The Central Bank of Barbados has announced a fourth consecutive year of robust economic expansion for the nation in 2025, with GDP growth reaching 2.7%. This sustained growth was primarily propelled by an unprecedented surge in tourism, which catalyzed widespread gains across multiple sectors of the economy.

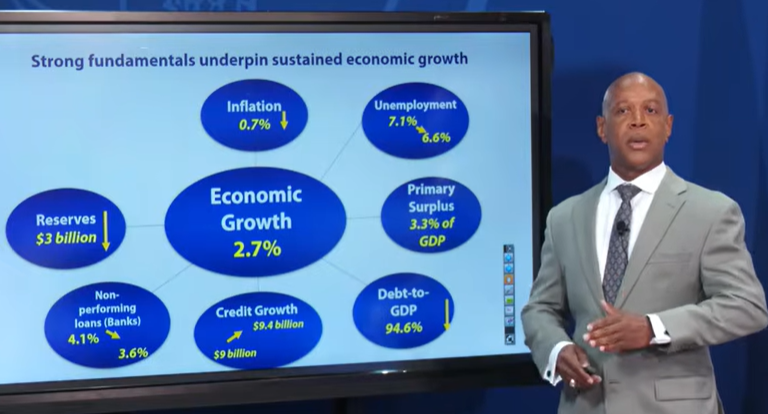

Central Bank Governor Dr. Kevin Greenidge, presenting the annual economic review at the bank’s Bridgetown headquarters, highlighted a simultaneous improvement in key macroeconomic indicators. Inflationary pressures continued to moderate throughout the year, with the average inflation rate declining by 0.7%. The labor market also showed significant strength, as the unemployment rate dropped to 6.6%, down from 7.1% recorded at the end of the previous September.

On fiscal stability, the government achieved a primary surplus equivalent to 3.3% of GDP, while successfully reducing the national debt-to-GDP ratio to 94.6%. The financial sector demonstrated resilience with credit expansion growing from $9 billion to $9.4 billion. Commercial banks notably improved their asset quality, reducing non-performing loans to 3.6%—the lowest level witnessed since June 2009. International reserves remained robust at approximately $3 billion, despite a widening current account deficit driven by increased imports and softer export performance.

The tourism sector emerged as the undeniable powerhouse behind the economic performance. Long-stay arrivals soared by 3.3% to exceed 727,000 visitors, setting an all-time annual record. This influx was dominated by the U.S. market, which expanded dramatically by 8.1% and accounted for roughly 80% of the additional visitors. Enhanced air connectivity from cities including Boston, New York, Philadelphia, and Atlanta was a critical driver. The CARICOM market also contributed significantly with a 6.1% growth, bolstered by increased flight capacity.

Strategic marketing initiatives yielded positive results from Canada, which saw a 3.5% increase in arrivals, and also supported growth from European markets. A notable exception was the UK market, where arrivals declined by 5.9%, a dip attributed to reduced seating capacity.

The hotel sector reaped substantial benefits from the tourism boom. Average occupancy rates climbed by 1.3 percentage points, while the average revenue per available room surged by approximately 15%. The shared accommodation sector (e.g., Airbnb) also saw occupancy rise by 0.7 percentage points, though revenue per room declined by about 10%, indicating a competitive pricing adjustment by hosts. The cruise segment performed marginally well, with visitor numbers edging up by nearly 1% to 546,000 despite 12 fewer ship calls, reflecting higher occupancy per vessel.

This tourism-driven growth had a multiplier effect across the economy. The agricultural sector experienced a remarkable 13.3% expansion, while construction grew by 9.2%. The business and other services sector advanced by 3.7%, and wholesale and distribution trade saw a 1.1% increase. Manufacturing remained stable without significant growth.

Governor Greenidge concluded that the 2025 economic performance was characterized by its ‘balanced and resilient’ nature, being supported by multiple sectors rather than dependence on a single industry, positioning Barbados on a stable path of continued economic development.