In a dramatic escalation of regulatory enforcement, Barbados’ Financial Services Commission (FSC) has revoked the operating license of Equity Insurance Company Ltd following a damning investigative report that confirmed systemic violations of insurance regulations. The decisive action prohibits the insurer from writing new policies or renewing existing ones, though existing contracts will remain valid through a one-year runoff period.

The regulatory confrontation stems from the FSC’s August 2025 intervention when it assumed control of Equity Insurance and appointed restructuring specialist Craig Waterman from PricewaterhouseCoopers SRL to manage operations. Waterman’s comprehensive assessment, submitted to regulators, validated initial findings that the company had committed serious breaches of the Financial Services Commission Act, Insurance Act, and international best practices.

In an unexpected countermove, Equity Insurance has initiated legal proceedings (Claim No. CIV1497/2025) against the financial watchdog, challenging both the license revocation and the commission’s earlier seizure of control. The company had previously submitted written objections and an independent assessment by Compass Advisory Services Inc. in efforts to prevent regulatory action.

The FSC maintained that its enforcement actions were applied “effectively and proportionately” after proper consultation with the Finance Minister. Regulators emphasized that the measures were necessary to address ongoing threats to consumer interests and restore operational integrity within the insurance sector.

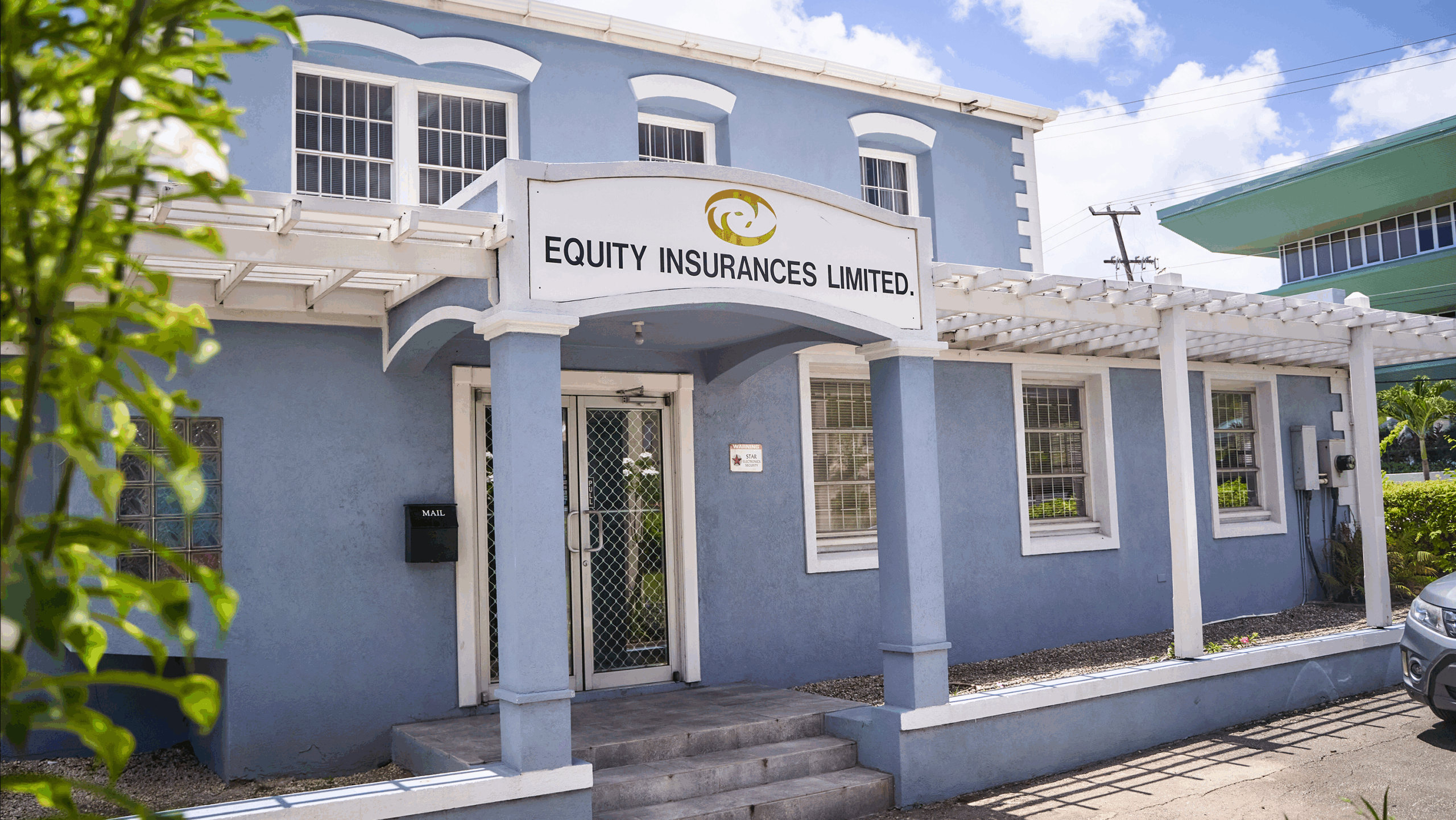

Founded by Managing Director Francis Pounder and operating from Collymore Rock, St Michael, Equity Insurance now faces a critical juncture as it navigates both regulatory sanctions and legal challenges. The commission has outlined appeal procedures available to aggrieved financial institutions within 30 days of notification, reaffirming its commitment to equitable treatment throughout enforcement processes.