Belize City residents are encountering a significant shift during this year’s property tax season, marking the first adjustment to the municipal taxation framework in thirteen years. Municipal authorities have declared the existing valuation model, unchanged since 2013, financially unsustainable and have enacted an 18% increase effective 2026.

Troy Smith, Valuation Manager for the Belize City Council, clarified that escalating demands for public services and current real estate market valuations made the revision unavoidable. A comprehensive feasibility study revealed that aligning taxes with present market values would have necessitated a drastic hike of nearly 50%. The Council, however, intervened to mitigate the burden on homeowners, ultimately approving a substantially lower increase.

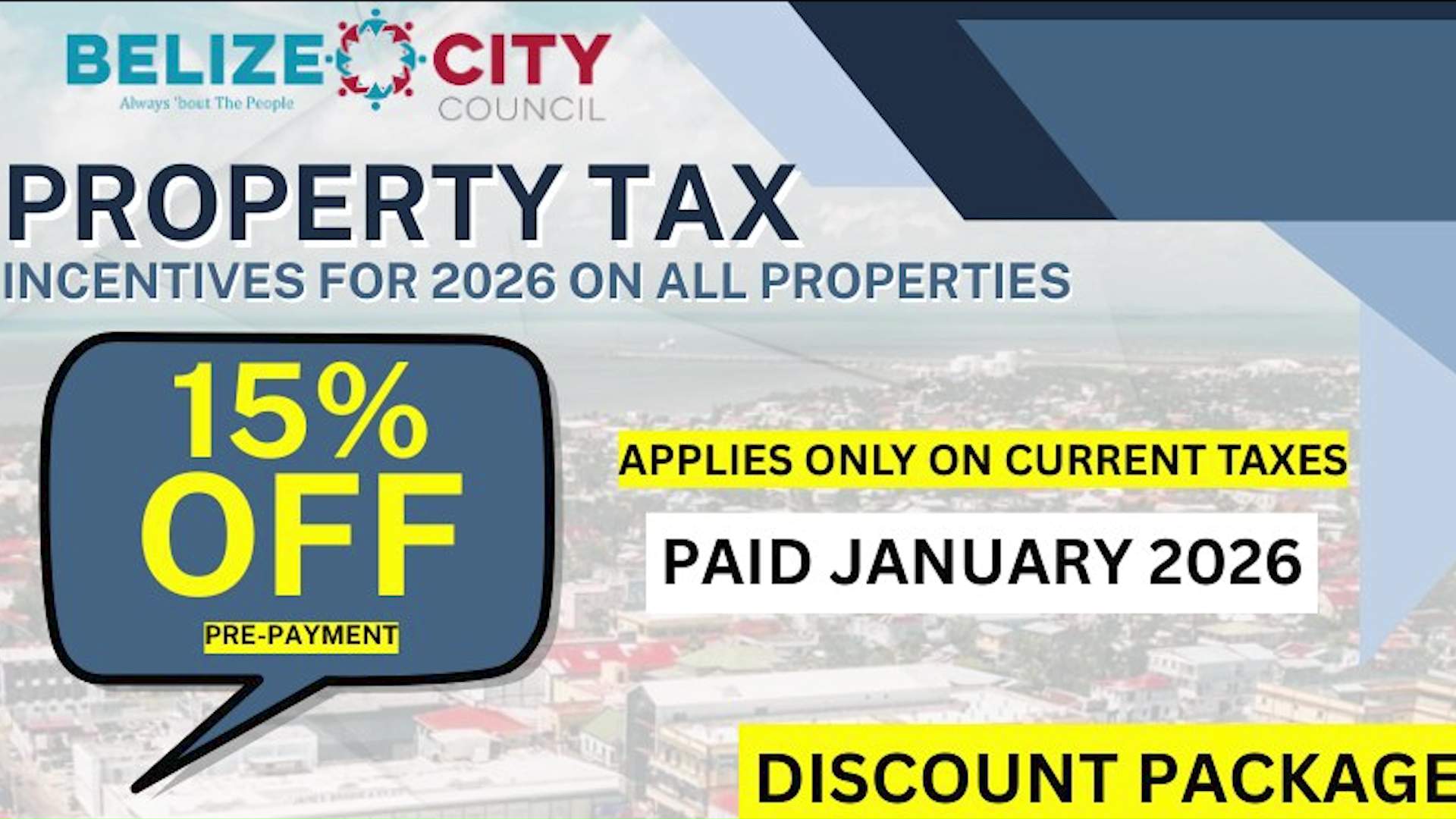

To further alleviate the impact, the new structure incorporates a 15% incentive discount for timely payments. This mechanism means the net effect for compliant taxpayers will be a modest 3% rise. For instance, an annual tax bill of $120 will increase by approximately $28 to $148 before the discount is applied. After claiming the incentive, the homeowner’s final obligation would be roughly $125.80.

City officials emphasize that the primary objective of this recalibration is to ensure the continuous delivery of essential municipal services without imposing excessive financial strain on the community. The policy reflects a balanced approach to addressing budgetary requirements while maintaining consideration for taxpayer affordability.