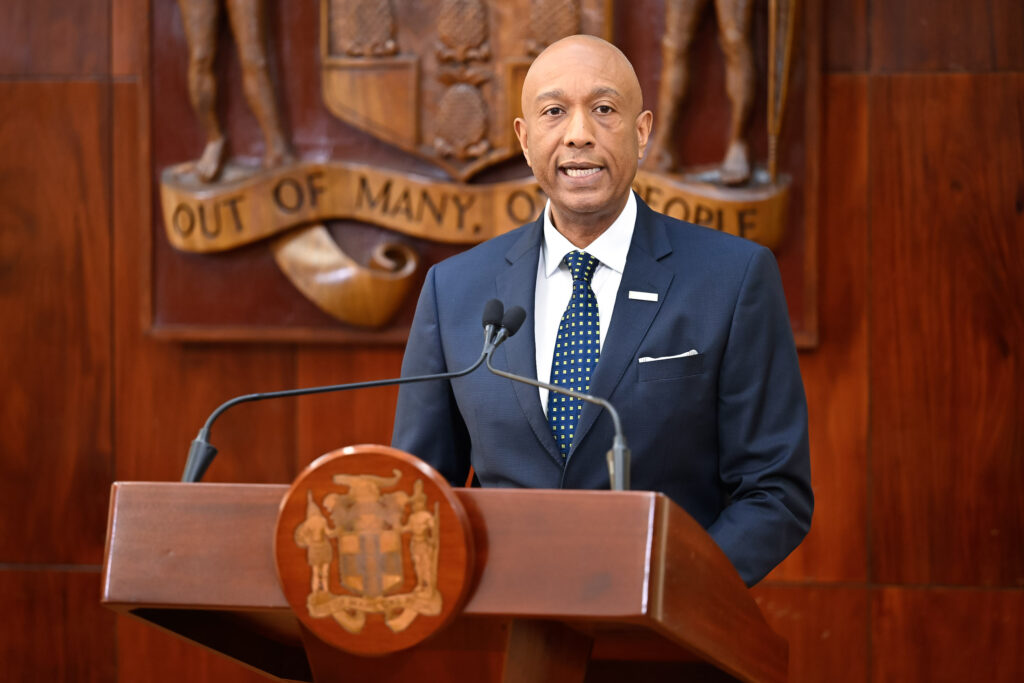

KINGSTON, Jamaica — In a decisive response to Hurricane Melissa’s devastation, the Development Bank of Jamaica (DBJ) has unveiled a comprehensive $10-billion Jamaican dollar (approximately $64 million USD) business recovery initiative. The M5 Business Recovery Programme, announced by DBJ Managing Director Dr. David Lowe at a November 26 Jamaica House briefing, targets enterprises across agriculture, manufacturing, distribution, and tourism sectors that suffered operational disruptions from the Category Five storm.

The program establishes a tiered support system through DBJ’s network of approved financial institutions (AFIs) and microfinance institutions (MFIs), offering qualified businesses access to financing ranging from $20 million to $50 million Jamaican dollars. Dr. Lowe outlined three distinct recovery pathways: a refinance window for existing borrowers needing term adjustments, a reboot window for addressing immediate operational needs, and a rebuild window for enterprises requiring comprehensive reconstruction.

‘Our most critical intervention is the rebuild window for businesses that have been totally disrupted,’ emphasized Dr. Lowe, noting that the program incorporates innovative features including grant components to encourage resilience-building innovations and credit collateral support covering up to 80% of security requirements where traditional collateral became unavailable post-hurricane.

The funding structure operates in phased deployments: an immediate $1 billion allocation from DBJ’s current balance sheet, a recently cabinet-approved $3 billion secondary phase, and a further $7 billion commitment for sector-wide rebuilding efforts. The program design emerged from extensive consultations with financial institutions, business associations, and existing borrowers following the hurricane’s passage, ensuring tailored solutions to address Jamaica’s post-disaster economic challenges.