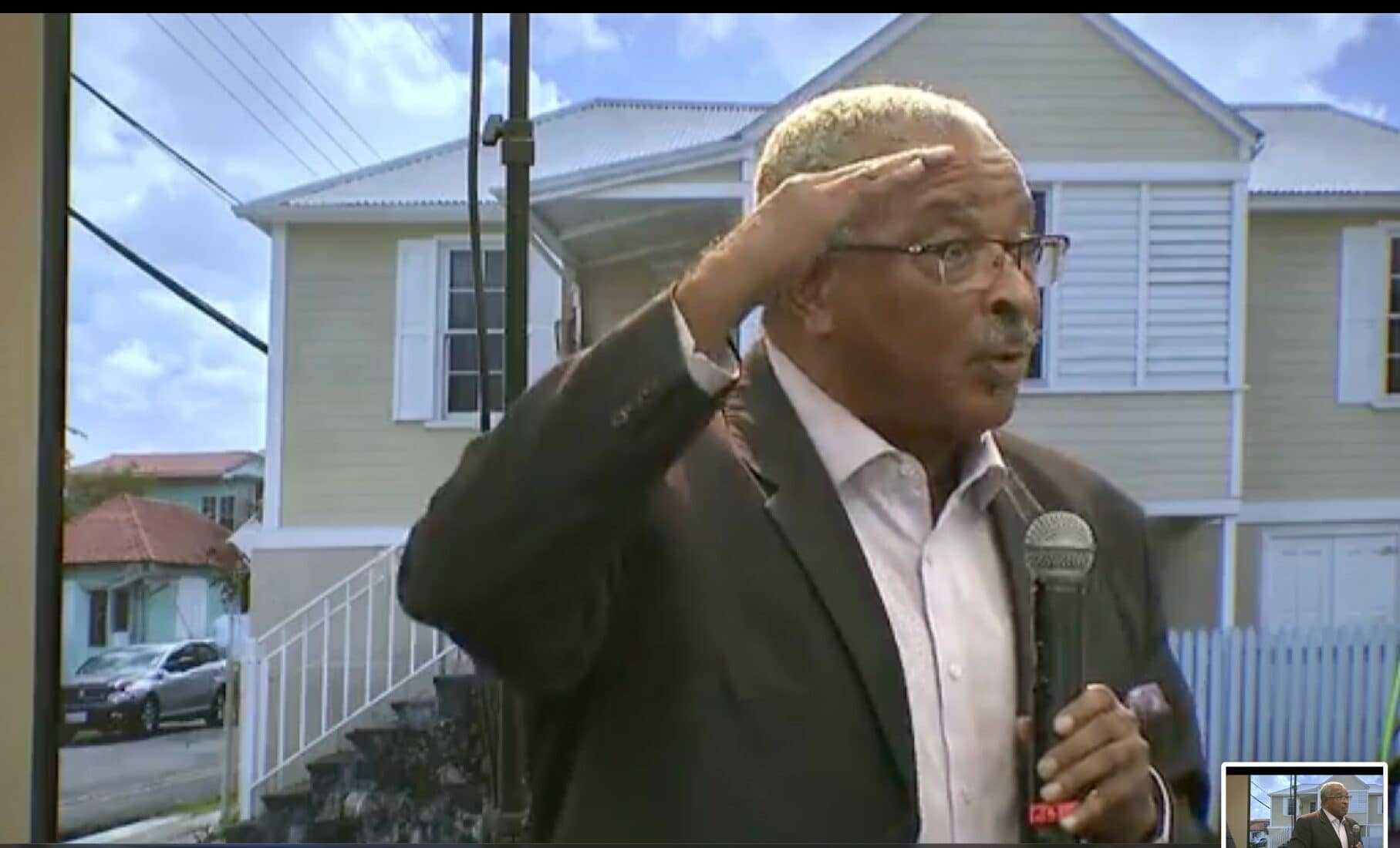

Government representatives acknowledged these concerns during the consultation, admitting that outdated rental legislation has become part of a complex challenge affecting building upkeep and investment in historic urban centers. The dialogue highlights the delicate balance between tenant protection and property preservation in aging Canadian cities.