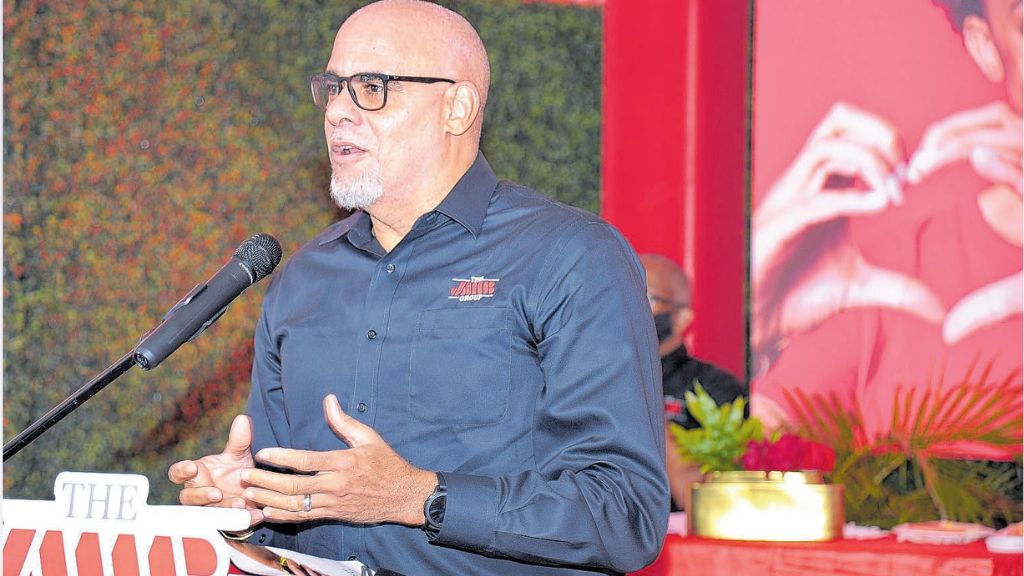

Jamaican financial institutions are pressing regulators to synchronize the implementation of new capital and liquidity regulations, citing the rapid pace of reforms as a significant compliance burden that could erode profitability. Keith Duncan, CEO of JMMB Group Ltd, one of Jamaica’s largest financial entities, emphasized this concern during the company’s 12th annual general meeting (AGM) on Friday. Duncan highlighted that over 100 policy reforms have been introduced in the past decade, creating substantial operational challenges for the sector. While these measures aim to enhance financial stability, their accelerated rollout has strained resources, particularly for smaller institutions. The Bank of Jamaica (BOJ) is currently advancing a series of reforms, including Basel III capital standards, a ‘twin peaks’ regulatory model, and new liquidity requirements for financial holding companies (FHCs). These changes, though beneficial in the long term, are driving up costs and limiting capital deployment flexibility. Duncan urged regulators to adopt a collaborative approach, ensuring reforms are sequenced to minimize the burden on the industry. The BOJ is also developing a special resolution regime (SRR) to address failing financial institutions, though its funding mechanism remains contentious. Additionally, the Financial Services Commission (FSC) has introduced reforms to exposure limits for collective investment schemes and dividend declarations by securities dealers. While these measures aim to strengthen the financial system, they may lead to higher compliance costs, potentially passed on to consumers. The JMMB Group CEO called for a balanced regulatory framework to safeguard profitability and shareholder returns.