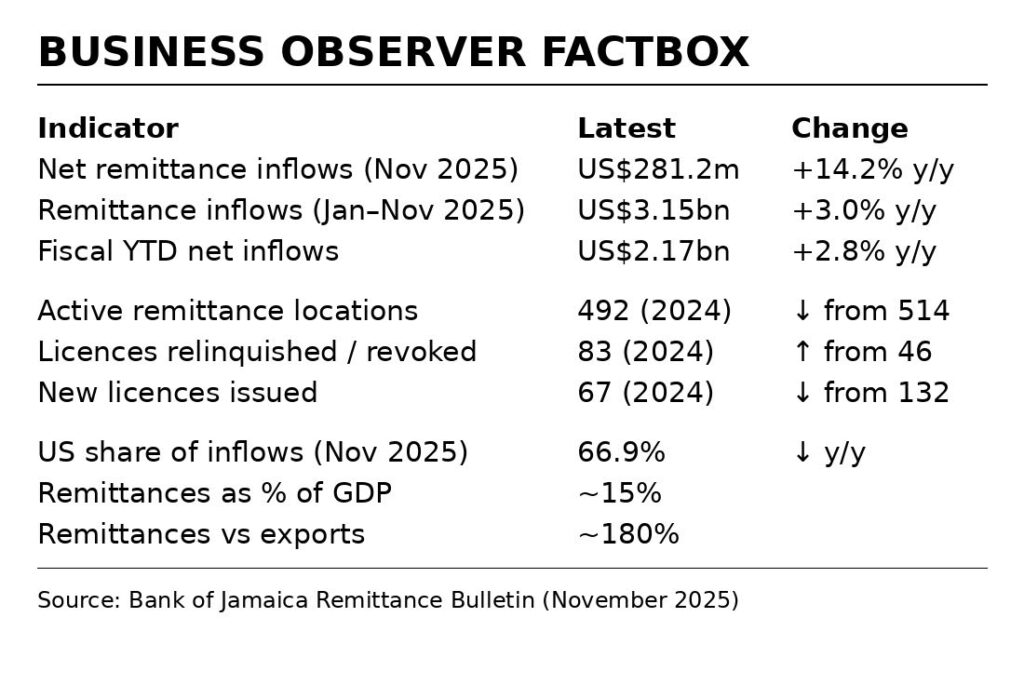

Jamaica’s remittance landscape is undergoing significant transformation as new data from the Bank of Jamaica reveals both substantial financial growth and structural consolidation within the industry. According to the latest Remittance Bulletin published by the central bank, November 2025 witnessed remarkable growth in net remittance inflows, which surged to US$281.2 million – representing a robust 14.2 percent increase compared to the same period in the previous year.

The impressive performance was primarily fueled by heightened activity through formal remittance companies, though partially tempered by an accompanying rise in outbound transfers. Cumulative figures for the current fiscal year demonstrate sustained growth, with net inflows reaching US$2.17 billion, marking a 2.8 percent year-over-year increase. Total incoming remittances grew by 2.9 percent, while outflows experienced a more pronounced uptick of 5.3 percent.

Parallel to these financial developments, the industry’s operational framework is evolving dramatically. The number of active remittance locations contracted significantly from 514 in 2023 to 492 in 2024, indicating a trend toward market consolidation. This restructuring is further evidenced by licensing patterns: revoked or relinquished licenses nearly doubled to 83 from 46 year-over-year, while new licenses issued plummeted from 132 to 67. Complete 2025 structural data remains pending publication.

From January through November 2025, total remittance inflows reached US$3.15 billion, maintaining a steady 3 percent annual growth rate. This performance positioned Jamaica favorably against regional counterparts, with some Central American nations experiencing stronger growth while Mexico recorded declines.

The United States continues to dominate as Jamaica’s primary remittance source, accounting for 66.9 percent of total inflows in November – though slightly diminished from previous levels. The United Kingdom, Canada, and the Cayman Islands followed as significant contributors.

Remittances remain a cornerstone of Jamaica’s economy, providing crucial foreign exchange equivalent to approximately 15 percent of GDP, nearly 80 percent of tourism earnings, and exceeding 180 percent of export values, according to the central bank’s macroeconomic indicators.