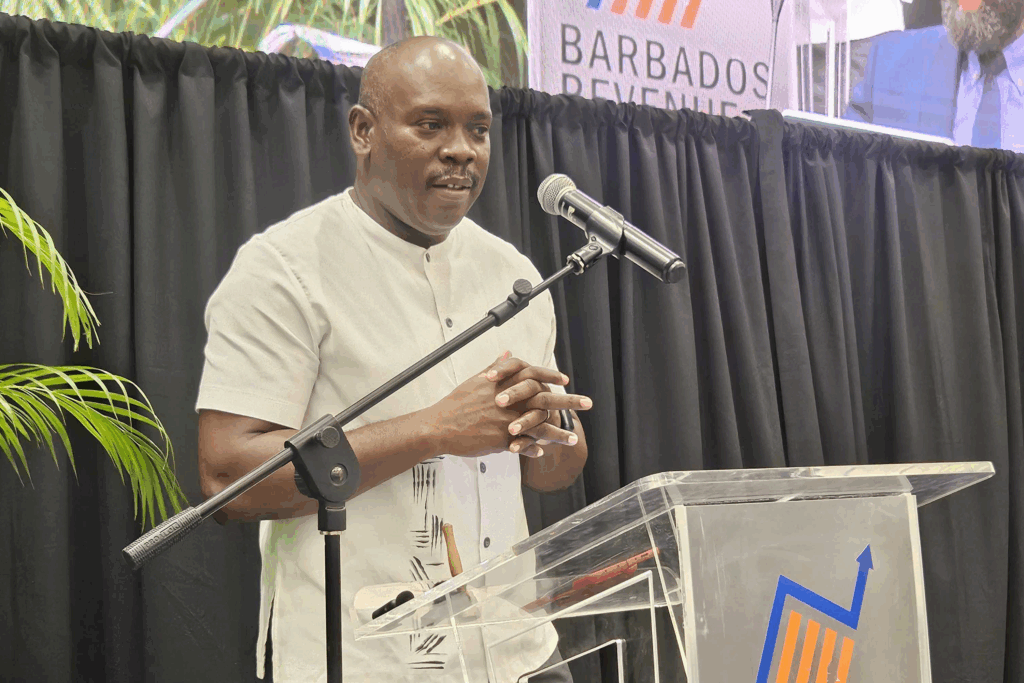

Barbados has reiterated its unwavering dedication to international tax transparency and compliance standards during a pivotal meeting of the Organisation for Economic Co-operation and Development (OECD) Global Forum. The event, held at the Hilton Barbados Resort, focused on assessing the island nation’s adherence to global tax obligations. Ryan Straughn, Minister in the Ministry of Finance, emphasized Barbados’ significant strides in aligning with international tax frameworks and its resolve to uphold these standards. Straughn highlighted the critical role of tax transparency and information exchange in fostering investment and economic growth, particularly for small states like Barbados. He detailed extensive reforms undertaken to meet global requirements, enhance governance, and bolster investor confidence, which have contributed to 17 consecutive quarters of economic growth. Straughn also addressed the evolution of Barbados’ corporate tax policy, noting the reduction of corporation taxes to 5.5% in 2018 and the subsequent adjustments necessitated by the OECD’s global minimum tax of 15%, effective in 2024. He underscored the importance of tax certainty for investors, stating that Barbados is no longer a low-tax jurisdiction. Additionally, Straughn outlined ongoing efforts to modernize the business environment, including digitization initiatives by the Barbados Revenue Authority (BRA) and the Central Bank’s plans for digital payments. Revenue Commissioner Jason King reaffirmed Barbados’ commitment to international standards, highlighting the BRA’s strengthened legislative and technical capacity and its readiness to implement the Common Reporting Standard 2.0 and the crypto asset reporting framework.